Borrowers today face rising EMIs, higher interest rates, and lifestyle expenses that grow faster than incomes.

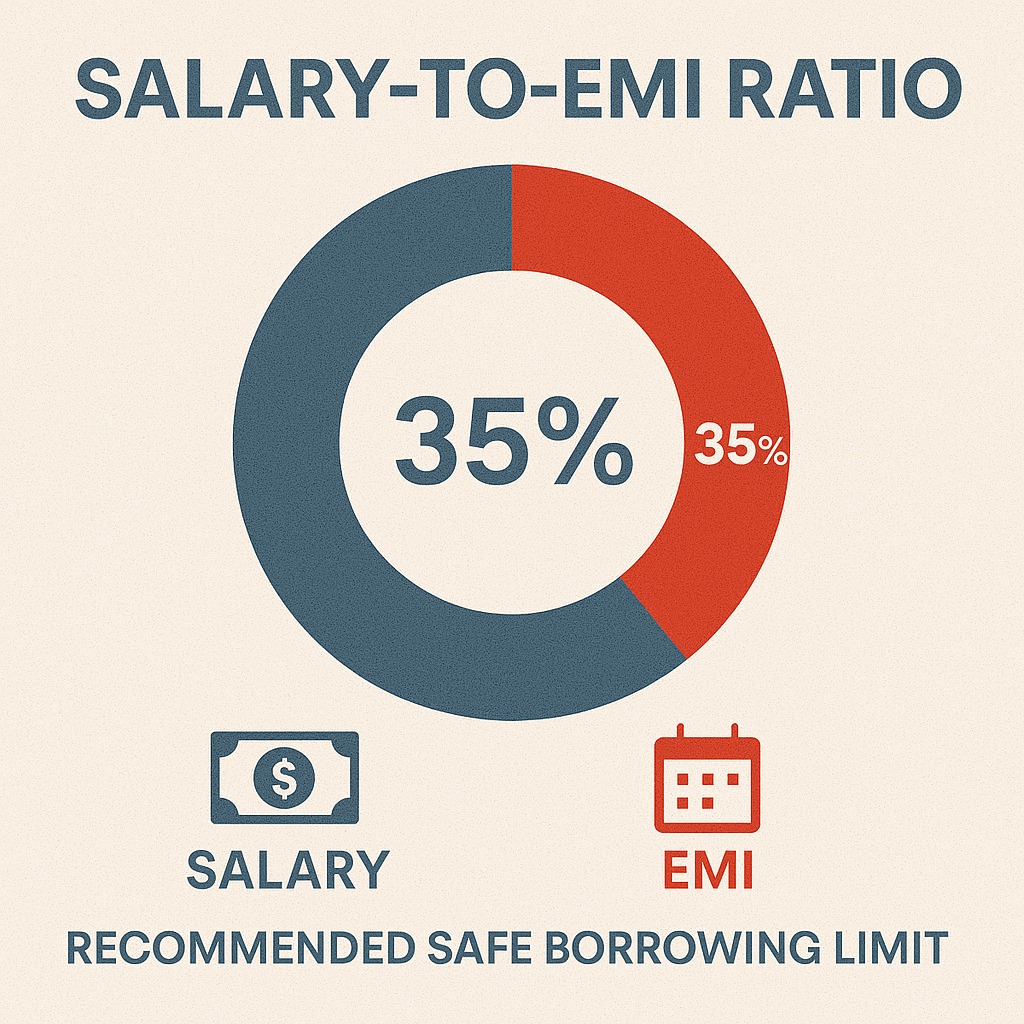

In this environment, financial planners and even lenders are increasingly recommending a simple thumb rule:

Keep all your EMIs within 35% of your take-home salary.

This guideline, known as the 35% EMI rule, is becoming the new standard for safe borrowing — and for good reason.

Here’s why.

1. It Protects You From Financial Stress

When EMIs exceed 40–50% of your income, your monthly budget becomes tight.

The 35% rule ensures:

Enough money for essentials

Smooth lifestyle management

Funds for emergencies

No constant fear of missing payments

It creates a healthy financial cushion.

2. Lenders Prefer Borrowers Who Follow This Ratio

Banks quietly use similar ratios during loan evaluations.

Keeping EMIs below 35%:

Improves your loan eligibility

Reduces chances of rejection

Makes you appear stable and low-risk

May even help secure better interest rates

Borrowers with high fixed obligations (FOIR above 40–45%) are more likely to default.

This is why lenders favour the 35% zone.

3. The Cost of Living Is Rising Faster Than Salaries

Housing, groceries, education, transportation — everything is more expensive.

If EMIs are too high, rising expenses can quickly overwhelm your budget.

35% gives enough room to handle inflation without damaging your financial health.

4. Helps You Continue Investing While Repaying Loans

If EMIs take up half your income, you stop investing — which hurts long-term wealth creation.

At 35%, you still have enough left to:

Build an emergency fund

Invest in SIPs

Save for retirement

Meet future goals

This balance keeps your finances growing even while you repay debt.

5. Prevents Loan Trap Situations

High EMI commitments often lead borrowers to:

Delay payments

Keep refinancing

Take top-up loans

Depend on credit cards

This creates an interest trap.

But staying within 35% keeps your debt manageable and reduces the risk of falling into a cycle of borrowing.

6. Rising Interest Rates Make EMIs More Volatile

Floating-rate loans (especially home loans) can rise sharply with interest hikes.

If you take a loan with EMIs already at 45–50% of your income:

A rate hike can push EMI beyond your comfort

Or extend your tenure drastically

Or both

The 35% buffer helps you absorb future rate increases without stress.

7. Ideal for Long-Tenure Loans (Especially Home Loans)

Since home loans stretch 20–30 years, your EMI-to-income ratio should be comfortable for the long term.

35% ensures:

Stability across career phases

Flexibility during job changes

Smooth handling of life events

It’s a practical ceiling for long-term financial health.

How to Calculate Your EMI Limit (Simple Formula)

Take-home monthly salary × 0.35 = Maximum total EMI

Example:

Salary ₹60,000 → EMI limit = ₹60,000 × 0.35 = ₹21,000 per month

This is the combined limit for all loans:

Home loan

Personal loan

Vehicle loan

Credit card EMIs

FAQs

1. What does the 35% EMI rule mean?

It means your total EMIs should not exceed 35% of your take-home pay.

2. Is 40–50% EMI ratio bad?

Not always, but it increases financial stress and default risk.

3. Do banks follow the 35% rule?

Most banks check FOIR (Fixed Obligation to Income Ratio). Many prefer borrowers below 35–40%.

4. Does this rule apply to all loans?

Yes — combined EMIs for all your loans.

5. Can I exceed 35% if I earn a very high salary?

High-income earners may afford more, but 35% remains a safe benchmark.

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed