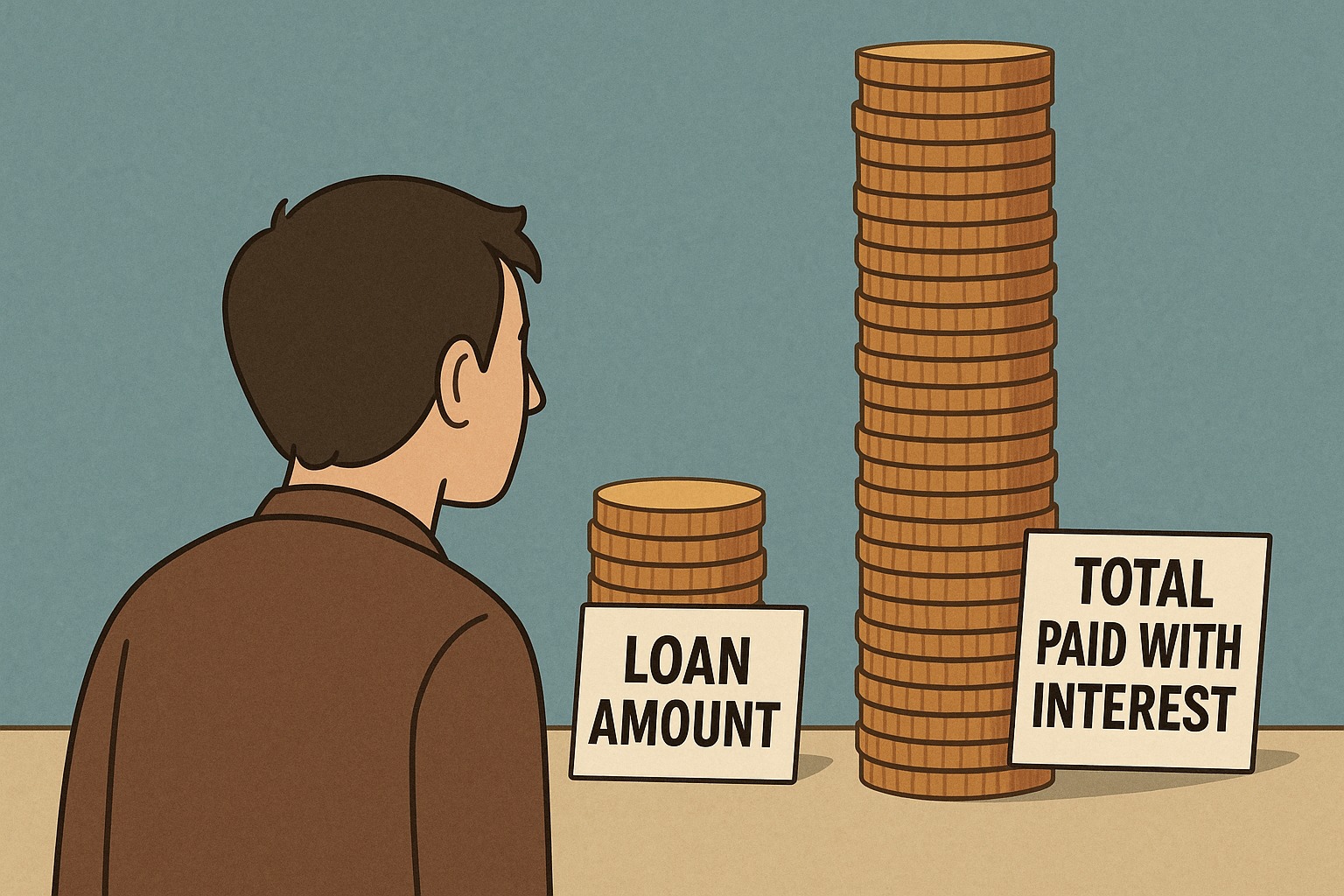

Here’s a question: if you take a ₹10 lakh loan, how much do you think you’ll actually repay?

Most people say “maybe ₹12–13 lakh.”

In reality, depending on your loan type and tenure, you could end up paying ₹18–20 lakh — almost double the original amount.

That’s the Interest Trap — a hidden cost that creeps up slowly, month by month, disguised as manageable EMIs.

Let’s break down how it happens — and how you can stop paying the price for borrowed money twice.

