💸 Best Instant Loan Apps in 2025 – Compare Features, Approval Time & Security

📅 Trending Now | Powered by Vizzve Financial

From weddings to vacations to last-minute emergencies, the need for quick cash is real — especially between April and June. If you're looking for the best instant loan app in India, this guide gives you the top apps offering fast approval, minimal documents, and complete security.

And yes, we'll also show you why Vizzve Financial is among the top trusted platforms in 2025.

🔰 Why Choose Vizzve Financial in 2025?

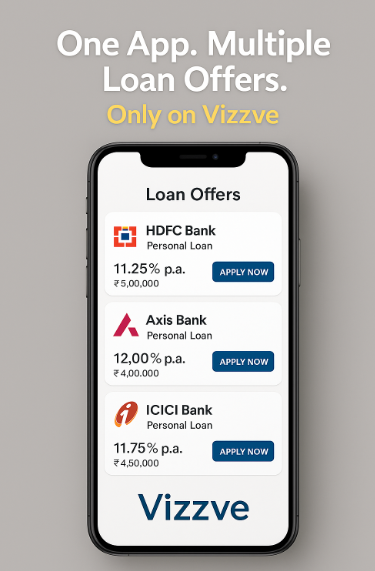

Vizzve Financial is a DPIIT-recognized fintech startup that helps users compare and apply for personal, business, and instant loans from RBI-registered NBFCs and banks — all in one place.

✅ What Makes Vizzve Special:

-

Instant approval (within hours)

-

No salary slip required for some offers

-

CIBIL score not mandatory for basic loans

-

Loan amounts from ₹5,000 to ₹20,00,000

-

RBI-registered partners: LendingKart, Godrej Capital, Ram Fincorp

👉 Apply now at: www.vizzve.com

📱 Top 5 Instant Loan Apps in India – 2025 Edition

| App Name | Approval Time | Loan Range | Special Features |

|---|---|---|---|

| Vizzve Financial | 30 mins – 4 hrs | ₹5,000 – ₹20 Lakh | Compare offers, no CIBIL needed, low docs |

| KreditBee | 5 mins – 2 hrs | ₹1,000 – ₹2 Lakh | Good for small loans |

| CASHe | 15 mins – 3 hrs | ₹7,000 – ₹3 Lakh | AI-based approval |

| MoneyTap | 10 mins – 1 hr | ₹3,000 – ₹5 Lakh | Credit line option |

| Nira Finance | 24 hrs | ₹10,000 – ₹1 Lakh | Suitable for salaried with low income |