When taking a loan — especially a home loan, personal loan, or education loan — the way you structure your EMIs can significantly impact your cash flow, total interest, and financial comfort.

Two popular repayment options are:

Step-Up EMIs

Step-Down EMIs

Understanding how these repayment structures work helps you decide which aligns best with your income growth, stability, and financial goals.

Here’s a clear and simple breakdown.

What Are Step-Up EMIs?

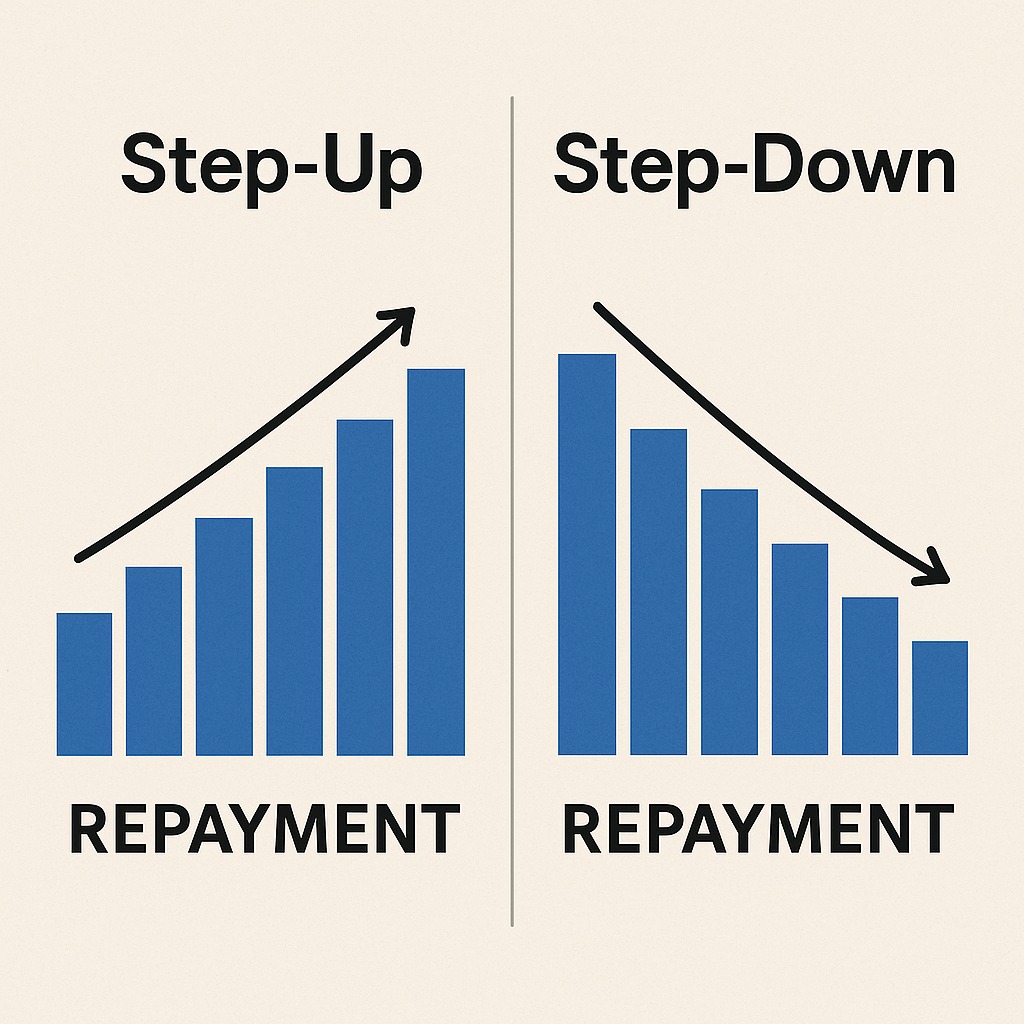

A step-up EMI starts with a lower EMI in the early years and gradually increases over time.

Useful For Borrowers Who:

Expect salary or business income to grow

Are in the early stage of their career

Want low EMIs initially for cash-flow comfort

Prefer to match EMIs with future income

How It Works

First 1–5 years: Low EMI

Later years: Higher EMI

Tenure remains the same

Total interest paid is higher compared to regular EMIs because early payments are low

Best For

Young salaried professionals

Fresh graduates with rising income paths

Borrowers expecting promotions or job switches

New business owners with revenue expected to grow

What Are Step-Down EMIs?

A step-down EMI begins with a higher EMI in the early years and gradually decreases as the loan ages.

Useful For Borrowers Who:

Have stable or high income currently

Expect expenses to rise later (kids, retirement, medical costs)

Want to reduce interest burden

Prefer aggressive early repayment

How It Works

First few years: High EMI

Later years: Gradual reduction

Total interest paid is lower than standard EMIs

Principal reduces faster, saving interest

Best For

Mid-career professionals

Borrowers nearing retirement

Individuals with high disposable income today

People wanting to repay faster and save interest

Step-Up vs Step-Down EMIs — Key Differences

| Feature | Step-Up EMI | Step-Down EMI |

|---|---|---|

| Initial EMI | Low | High |

| Future EMI | Increases | Decreases |

| Interest Paid Overall | Higher | Lower |

| Cash Flow in Early Years | Comfortable | Tighter |

| Ideal For | Young earners | High earners, mid-career |

| Risk Level | Higher (if income doesn’t rise) | Lower |

| Principal Repayment | Slow in early years | Fast initially |

Who Should Choose Step-Up EMIs?

✔ Young professionals

Lower initial burden suits early-career cash flow.

✔ Borrowers expecting steady income growth

Promotions, salary increments, or business expansion.

✔ First-time home buyers

Makes large loans manageable initially.

✔ People with new financial responsibilities

Marriage, relocation, higher living expenses.

⚠ Caution:

If your income doesn’t rise as expected, future EMIs may become difficult.

Who Should Choose Step-Down EMIs?

✔ People with high income today

Allows faster principal repayment and lower long-term interest.

✔ Borrowers nearing retirement

EMIs reduce over time when income may decline.

✔ Those expecting future expenses

Children’s education, healthcare, home renovation.

✔ Borrowers focusing on maximum interest savings

Step-down structure is best for reducing total cost of loan.

Which EMI Option Saves More Interest?

Step-Down EMIs save more, because:

Higher initial EMIs → faster principal reduction

Interest calculated on lower outstanding principal

Total interest significantly decreases

Step-Up EMIs cost more, because:

Low initial EMIs → principal remains high

You pay more interest overall

FAQs

1. Do banks offer both step-up and step-down EMI options?

Yes, most banks and NBFCs offer these for home and personal loans, depending on eligibility.

2. Can I switch between EMI types later?

Possible, but depends on bank policy and may involve charges.

3. Are step-up EMIs risky?

Only if your future income doesn’t rise as expected.

4. Which EMI type is best for saving interest?

Step-down EMI.

5. Can step-up EMIs improve loan eligibility?

Yes — lower initial EMI increases loan approval chances.

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed