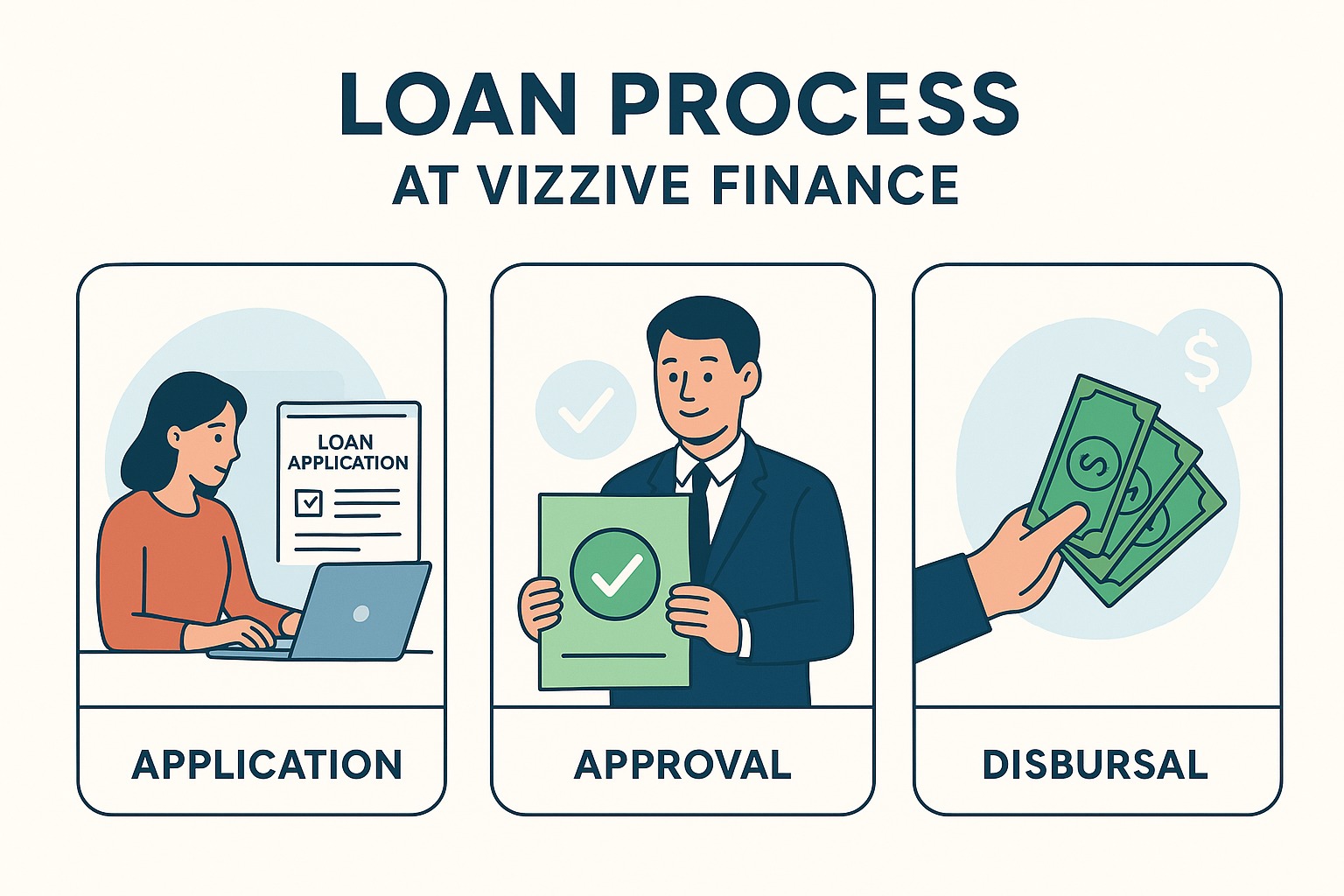

Applying for a loan can sometimes feel overwhelming, especially if you’re not sure what happens after you submit your documents. At Vizzve Finance, we make the process transparent, quick, and hassle-free. Here’s a step-by-step breakdown of what you can expect after applying for a loan with us.

Step 1: Loan Application Submission

You begin by filling out the loan application form online or offline.

Provide basic details such as loan amount, purpose, income, and repayment preference.

Upload or submit required documents (ID proof, address proof, income proof, etc.).

Step 2: Preliminary Verification

Our team verifies your documents and details.

This includes checking identity, address, and employment information.

At this stage, we ensure that your profile meets Vizzve Finance eligibility criteria.

Step 3: Credit Assessment

A credit check is carried out using your CIBIL score and repayment history.

Your financial stability, current liabilities, and income are assessed.

Based on this, we determine the loan amount and interest rate that best fits your profile.

Step 4: Loan Approval

Once the verification and credit assessment are complete, your loan moves to approval.

You receive a Loan Sanction Letter outlining the loan amount, tenure, interest rate, and repayment schedule.

If required, you can clarify terms with our representatives before signing.

Step 5: Agreement & Documentation

You sign the loan agreement digitally or physically.

This is a legally binding document confirming all terms and conditions.

Additional documents (like post-dated cheques or ECS mandate) may be collected for repayment setup.

Step 6: Loan Disbursal

After final approval, the loan amount is credited directly into your bank account.

Disbursal is usually quick — ensuring you get funds when you need them most.

Step 7: Repayment Begins

Your repayment schedule starts as per the agreed EMI plan.

With Vizzve Finance’s flexible repayment options, you can easily manage your installments.

Timely repayments help improve your credit score.

Conclusion

Applying for a loan doesn’t have to be stressful. At Vizzve Finance, we ensure complete clarity at every step — from application to disbursal. With quick processing, transparent policies, and customer-friendly terms, we make borrowing simple and reliable.

FAQs

Q1. How long does it take for Vizzve Finance to approve a loan?

Approval is usually quick, depending on document verification and credit checks.

Q2. What documents are required for applying?

Typically ID proof, address proof, income proof, and bank statements are required.

Q3. Will my CIBIL score affect loan approval?

Yes, a good CIBIL score increases approval chances and helps secure better terms.

Q4. How is the loan amount disbursed?

Once approved, the sanctioned amount is directly credited to your bank account.

Q5. Can I prepay or foreclose my loan with Vizzve Finance?

Yes, depending on your loan type and terms, foreclosure and prepayment options are available.

Published on : 31st August

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share