Auto-payments have become essential for smooth financial management — whether it’s OTT subscriptions, SIPs, loan EMIs, electricity bills or insurance premiums.

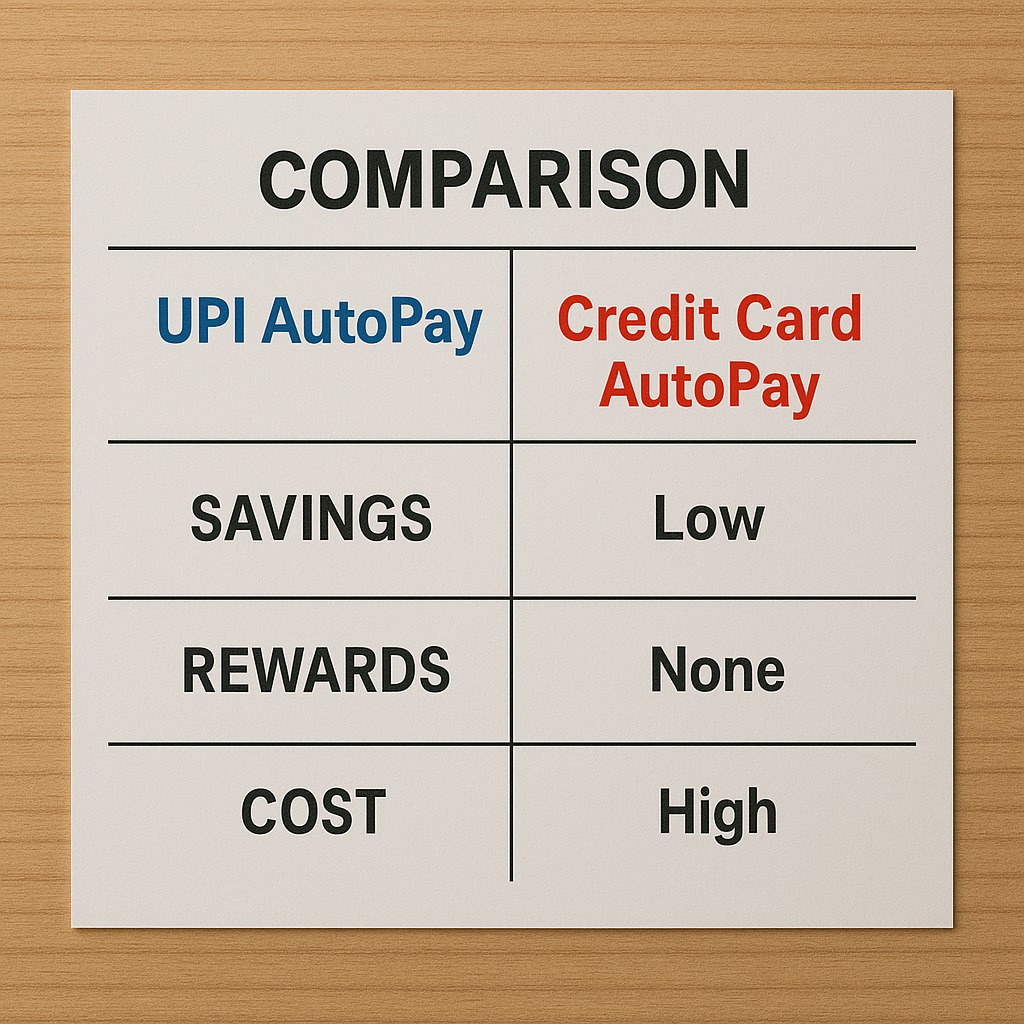

The two most popular auto-debit options today are UPI AutoPay and Credit Card AutoPay.

But which one actually saves you more money?

The answer isn’t the same for everyone — it depends on how you spend, your fees, and your credit habits.

Here’s a simple, clear comparison to help you choose the best money-saving option.

⭐ 1. Convenience & Cost: UPI AutoPay Is Free, Card AutoPay Has Hidden Charges

UPI AutoPay:

✔ Free to set up

✔ No annual fee

✔ No interest

✔ No processing charges

Credit Card AutoPay:

✔ Free to enable

✘ Late payment interest if balance isn’t cleared

✘ Taxes on interest

✘ Minimum payment trap

✘ Over-limit charges

👉 Winner: UPI AutoPay (Zero cost, zero risk)

⭐ 2. Rewards & Cashback: Credit Cards Save More Here

Credit Card AutoPay:

✔ Cashback, reward points, offers

✔ Extra savings on OTT, travel, food, fuel

✔ Up to 1–5% reward rate depending on card

✔ Can stack offers with bill payments

UPI AutoPay:

✔ Mostly no rewards

✔ Occasional app-based cashback only

👉 Winner: Credit Cards (Higher long-term savings if used responsibly)

⭐ 3. Risk of Penalties: Cards Are Riskier

Credit cards carry heavy penalties:

Late fee charges

30–42% interest per annum

Over-limit charges

Penalty interest

GST on all charges

UPI AutoPay automatically pays from your bank balance.

No balance → payment simply fails → no penalty from UPI.

👉 Winner: UPI AutoPay (Zero penalty risk)

⭐ 4. Impact on Credit Score

UPI AutoPay:

No effect on credit score.

Credit Card AutoPay:

✔ Paying full bill → improves score

✘ Missing payment → major score drop

✘ Paying only minimum due → long-term negative effect

👉 Winner: Depends on behaviour

Disciplined user → Credit card AutoPay is beneficial

Irregular user → UPI AutoPay is safer

⭐ 5. Budgeting & Control: UPI Helps You Avoid Overspending

With UPI AutoPay:

Money is deducted only if your bank balance has funds

You spend from your own money, not borrowed money

Better expense tracking

No debt cycle risk

With credit cards:

Easy to overspend

Revolving credit becomes costly

Debt builds silently

👉 Winner: UPI AutoPay (Best for budgeting & money control)

⭐ 6. Where Each Option Works Best

Use UPI AutoPay for:

✔ OTT apps

✔ Utility bills

✔ EMI mandates linked to bank

✔ Insurance premiums

✔ Regular monthly subscriptions

Use Credit Card AutoPay for:

✔ High-value purchases

✔ Shopping apps

✔ Food, fuel, travel

✔ Payments with cashback or reward benefits

⭐ So Which One Actually Saves You More Money?

UPI AutoPay saves more if:

You want zero fees

You want zero interest

You want strict budgeting

You want a no-risk option

Credit Card AutoPay saves more if:

You always pay FULL bill on time

You want cashback/rewards

You’re disciplined with spending

You track your expenses well

The real saver depends on your behaviour.

Final Verdict

| Category | Better Option |

|---|---|

| Zero fees | UPI AutoPay |

| Rewards & Cashback | Credit Card AutoPay |

| Budget control | UPI AutoPay |

| Credit score improvement | Credit Card AutoPay |

| Low risk | UPI AutoPay |

| Long-term savings (disciplined users) | Credit Card AutoPay |

If you’re financially disciplined → Credit Card AutoPay saves you MORE.

If you want to avoid debt traps → UPI AutoPay is the safest and cheapest.

FAQs

Q1. Does UPI AutoPay charge any fees?

No, it is completely free.

Q2. Can credit card AutoPay improve my credit score?

Yes — if you always pay the full bill.

Q3. Which one is safer for beginners?

UPI AutoPay, because it uses your own money.

Q4. Which one gives more cashback?

Credit cards offer better reward programs.

Q5. Can I use both?

Yes — many people use UPI AutoPay for essentials and credit cards for reward-based payments.

Published on : 14th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed