🏦 Top 5 NBFC Loan Offers in India – September 2025 Edition

📅 Last Updated: September 2025

🖋️ Published by: Vizzve Financial

💡 Why NBFCs Are Dominating the Loan Market in 2025

In 2025, NBFCs (Non-Banking Financial Companies) are emerging as preferred lenders for personal loans, especially for:

-

✅ Instant disbursement needs

-

✅ Freelancers and self-employed individuals

-

✅ Borrowers with low or no CIBIL score

-

✅ Zero-collateral small-ticket loans

Unlike traditional banks, NBFCs are more flexible, faster, and offer paperless approval processes — making them ideal for today's digital-savvy borrowers.

Here are the top 5 NBFCs in India offering the best personal loan deals in September 2025.

🔝 Top 5 NBFC Personal Loan Offers – September 2025

1️⃣ Vizzve Financial (Powered by Partnered NBFCs)

💰 Loan Amount: ₹10,000 – ₹5,00,000

📉 Interest Rate: Starting from 11.99% p.a.

⚡ Approval: In 10 minutes (AI-powered)

📄 Docs Needed: PAN, Aadhaar, bank statement

🧾 CIBIL Flexibility: Yes – loans approved for <650 score

🎯 Ideal For: Gig workers, salaried, and self-employed

2️⃣ Bajaj Finserv

💰 Loan: Up to ₹25 Lakhs

📉 Rate: 11% – 25%

⏱️ Disbursal: Within 24 hours

📄 Documents: Standard KYC + salary slip

🎯 Ideal For: Salaried professionals with stable income

📌 Note: Higher eligibility required for top amounts.

3️⃣ Tata Capital

💰 Loan: ₹75,000 – ₹25 Lakhs

📉 Rate: 10.99% onwards

📆 Tenure: Up to 6 years

🧑💼 Pre-approved options available

📲 Apply via: App or website

👍 Strength: Trusted brand with hybrid customer service.

4️⃣ IIFL Finance

💰 Loan: ₹5,000 – ₹2 Lakhs

📉 Rate: 12% – 26% p.a.

⏱️ Fast processing for micro-loans

✅ Works well for traders and rural applicants

📌 Feature: Gold-backed & unsecured loan options available.

5️⃣ KreditBee

💰 Loan: ₹1,000 – ₹2 Lakhs

📉 APR: 14% to 30% (short tenures)

📱 100% App-based

📄 Only PAN + Aadhaar needed

💬 Ideal For: First-time loan takers and students.

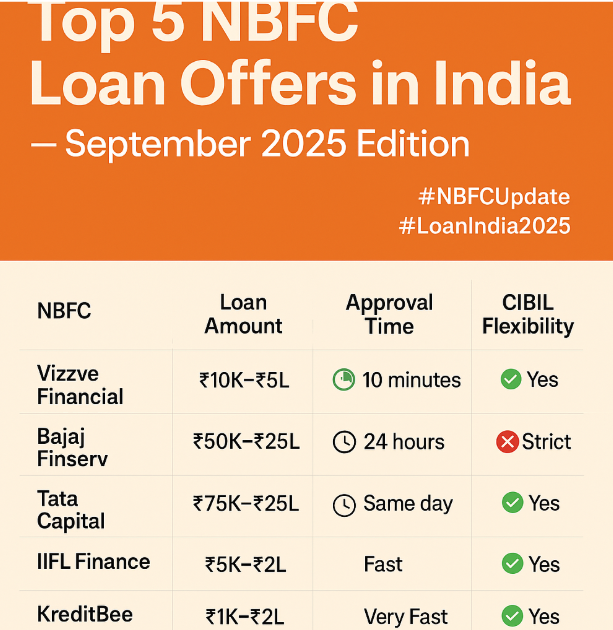

📊 Comparison Table – Top NBFC Loans September 2025

| NBFC Name | Loan Amount | Approval Time | CIBIL Flexibility | Special Feature |

|---|---|---|---|---|

| Vizzve Financial | ₹10K – ₹5L | ⏱️ 10 minutes | ✅ Yes | AI approval, low EMI, festive offers |

| Bajaj Finserv | ₹50K – ₹25L | ⏱️ 24 hours | ❌ Strict | Large amounts for salaried |

| Tata Capital | ₹75K – ₹25L | 🕒 Same day | ✅ Partial | Long tenure, good for salaried/self-employed |

| IIFL Finance | ₹5K – ₹2L | ⏱️ Fast | ✅ Yes | Great for small business owners |

| KreditBee | ₹1K – ₹2L | ⚡ Very Fast | ✅ Yes | Best for students & gig workers |