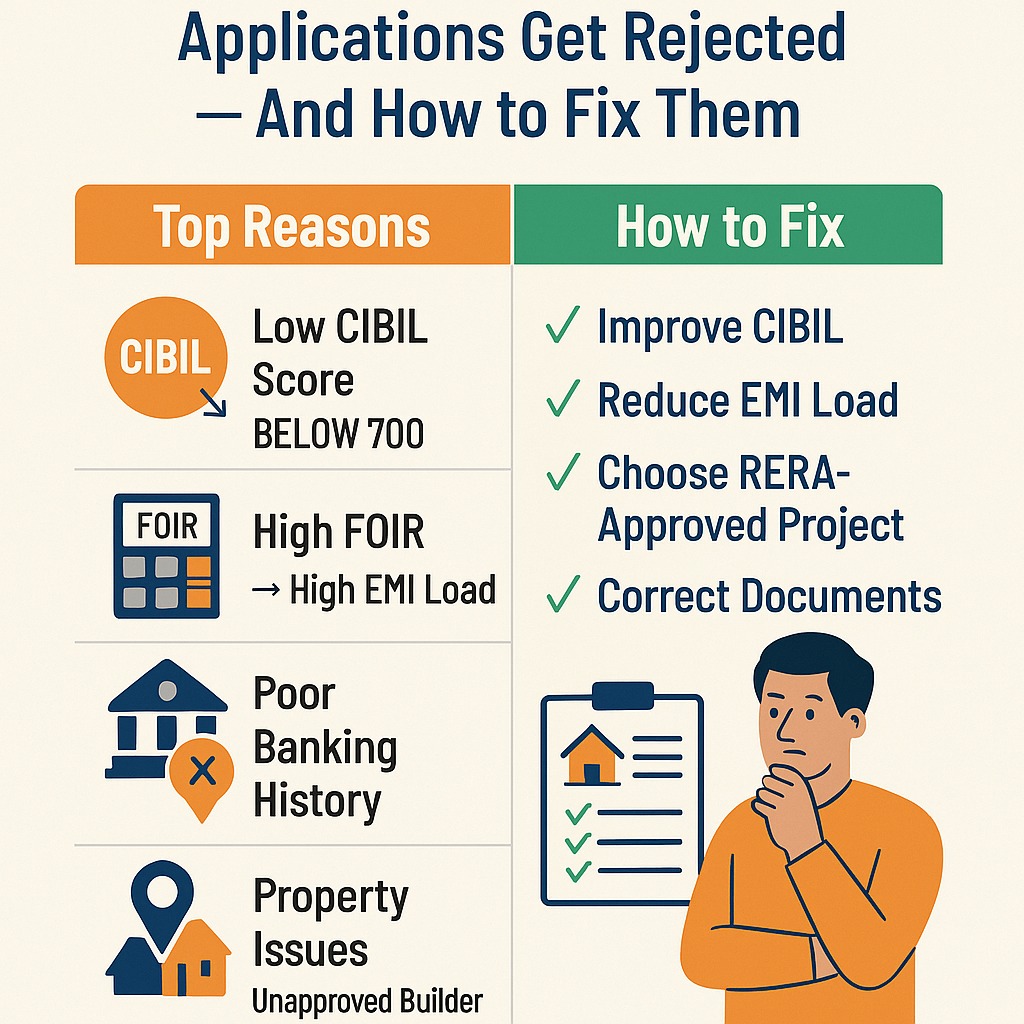

Home loans get rejected mainly due to low CIBIL score, unstable income, high FOIR (50–65%), poor banking behavior, property legal issues, mismatched documents, unapproved builder projects, or too many existing loans. Fixing these requires improving credit score, reducing EMI load, stabilizing employment, clearing documentation errors, and choosing RERA-approved properties.

1. Low or Weak CIBIL Score (Below 700)

Banks prefer 700+ CIBIL for home loans.

Below 650 = high rejection probability.

Why it happens:

Missed EMIs

Credit card overuse

Past settlements

Hard enquiries

Thin credit history

✔ Fix It:

Increase score to 720+

Pay credit card dues fully

Bring credit utilization below 30%

Don’t apply for new loans for 3 months

Correct errors in your CIBIL report

2. High FOIR (Fixed Obligation to Income Ratio)

FOIR = (Total EMIs ÷ Monthly Income)

Banks prefer FOIR below 40–50%.

Example:

Income = ₹40,000

Existing EMIs = ₹25,000

FOIR = 62.5% → Loan rejected

✔ Fix It:

Close small loans

Consolidate high-cost EMIs

Add co-applicant (spouse/parent)

Choose a longer tenure to reduce EMI

3. Unstable Employment or Inconsistent Income

Banks reject home loans if you:

Frequently change jobs

Have less than 6 months in current job

Are in probation

Work in cash-based income roles

Run unstable business income

✔ Fix It:

Show 6–12 months continuity

Provide IT returns for 2–3 years (self-employed)

Add co-applicant

Increase average bank balance

4. Property Has Legal or Technical Issues

This is a major home loan rejection reason.

Banks reject properties with:

Missing approvals

Encroachments

Disputed land

Non-RERA registration

Incomplete OC/CC

Builder not approved with bank

✔ Fix It:

Choose a RERA-approved project

Ask bank for builder approval list

Conduct legal verification before booking

Provide all chain-of-title documents

5. Low Income or Not Meeting Eligibility Criteria

Banks have minimum income thresholds:

Metro cities: ₹25,000–₹30,000+

Tier-2 cities: ₹18,000–₹22,000+

If income is too low → loan gets rejected.

✔ Fix It:

Add co-borrower

Extend tenure (up to 30 years)

Show additional income sources

Apply with NBFC (flexible criteria)

6. Poor Banking Behaviour (New 2026 Factor)

Lenders check your last 6–12 months of bank statements.

Rejection causes:

Low balance

Salary not credited regularly

Excessive cash withdrawals

Returned ECS/EMIs

High UPI spending without savings

Overdraft usage

✔ Fix It:

Maintain minimum average balance

Avoid EMI bounces for 3–6 months

Increase savings behaviour

Keep account clean before applying

7. Too Many Recent Loan Enquiries

Too many credit inquiries = “Credit hungry”

Banks see this negatively.

✔ Fix It:

Stop applying for 60–90 days

Allow score to stabilize

Apply to only one lender at a time

8. Errors in Documentation / Identity Mismatch

Common errors:

PAN-Aadhaar mismatch

Name spelling issues

Wrong address

Missing signatures

Incorrect income proof

✔ Fix It:

Update Aadhaar/PAN

Submit correct KYC

Re-upload missing documents

9. Your Employer Is Categorized as High-Risk

Banks maintain employer categories (A+, A, B, C, D).

Loans are often rejected if:

Company is not registered

Company has financial risk

Company is not in bank's approved list

✔ Fix It:

Apply with NBFCs (more flexible)

Add stable co-applicant

10. Property Valuation Lower Than Loan Applied

Bank valuation < Market price

Example:

Property cost = ₹60 lakh

Bank valuation = ₹50 lakh

Loan requested = ₹48 lakh → Rejected or reduced

✔ Fix It:

Increase down payment

Choose lender with different valuation team

Comparison Table – Why Home Loans Get Rejected

| Reason | Bank Perspective | Fix |

|---|---|---|

| Low CIBIL | High default risk | Improve score |

| High FOIR | Excess EMI load | Close loans / co-applicant |

| Job instability | Future risk | 6–12 months stability |

| Property issues | Legal risk | RERA-approved projects |

| Low income | Not eligible | Increase tenure |

| Poor banking history | Weak financial discipline | Clean statements |

| Documentation errors | Verification failed | Correct and reapply |

Expert Commentary

As a home loan advisor, I’ve seen that more than 60% of rejections are due to factors other than CIBIL score.

Banks analyze employment stability, repayment behaviour, FOIR, and property legality more deeply for home loans than any other type of loan.

A simple correction in documents or selecting the right lender can turn a rejection into approval.

🟦 Key Takeaways

CIBIL score alone does not guarantee approval.

Property documents and job stability matter heavily.

Clean bank statements improve approval chances.

High EMI load (FOIR) is the biggest hidden rejection reason.

Fix issues and reapply after 60–90 days.

FAQs

1. Why was my home loan rejected even with CIBIL 750?

Because banks check FOIR, property legality, and job stability.

2. Can I reapply after rejection?

Yes—after fixing the issue (usually after 60 days).

3. Is a co-applicant helpful?

Yes—improves eligibility and reduces FOIR.

4. Do banks reject loans due to property issues?

Yes—major reason for rejection.

5. What is a good FOIR for home loans?

Below 40–50%.

6. I changed jobs. Will loan be rejected?

Possibly—banks prefer stability.

7. Can NBFCs approve rejected cases?

Yes—NBFCs are more flexible.

Conclusion

Home loan rejection isn’t the end — it’s simply a signal that something needs correction.

With the right documents, stable income, and the correct lender choice, you can turn rejection into approval quickly.

Looking for easy loan access?

Vizzve Financial offers:

✔ Fast personal loan approvals

✔ Low documentation

✔ Flexible eligibility

✔ Trusted, secure experience

👉 Apply now at www.vizzve.com

Published on : 3rd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed