Access to affordable credit is vital for individuals and businesses looking to expand, innovate, or meet personal financial needs. In India, several government-backed loan schemes provide subsidized interest rates, flexible repayment options, and easy eligibility, helping borrowers access funds without heavy financial burden. These schemes cover small businesses, agriculture, education, housing, and startups, making credit accessible to a wide range of people.

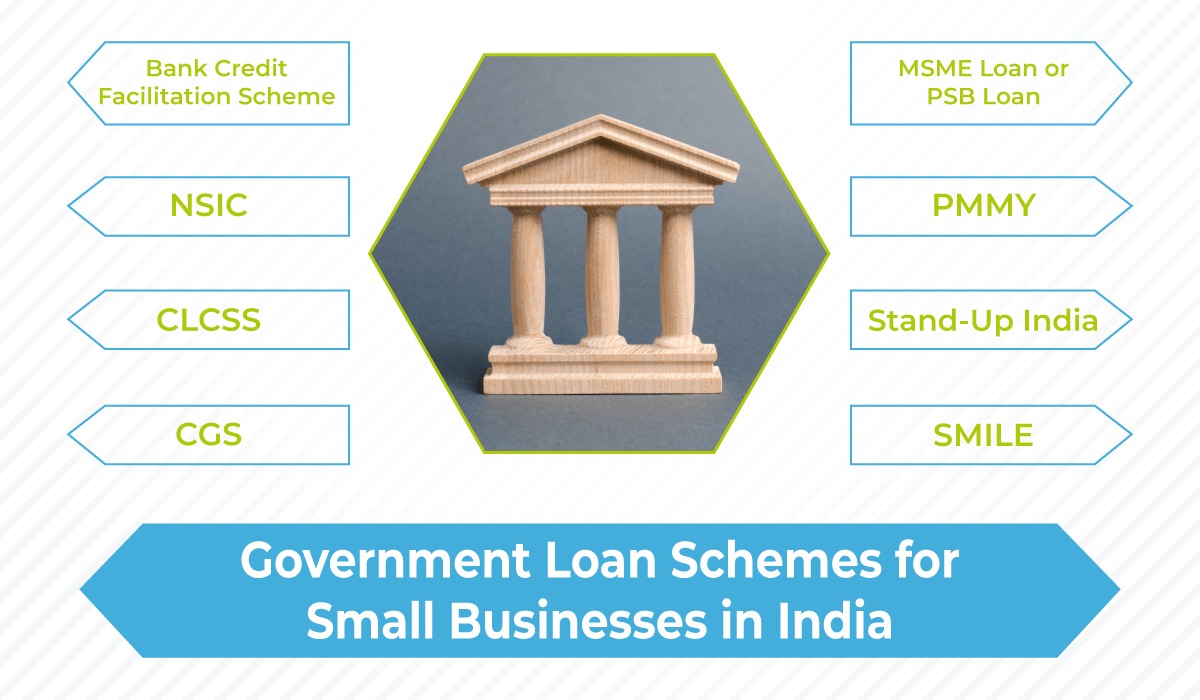

Key Government-Backed Loan Schemes

1. Pradhan Mantri Mudra Yojana (PMMY)

Target: Small businesses, micro-enterprises, and entrepreneurs

Loan Amount: Up to ₹10 lakh

Shishu: Up to ₹50,000

Kishore: ₹50,001 – ₹5 lakh

Tarun: ₹5 lakh – ₹10 lakh

Benefits: No collateral for loans under ₹10 lakh, easy application, and subsidized rates

2. Pradhan Mantri Awas Yojana (PMAY)

Target: Individuals seeking affordable housing

Loan Amount: Up to ₹2.67 lakh interest subsidy on home loans under the Credit Linked Subsidy Scheme (CLSS)

Benefits: Reduced interest rates, support for first-time homebuyers, and priority for women and lower-income groups

3. Stand-Up India Scheme

Target: SC/ST and women entrepreneurs

Loan Amount: ₹10 lakh – ₹1 crore for setting up greenfield enterprises

Benefits: Bank loans with government support, guidance, and mentoring for startups

4. Education Loans (Vidya Lakshmi Portal)

Target: Students pursuing higher education in India or abroad

Loan Amount: Up to ₹20 lakh for studies in India, ₹60 lakh abroad

Benefits: Subsidized interest, repayment after course completion, and multiple bank options

5. National Small Industries Corporation (NSIC) Scheme

Target: Micro, Small, and Medium Enterprises (MSMEs)

Benefits: Working capital finance, credit guarantee support, and preferential government contracts

Advantages of Government-Backed Loans

Lower Interest Rates – Substantially less than commercial loans.

Collateral-Free Options – Many schemes allow loans without security for small amounts.

Easy Access & Application – Digital portals like Mudra Portal, Stand-Up India, and Vidya Lakshmi streamline applications.

Inclusive Eligibility – Focused on women, SC/ST communities, and low-income groups.

Support & Guidance – Government support includes mentoring, subsidies, and repayment assistance.

Tips to Make the Most of These Schemes

Check Eligibility First: Ensure you meet criteria for income, business type, or education.

Compare Interest Rates: Different banks may offer slightly varying rates under the same scheme.

Keep Documents Ready: Aadhaar, PAN, business proof, and income certificates can speed up approvals.

Understand Repayment Terms: Plan your EMI structure and subsidy benefits carefully.

Seek Advisory Help: Banks and government portals often provide guidance for first-time borrowers.

Key Takeaways

Government-backed loans provide affordable credit for businesses, education, housing, and entrepreneurship.

Schemes like PMMY, PMAY, Stand-Up India, and NSIC are tailored to support inclusive growth.

Borrowers can benefit from subsidized interest, flexible repayment, and collateral-free options.

Understanding eligibility, documentation, and repayment terms is critical to maximize benefits.

Conclusion

Government-backed loan schemes are an effective way to kickstart a business, fund education, or buy your dream home without facing high interest costs. By choosing the right scheme and planning carefully, borrowers can access credit responsibly, grow their ventures, and secure financial stability.

✍️ These loans are designed to empower citizens across India—making opportunities accessible and fostering economic growth.

❓ Frequently Asked Questions (FAQ)

Q1. Who can apply for government-backed loans in India?

Individuals, entrepreneurs, MSMEs, students, women, and SC/ST communities can apply depending on the specific scheme.

Q2. What are the main government-backed loan schemes?

Key schemes include Pradhan Mantri Mudra Yojana (PMMY), Pradhan Mantri Awas Yojana (PMAY), Stand-Up India, NSIC loans, and education loans via Vidya Lakshmi Portal.

Q3. Are collateral or security required for these loans?

Many schemes like PMMY (up to ₹10 lakh) and certain education loans are collateral-free, while higher loan amounts may require security.

Q4. How do I apply for these loans?

Applications can be made via bank branches or digital portals like Mudra Portal, Stand-Up India, PMAY CLSS, and Vidya Lakshmi Portal.

Q5. What are the benefits of these loans?

Subsidized interest rates

Flexible repayment terms

Collateral-free options

Government support and mentoring

Q6. Can these loans help start a business?

Yes. Schemes like PMMY and Stand-Up India are specifically designed for entrepreneurs, MSMEs, and startups, offering funds for business expansion and working capital.

Published on : 9th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share