1️⃣ How the Interest Trap Works

When you borrow money, you don’t just pay back the principal — you also pay interest, which is the lender’s profit.

But the trap lies in loan tenure and amortization — how your EMI is structured.

In the early years, most of your EMI goes toward interest, not the principal.

This means that for the first half of your loan, your outstanding balance barely moves.

📘 Example:

₹10 lakh loan @10% interest for 15 years

Total repaid: ₹19.3 lakh

Interest alone: ₹9.3 lakh

That’s 93% of the loan amount in interest!

2️⃣ The Longer the Tenure, the Bigger the Trap

A longer tenure reduces your EMI, but drastically increases total interest.

📊 Example Comparison:

| Loan Amount | Tenure | Interest Rate | Total Repaid | Interest Paid |

|---|---|---|---|---|

| ₹10 lakh | 5 years | 10% | ₹12.9 lakh | ₹2.9 lakh |

| ₹10 lakh | 10 years | 10% | ₹15.8 lakh | ₹5.8 lakh |

| ₹10 lakh | 15 years | 10% | ₹19.3 lakh | ₹9.3 lakh |

💬 Verdict:

A 15-year loan looks affordable but can cost 3x more in interest than a 5-year one.

✅ Rule: Don’t just look at EMI — look at total cost of credit.

3️⃣ The Common Triggers of the Interest Trap

Borrowers often fall into this trap due to:

Choosing longer tenures for lower EMIs

Ignoring total repayment amount while signing

Delaying prepayments due to comfort

Not refinancing when rates drop

Relying on minimum payments for credit cards

💬 It’s not just about borrowing — it’s about not acting smartly after borrowing.

4️⃣ How to Avoid Paying Twice the Loan Amount

✅ 1. Choose the Shortest Tenure You Can Comfortably Afford

A higher EMI may feel tight initially, but it saves you lakhs in the long run.

Always choose the shortest feasible repayment period.

✅ 2. Make Small Prepayments Regularly (The Snowflake Trick)

Even tiny extra payments directly reduce your principal.

Try adding ₹1,000–₹2,000 monthly as part prepayment — it shortens your tenure and slashes interest.

💡 Over 10 years, that small amount could save you over ₹1–2 lakh.

✅ 3. Refinance or Balance Transfer to Lower Rates

If you find better offers, refinance your loan or transfer it to a new lender with lower interest.

Even a 1% reduction in rate can save thousands over the tenure.

✅ 4. Pay More Than the Minimum on Credit Cards

Credit card interest rates (30–42% annually) are the worst form of interest trap.

Always pay your full due, not just the minimum — or you’ll end up paying 3x the purchase cost.

✅ 5. Avoid Frequent Loan Resets or Top-Ups

Each time you refinance or take a top-up, your loan clock restarts, extending your interest burden.

Borrow once, repay fast, and stay disciplined.

5️⃣ Bonus Tip: Track Your “True Interest Cost”

Most borrowers only track EMIs — but the smarter way is to calculate your total interest paid over time.

✅ Use an EMI calculator to compare:

Original repayment plan

After prepayments or refinances

Seeing your total interest drop in real time is the best motivation to stay debt-conscious.

Final Thoughts

The Interest Trap is silent — it doesn’t hit you all at once, but bit by bit through every EMI.

The solution isn’t to fear loans — it’s to understand them.

Every rupee of prepayment, every shorter tenure, every refinancing decision helps you take back control.

A smart borrower doesn’t pay twice for what they borrow once.

Because financial freedom isn’t about avoiding debt — it’s about mastering it.

❓ Frequently Asked Questions (FAQ)

1. What is the interest trap?

It’s when borrowers end up paying nearly double the loan amount over time due to long tenures, high interest, or poor repayment planning.

2. How can I reduce my total loan cost?

Make prepayments, refinance to lower rates, and choose shorter tenures whenever possible.

3. Why does my EMI mostly cover interest in the beginning?

Because of amortization — lenders collect interest first, so early EMIs go mostly toward interest rather than principal.

4. How much extra do I pay on a 15-year home loan?

Depending on the rate, you can pay 80–100% of your loan amount again in interest.

5. Is prepayment always beneficial?

Yes — unless your lender charges very high prepayment penalties. Always check before paying early.

Published on : 10th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed