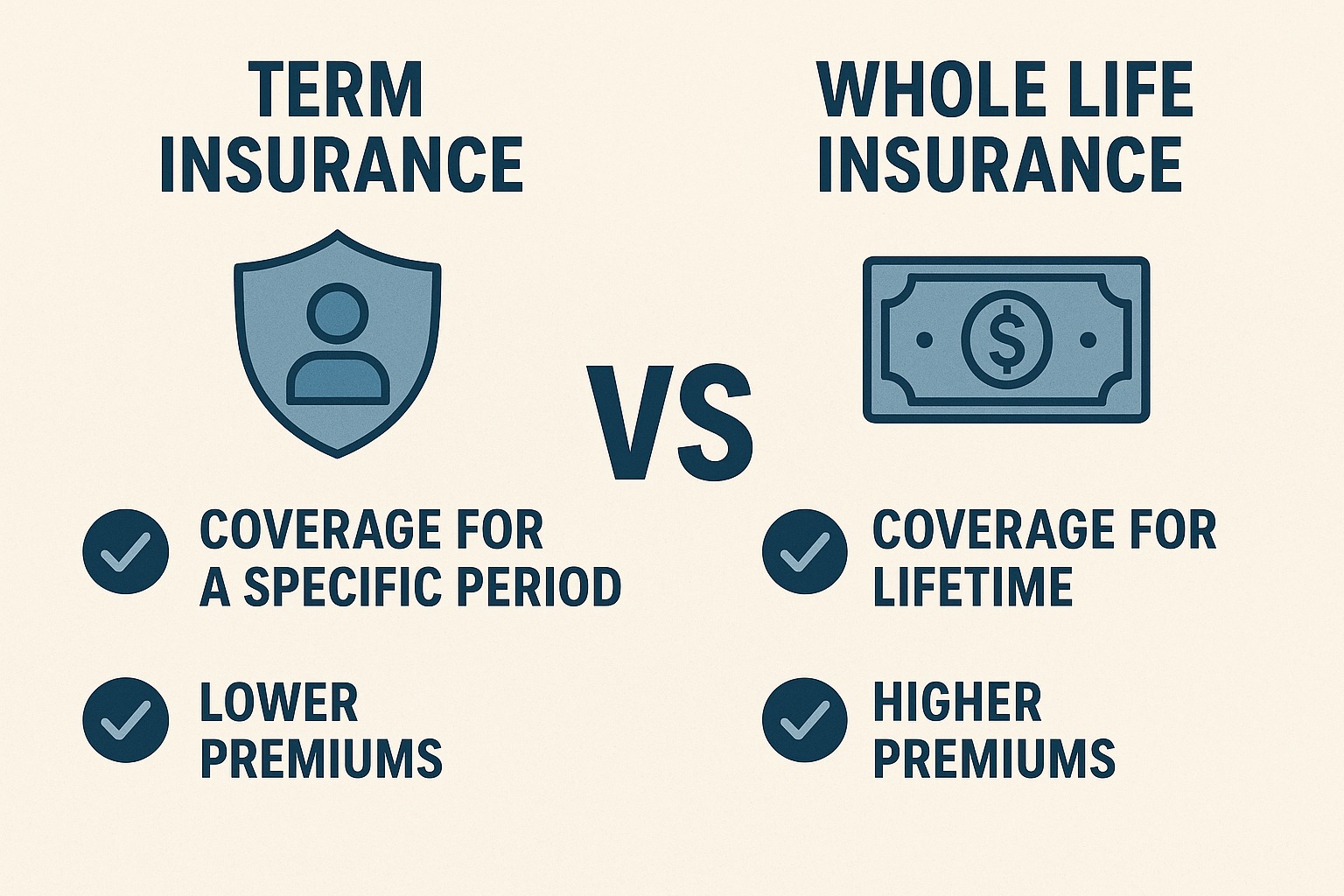

Choosing the right life insurance policy is crucial for securing your family’s financial future. Term insurance and whole life insurance serve different purposes. Understanding the differences can help you pick the policy that fits your needs and budget.

1. What is Term Insurance?

Term insurance is a pure protection plan that provides coverage for a specific term, such as 10, 20, or 30 years. It pays a death benefit to your beneficiaries if you pass away during the term.

Key Benefits:

Affordable premiums for high coverage

Simple and straightforward

Ideal for short- to medium-term protection

Considerations:

No maturity benefit

Coverage ends after the term expires

2. What is Whole Life Insurance?

Whole life insurance provides lifelong coverage and often includes a savings or investment component. It ensures that your beneficiaries receive a payout regardless of when you pass away.

Key Benefits:

Lifelong coverage

Can accumulate cash value

Suitable for long-term financial planning and estate planning

Considerations:

Higher premiums compared to term insurance

Returns may be lower than other investment options

3. Term vs Whole Life Insurance: Key Differences

| Feature | Term Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10–30 years) | Lifetime |

| Premium | Lower | Higher |

| Payout | Death during term only | Death at any time |

| Investment Component | None | Often included |

| Purpose | Pure protection | Protection + savings |

4. How to Choose the Right Policy

Budget: Term insurance is cost-effective for high coverage. Whole life insurance requires higher premiums.

Financial Goals: Choose term for short-term protection and debt coverage, whole life for long-term security and wealth transfer.

Family Needs: Consider dependents’ future expenses, liabilities, and estate planning goals.

Conclusion:

Both term and whole life insurance have distinct advantages. Term insurance is ideal for affordable, high-coverage protection, while whole life insurance suits long-term planning with lifelong coverage. Analyze your financial goals, budget, and family needs to make the best choice in 2025.

FAQ :

Q1: Can I combine term and whole life insurance?

Yes, a hybrid approach can provide high-term coverage with long-term savings benefits.

Q2: Which is more affordable, term or whole life insurance?

Term insurance generally has lower premiums because it provides pure protection without an investment component.

Q3: Does whole life insurance build cash value?

Yes, whole life policies often accumulate cash value that can be borrowed against or withdrawn.

Q4: Is term insurance renewable?

Many term plans allow renewal at the end of the term, though premiums may increase with age.

Q5: Which is better for young professionals?

Term insurance is usually better for young professionals due to lower costs and high coverage for early financial responsibilities.

Published on : 3rd September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share