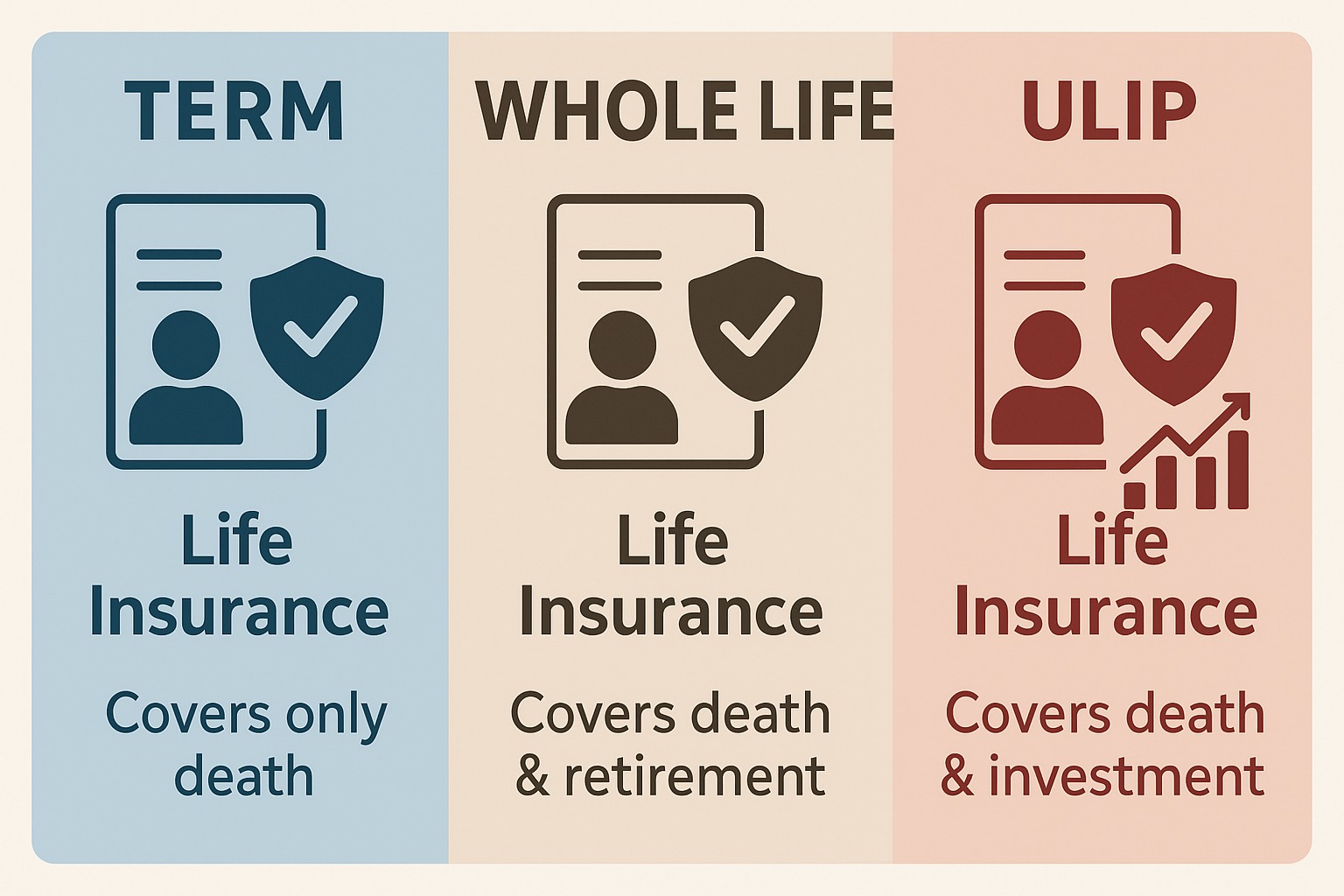

Life insurance is a cornerstone of financial planning, but choosing the right type can be confusing. In India, three popular options are Term Insurance, Whole Life Insurance, and ULIPs (Unit Linked Insurance Plans). Each serves different financial goals—whether it’s pure protection, lifelong coverage, or investment-linked growth.

1. Term Insurance – Pure Protection at Low Cost

What it is: A policy that provides a death benefit if the insured passes away during the term.

Key Features:

Lowest premiums among life insurance types.

No maturity benefit (unless return-of-premium variant).

Ideal for replacing income and securing dependents.

Best For: Young earners, families looking for high cover at affordable rates.

2. Whole Life Insurance – Lifelong Security

What it is: A policy that covers the insured for their entire lifetime (up to 99 or 100 years).

Key Features:

Guaranteed death benefit.

Some plans include savings or bonus components.

Premiums are higher than term insurance.

Best For: Individuals wanting long-term protection, estate planning, or leaving a legacy.

3. ULIPs – Insurance with Investment

What it is: A hybrid plan combining life cover with market-linked investments.

Key Features:

Part of the premium goes toward insurance, the rest is invested in equity or debt funds.

Flexibility to switch between funds.

Lock-in period of 5 years.

Best For: People with medium- to long-term goals like wealth creation, children’s education, or retirement.

Quick Comparison Table

| Feature | Term Insurance | Whole Life Insurance | ULIP |

|---|---|---|---|

| Coverage Duration | Fixed term (10–40 years) | Lifetime (99–100 yrs) | Flexible (policy term) |

| Premium Cost | Lowest | Higher | Moderate to High |

| Maturity Benefit | None (except return variant) | Possible bonuses/savings | Market-linked returns |

| Primary Goal | Protection | Lifelong security | Investment + Protection |

FAQs

Q1: Which is best for beginners?

Term insurance is the most affordable and effective for basic financial protection.

Q2: Can I switch from term to ULIP later?

No, but you can buy separate policies for different goals.

Q3: Are ULIPs risky?

Yes, since returns depend on market performance. Suitable for those comfortable with moderate risk.

Q4: Do I get tax benefits on these plans?

Yes, premiums qualify for tax deductions under Section 80C, and maturity/death benefits may be tax-free under Section 10(10D).

Q5: Can I hold more than one type of policy?

Absolutely. Many people combine term insurance with ULIPs or whole life policies.

Published on : 12th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share