Borrowing money is easier today than ever, but understanding the actual cost of a loan is crucial. Loan calculators are free online tools that help you estimate EMIs, total interest, and repayment schedules. Using these tools before borrowing ensures smarter financial planning and avoids surprises.

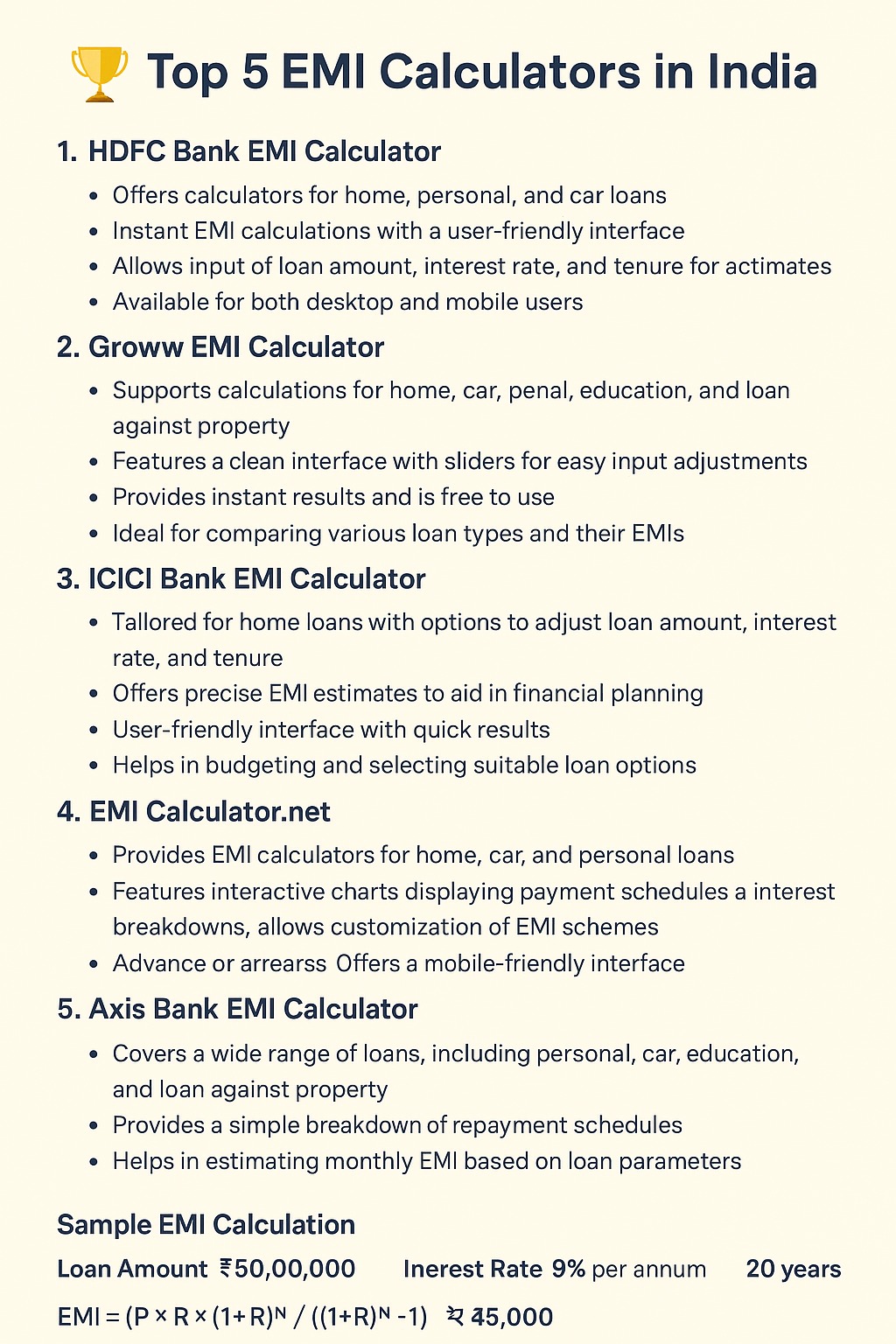

Top 5 Loan Calculators in India

Bank Loan Calculators

Offered by most public and private banks.

Can calculate EMIs for personal, home, and education loans.

Example: SBI Loan EMI Calculator, HDFC Loan Calculator.

RBI-Approved Financial Portals

RBI-endorsed websites provide calculators for various loan types.

Offer accurate interest and tax-inclusive computations.

NBFC Loan Calculators

Non-banking lenders like Bajaj Finserv, Tata Capital, and Fullerton offer calculators.

Useful for short-term personal and business loans.

Comparison Platforms

Websites like PaisaBazaar, BankBazaar, and MoneyControl allow side-by-side comparison of different lenders.

Helps find the best interest rate and total repayment amount.

Mobile Apps

FinTech apps like Paytm Money, Cred, and Groww provide in-app EMI calculators.

Instant calculation with easy scenario testing for loan tenure, interest rate, and principal.

Why Use Loan Calculators?

Estimate EMIs: Know exactly what you’ll pay monthly.

Compare Lenders: Evaluate different rates and terms.

Plan Repayment: Avoid over-borrowing and manage cash flow.

Save Money: Spot cheaper options with lower interest or shorter tenure.

Conclusion

Before taking any loan, using one of these top 5 calculators can save you time, stress, and money. They make complex calculations easy and ensure you make informed borrowing decisions.

FAQ Section

Q1. Are online loan calculators accurate?

Yes, most calculators give a close estimate, but final figures may vary slightly depending on lender charges or processing fees.

Q2. Can I calculate EMI for any loan type?

Yes, calculators typically support personal, home, education, and business loans.

Q3. Do loan calculators include processing fees?

Some calculators allow you to include processing fees, while others may focus on principal + interest only.

Q4. Are mobile app calculators reliable?

Yes, apps from verified banks and financial platforms are safe and accurate for EMI and repayment estimates.

Q5. Can calculators help me choose the cheapest loan?

Yes, using comparison platforms lets you compare interest rates, EMIs, and total repayment across multiple lenders.

Published on : 17th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share