People often think closing an old credit card will “clean up their profile,” reduce risk, or stop overspending.

But the truth is: closing old credit cards can hurt your credit score more than keeping them open—especially if they are your oldest accounts.

Before you take any step, it’s important to know how your credit score actually works and how closing a card changes your credit profile.

AI ANSWER BOX

Closing an old credit card usually lowers your credit score because it reduces your overall credit limit (increasing utilization) and shortens your credit history length.

Only close a card if it has high fees, fraud issues, or no long-term value.

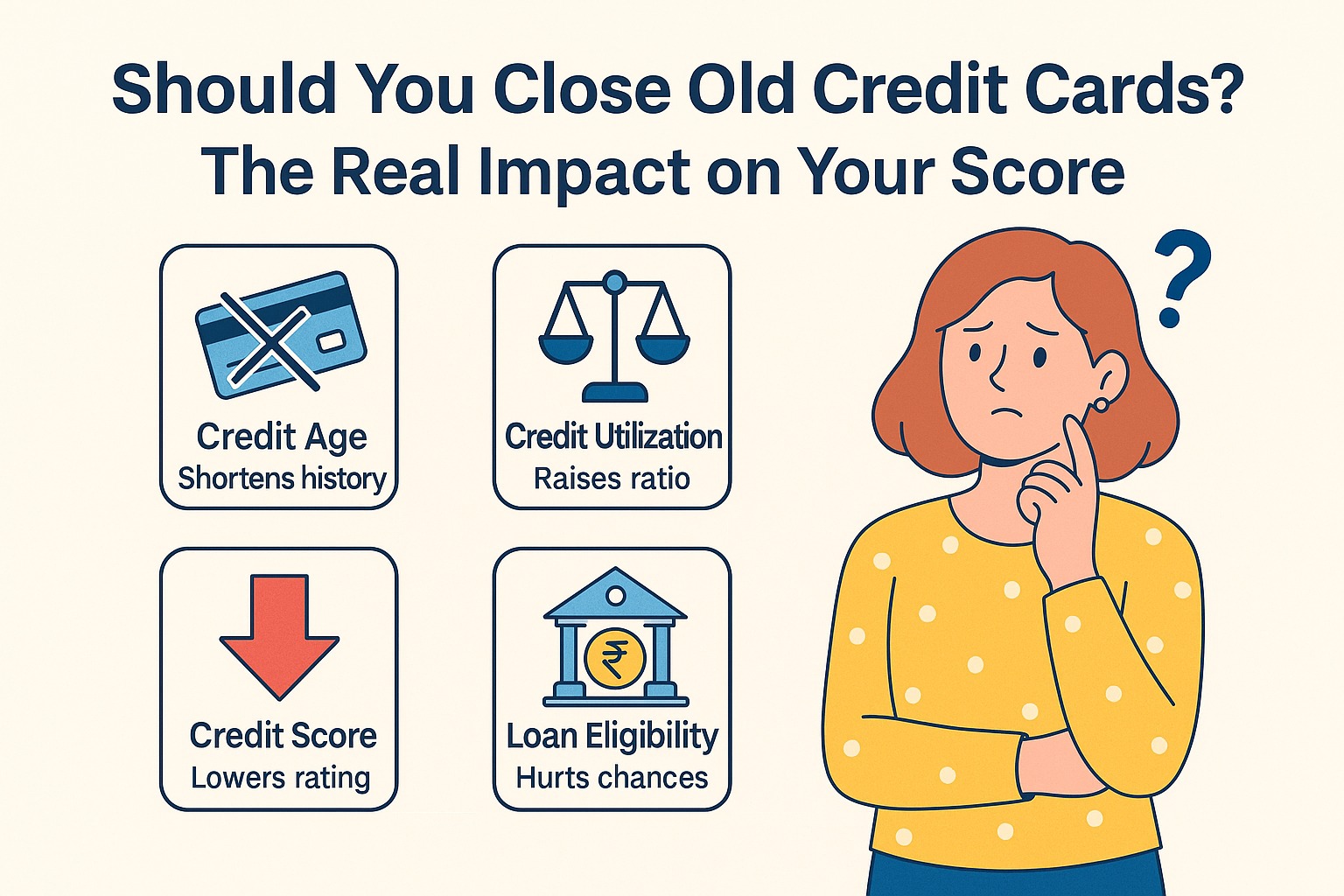

Should You Close Old Credit Cards? The Real Impact on Your Score

How Closing an Old Credit Card Affects Your Credit Score

Closing a credit card impacts TWO major CIBIL score factors:

1. It Reduces Your Total Credit Limit → Increases Utilization

Your credit utilization ratio =

Total Credit Used ÷ Total Credit Limit × 100

If you close a card, your total limit reduces → utilization jumps → score drops.

