As the world moves toward sustainability-driven economies, finance is undergoing a major transformation. Enter GreenFinTech—a fusion of finance, technology, and environmental responsibility. From green loans and carbon credit platforms to eco-investment apps, startups in this space are changing how money flows into sustainable projects. In 2025, several GreenFinTech startups are standing out as game-changers.

Top GreenFinTech Startups to Watch in 2025

1. Clim8 Invest (UK)

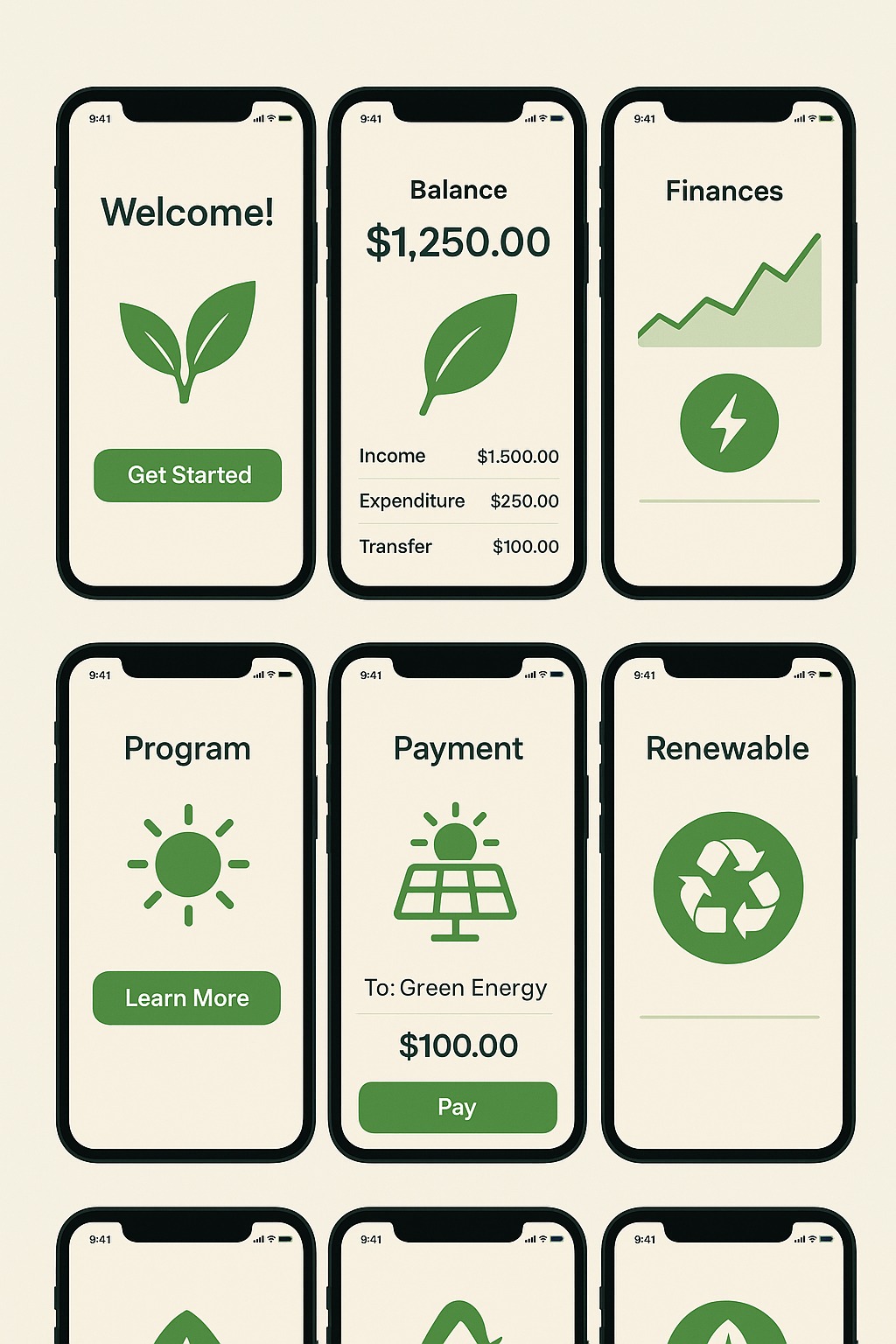

A mobile app that allows users to invest exclusively in sustainable companies and funds, focusing on renewable energy, clean tech, and water conservation.

2. Aspiration (USA)

This neo-bank combines sustainable banking with impact investing, offering debit cards that plant trees with every swipe.

3. GoGreen Finance (India)

An Indian startup enabling green loans for EV purchases, rooftop solar, and energy-efficient appliances, targeting middle-income households.

4. Plan A (Germany)

A data-driven carbon accounting platform that helps businesses track, reduce, and offset emissions while connecting them with green financing opportunities.

5. Trine (Sweden)

A crowdfunding platform for renewable energy projects, allowing individuals to invest directly in solar power for developing countries.

6. Doconomy (Sweden)

Famous for its carbon footprint calculator linked to credit cards, it empowers consumers to make climate-conscious financial decisions.

7. Moolaah Green (Singapore)

A FinTech app offering green savings accounts and digital bonds for retail investors looking to support sustainable projects in Asia.

Why GreenFinTech Startups Matter

✅ Democratizing Sustainable Investing – Anyone can start small and contribute to climate action.

✅ Driving ESG Adoption – Businesses get easier access to eco-friendly financing.

✅ Innovating Finance Models – From tokenized green bonds to carbon-tracking apps, FinTech is making sustainability measurable.

✅ Creating Impact – Every transaction and investment is linked to real-world environmental benefits.

Challenges These Startups Face

Regulatory frameworks are still catching up with green finance.

Greenwashing risks demand higher transparency.

Technology adoption gaps may slow down retail participation.

Future Outlook

By 2030, the GreenFinTech market is expected to grow exponentially, fueled by climate goals, digital adoption, and millennial/Gen Z investors who prioritize sustainability. The startups of 2025 are not just financial innovators—they’re climate warriors with code.

FAQs

1. What is GreenFinTech?

GreenFinTech combines financial technology and sustainability, focusing on eco-friendly lending, green bonds, carbon tracking, and climate-positive investments.

2. Why are GreenFinTech startups important in 2025?

They provide accessible tools for individuals and businesses to support climate action while earning financial returns.

3. Can individuals invest in GreenFinTech platforms?

Yes, many startups allow retail investors to start with small amounts in green bonds, carbon credits, or renewable projects.

4. Which sectors are most impacted by GreenFinTech?

Energy, mobility (EVs), carbon management, and sustainable banking are leading beneficiaries.

5. What is the future of GreenFinTech in India?

With government EV incentives, renewable energy push, and digital adoption, India’s GreenFinTech ecosystem is set to expand rapidly.

Published on : 1st September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share