According to a recent report, India’s top-rated finance companies (“fin-cos”) are expected to grow their loan books by 21-22% over the next two years, significantly outpacing the projected 11-12% growth in the banking sector. This trend reflects the growing role of non-banking financial companies (NBFCs) in India’s credit ecosystem and their increasing appeal to retail and corporate borrowers alike.

Why Finance Companies Are Outpacing Banks

Flexibility in Lending: Fin-cos offer customized loan products and faster processing compared to traditional banks.

Focus on Retail & SME Segments: Many NBFCs target personal loans, two-wheeler & car loans, and SME lending, segments where banks face operational constraints.

Digital Integration: Adoption of fintech platforms allows quicker approvals, paperless processes, and lower turnaround times.

Risk Appetite: Top-rated finance companies can selectively lend to higher-margin segments, supporting faster loan book expansion.

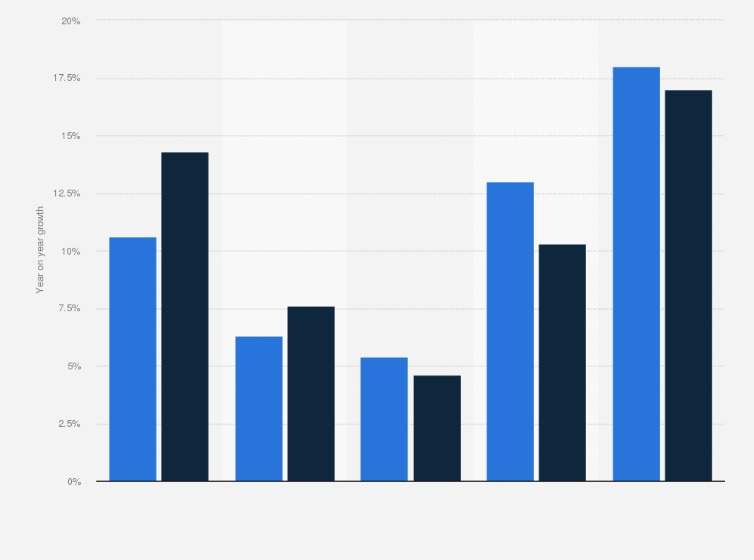

Projected Growth Metrics

| Segment | Projected Loan Book Growth |

|---|---|

| Top-Rated Finance Companies | 21–22% |

| Banking Sector | 11–12% |

This differential underscores NBFCs’ ability to capture underserved segments and adapt quickly to market needs, compared to larger banks with more rigid regulatory frameworks.

Implications for Borrowers

Faster Loan Approvals: Borrowers may benefit from speedier credit disbursal and more flexible terms.

Diverse Product Offerings: Top-rated fin-cos provide vehicle loans, personal loans, gold loans, and SME financing.

Competitive Interest Rates: Healthy competition may drive more favorable rates for borrowers.

Digital Convenience: Borrowers increasingly enjoy online application, instant eligibility checks, and quick disbursal.

Implications for the Financial Sector

Banks May Face Competitive Pressure: Strong NBFC growth could push banks to innovate and improve customer experience.

Portfolio Diversification: Investors may diversify between bank and NBFC debt products.

Sector Growth Outlook: India’s credit market overall is expected to expand faster due to NBFC penetration, particularly in tier-2 and tier-3 cities.

Conclusion

India’s top-rated finance companies are set to outgrow the banking sector in loan book expansion, highlighting their growing role in retail, SME, and specialized lending. Borrowers can expect faster, more flexible loan products, while banks may respond with competitive strategies. The next two years look promising for NBFC-led credit growth in India.

Frequently Asked Questions (FAQ)

1. Which finance companies are considered top-rated?

Top-rated NBFCs are those with high credit ratings, strong financials, and consistent performance in lending, typically operating across retail, SME, and vehicle financing.

2. Why are finance companies growing faster than banks?

They offer flexible products, faster approvals, and targeted lending to segments where banks face operational or regulatory constraints.

3. What types of loans are driving growth?

Personal loans, vehicle loans, gold loans, SME financing, and specialized consumer credit are major contributors.

4. Does this growth affect borrowers?

Yes. Borrowers can benefit from faster approvals, competitive rates, and digital lending convenience.

5. How does this impact the banking sector?

Banks may face competitive pressure, prompting better customer experience, innovative loan products, and improved lending efficiency.

Published on : 15th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share