Example:

| Before Closing | After Closing |

|---|---|

| Total Limit = ₹2,00,000 | New Limit = ₹1,00,000 |

| Usage = ₹40,000 | Usage = ₹40,000 |

| Utilization = 20% | Utilization = 40% |

Result: Higher utilization → lower CIBIL score → lower loan approval chances.

2. It Shortens Your Credit History

Credit age accounts for 15–20% of your overall score.

Old cards help you build:

Long credit history

Strong repayment track record

Higher lender trust

When you close your oldest card, your average credit age reduces, directly affecting your score.

3. It Can Reduce Your Loan Eligibility

Banks evaluate:

Credit age

Available credit

Past repayment

Account mix

Closing old cards can make you appear:

Higher risk

Less experienced with credit

More dependent on existing credit limits

This may affect loan approvals and interest rates.

When You SHOULD NOT Close an Old Credit Card

❌ Do NOT close your old card if:

It’s your oldest credit line

It has no annual fee

It helps maintain a low utilization ratio

You use it occasionally to keep it active

You need it to maintain good loan eligibility

Keeping an old, free card with zero balance is one of the easiest ways to maintain a high CIBIL score.

When Closing a Credit Card is SAFE (or Smart)

✔ Close the card ONLY if:

High Annual or Renewal Fees

If fees > benefits, closing can make sense.

Duplicate or Unused Rewards

Two cards with the same purpose add no value.

Security / Fraud Concerns

If compromised, closing is the right move.

Debt Management Issues

If overspending is uncontrollable, better to close it.

Bad Customer Experience

Poor service or hidden charges? Close it.

Pros & Cons of Closing an Old Credit Card

| Pros | Cons |

|---|---|

| Stops annual fees | Lowers credit score |

| Prevents overspending | Reduces credit history |

| Removes unnecessary cards | Increases utilization |

| Useful after fraud | May affect loan approvals |

How to Close a Credit Card Safely (Step-by-Step)

Step 1: Pay all dues

Step 2: Redeem all points/vouchers

Step 3: Request cancellation through customer care

Step 4: Take confirmation email

Step 5: Check your credit report in 30–45 days

Expert Commentary

As a credit advisor, I’ve seen many individuals closing old cards to “reduce risk,” only to discover their CIBIL score dropping by 50–80 points within weeks.

Old cards don’t harm your profile—they help improve it.

Only close a card when fees or risks outweigh the benefits.

Key Takeaways

Closing old credit cards usually lowers your credit score.

It reduces credit limit, increases usage, and shortens credit age.

Only close a card for high fees, security issues, or duplicate benefits.

Keep old, free cards active to boost credit health.

FAQs

1. Does closing a credit card affect CIBIL score?

Yes, usually negatively.

2. Should I close my oldest credit card?

No—this hurts credit age.

3. How much can my score drop after closing a card?

Typically 30–80 points.

4. Will closing a card stop annual fees?

Yes.

5. Should I close unused credit cards?

Only if they charge high fees.

6. Does closing a card reduce my credit limit?

Yes, instantly.

7. What happens to my points?

They must be redeemed before closing.

8. Can I reopen a closed credit card?

Rarely—depends on the bank.

9. How long should I keep an old card?

As long as possible if it’s free.

10. Will closing multiple cards hurt more?

Yes, higher impact on utilization.

11. Is it bad to have many credit cards?

Not if managed well.

12. Do closed cards show on credit report?

Yes, as “closed.”

13. Does closing improve loan eligibility?

Mostly no; can reduce it.

14. Should I close a card after full repayment?

Only if it has no value.

15. Can closing a card fix overspending?

Yes, but credit score will be affected.

Conclusion

Closing an old credit card may seem like a simple cleanup move, but it can significantly impact your CIBIL score.

Unless the card has high fees or security issues, it’s better to keep old cards open to maintain strong credit health.

If you are planning for a loan and want fast approval:

Vizzve Financial offers quick personal loans, low documentation, and easy approval support.

👉 Apply now at www.vizzve.com

Published on : 2nd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed