In 2025, a notable shift occurred in India's personal loan landscape: vacations overtook medical emergencies and home renovations as the leading reasons for borrowing. This change reflects evolving consumer priorities and financial behaviors, particularly among younger and digitally savvy borrowers.

The Rise of Travel Loans

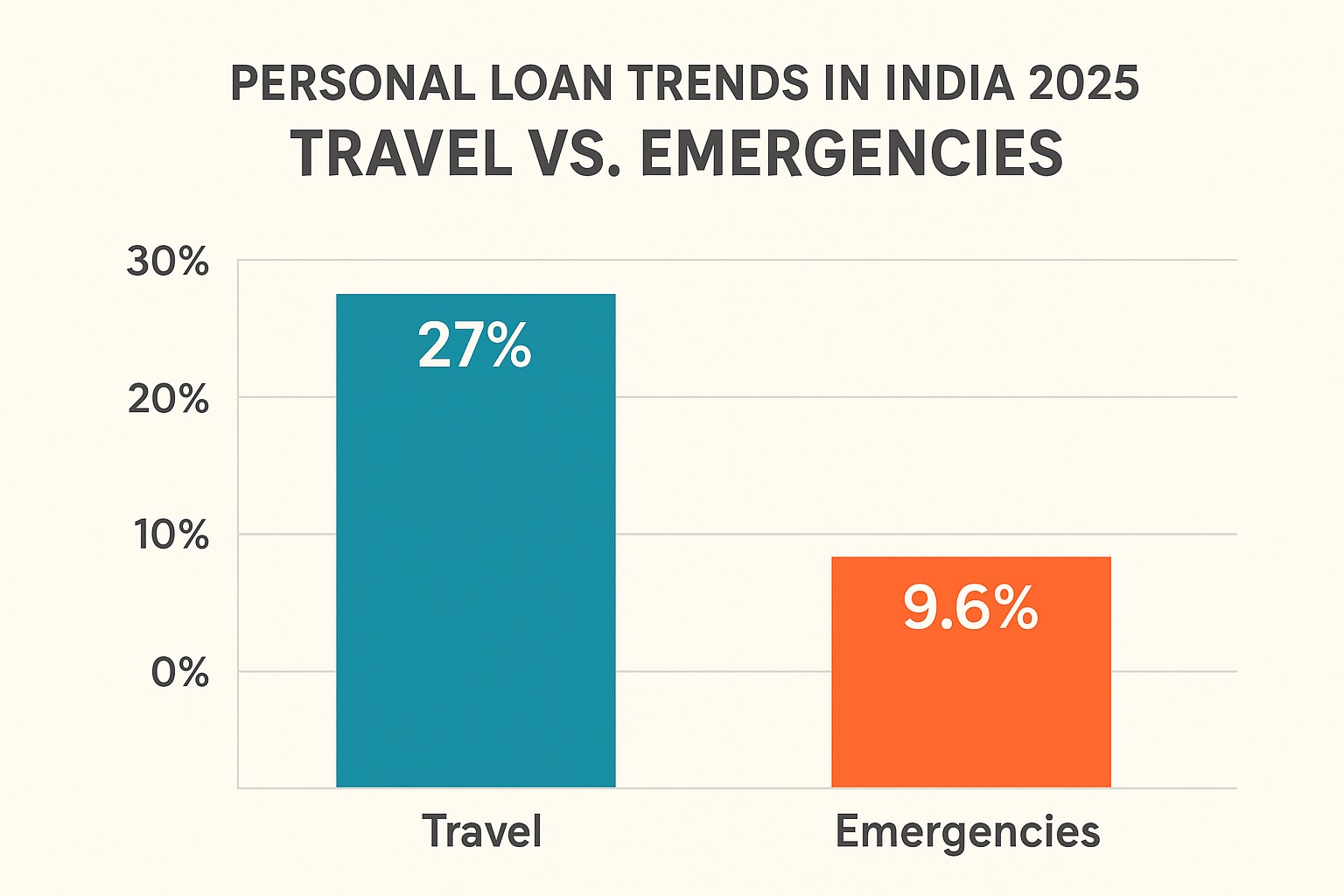

Recent surveys indicate that around 27% of personal loan borrowers used the funds for travel, up from 21% in 2023. This trend is especially prominent in Tier-2 and Tier-3 cities, where more than 70% of borrowers are opting for holiday loans.

Why Travel Loans Are Gaining Popularity

Several factors contribute to the surge in travel-related borrowing:

Aspirational Spending: With increasing disposable incomes, many Indians are prioritizing experiences like vacations over material purchases.

Easy Access to Credit: Digital lending platforms and fintech companies have streamlined the loan application process, making it quicker and more accessible.

Flexible Repayment Options: Personal loans offer manageable EMIs, allowing borrowers to finance their vacations without immediate financial strain.

Emergency Loans: Still a Critical Need

Despite the rise in travel loans, medical emergencies remain a significant reason for borrowing. Personal loans provide quick access to funds for unforeseen medical expenses, offering flexibility and no collateral requirements.

Comparative Overview

| Purpose | Percentage of Borrowers | Key Drivers |

|---|---|---|

| Travel | 27% | Aspirational spending, easy credit |

| Medical Emergencies | 9.6% | Unforeseen health expenses |

| Home Renovations | 24% | Property value enhancement |

Implications for Lenders and Borrowers

For lenders, this shift presents an opportunity to tailor products that cater to the growing demand for travel loans. Offering competitive interest rates and flexible terms can attract a broader customer base.

For borrowers, it's essential to assess the necessity of the loan and ensure that repayment terms align with their financial capabilities. While financing a vacation can be appealing, it's crucial to avoid over-leveraging.

Conclusion

The evolving trends in personal loan usage highlight a shift in consumer priorities, with experiences like travel gaining prominence over traditional needs. Both lenders and borrowers must adapt to these changes, ensuring that financial products and borrowing decisions align with current economic realities and personal aspirations.

FAQs

Q1: Why are more people taking personal loans for travel than emergencies?

A: Rising disposable incomes, aspirational spending, and easy access to digital loans have made vacations a popular reason for borrowing.

Q2: Are travel loans different from regular personal loans?

A: Typically, travel loans are a type of personal loan with similar interest rates and repayment terms, but lenders may offer tailored packages or promotional rates for vacation financing.

Q3: Is borrowing for travel financially safe?

A: Borrowing for travel can be safe if EMIs fit within your budget. Over-borrowing or high-interest loans can lead to financial strain.

Q4: Do medical emergencies still require personal loans?

A: Yes, personal loans remain a quick, flexible, and collateral-free way to fund unexpected medical expenses.

Q5: How should borrowers choose between a travel loan and other types of personal loans?

A: Assess urgency, purpose, repayment capacity, and interest rates. Travel loans should complement your finances without jeopardizing essential expenses.

Published on : 6th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share