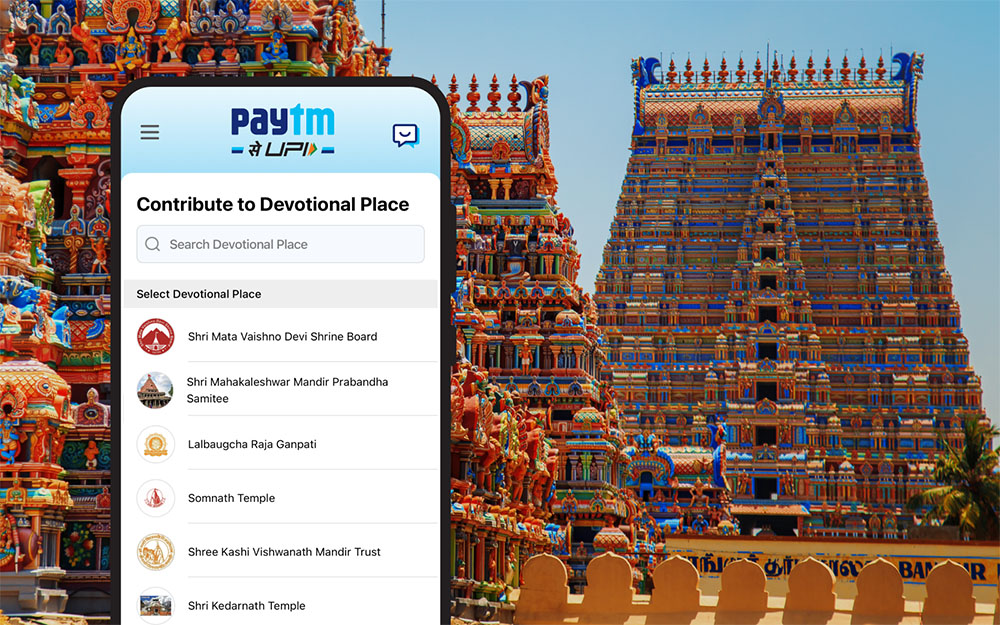

India’s temples—timeless symbols of faith, tradition, and community—are undergoing a quiet revolution.

From Tirupati to Siddhivinayak, many major temple trusts now accept UPI payments for everything from:

Donations and aartis

Annadanam (free meals)

Sevas and online darshan bookings

What was once a physical act—offering a ₹10 note in a hundi—has now become a digital tap on your phone.

But here’s the real question:

Is FinTech quietly transforming how we give, connect, and support our faith?

Let’s decode this with Vizzve Finance.

📱 Faith Meets FinTech: The Rise of Digital Donations

Temples that once operated entirely in cash are now adopting:

UPI QR codes at entrances and donation counters

Online portals for donations with tax exemption (80G)

Digital receipts and aarti booking confirmations on WhatsApp

Donation dashboards to track monthly contributions

🔍 Real Stats:

Tirumala Tirupati Devasthanams (TTD) received ₹200+ crores via UPI in FY 2024-25

Over 1500 temples across India now accept QR-based donations

Tax-exempt e-receipts help donors maintain clean digital records

💡 Why Are Devotees Switching to Digital?

| Reason | Benefit |

|---|---|

| Convenience | Donate in seconds from anywhere |

| Transparency | Get receipts, tax exemptions, and traceability |

| Personalization | Choose specific pujas or annadanam to support |

| Trust | Donations directly go to temple accounts, no middlemen |

🧘 How Vizzve Helps You Give Smart, Even Spiritually

While your giving comes from the heart, Vizzve helps align it with financial clarity:

✅ 1. Track Charitable Giving in Budgets

With Vizzve, you can:

Categorize UPI donations under “Charity”

Set monthly giving limits

Get year-end donation summaries (helpful for tax filing)

✅ 2. Plan Seva Contributions Like SIPs

Devote ₹500/month towards monthly annadanam or goshala support through Vizzve’s Automated UPI Donation Scheduler.

Faith meets finance = Purposeful giving.

✅ 3. Tax Optimization via 80G Tracking

Vizzve’s Tax Planner auto-detects 80G donations via UPI receipts—ensuring:

You don’t miss any deduction

You reduce your taxable income legally

You get real-time alerts on limits

✅ 4. Temple Investment Transparency

Coming soon: Vizzve’s Trust Audit Tracker will help donors see:

Where their money is used (CSR, community kitchens, hospitals)

Annual reports from temple trusts

Ethical donation scores (pilot with 100 temples)

🌍 Faith x FinTech = A New Era of Devotion

This digital shift is more than just convenience.

It reflects a mindful India—a country blending tradition with tech.

Whether you donate ₹11 or ₹11,000, it’s now easier, smarter, and more connected.

And with Vizzve, your devotion aligns with your data.

💬 FAQs

Q1: Are UPI donations to temples tax deductible?

Yes, most registered temples offer 80G deductions. Ensure you receive a digital receipt.

Q2: How do I track all my UPI donations?

Use Vizzve Finance to auto-categorize UPI spends under “Charity” and generate donation summaries.

Q3: Is online donation safe for temples?

Absolutely—UPI is encrypted, and most temples link donations to verified trust accounts.

Q4: Can I schedule monthly donations?

Yes, Vizzve offers automated UPI scheduling options (coming soon) so you never miss a monthly seva.

🔚 Final Thought from Vizzve

You no longer need to wait for the next temple visit to give.

In 2025, devotion is just a tap away.

But giving from the heart should still come with financial mindfulness.

With Vizzve Finance, you can now give smarter—blending purpose with planning.

Published on : 18th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed.