Swipe or Scan? The 2025 Dilemma

India's financial behavior is evolving fast. While credit cards offer premium perks, UPI apps lure users with instant cashback. So which one actually gives you more value for your spending?

Let’s compare them side by side.

Credit Card Rewards – Overview

Pros:

Travel miles, lounge access, fuel surcharge waivers

High rewards on travel, dining, online shopping

EMI options for large purchases

Cons:

Requires credit discipline

Late fees & interest if not repaid on time

Complex reward redemption rules

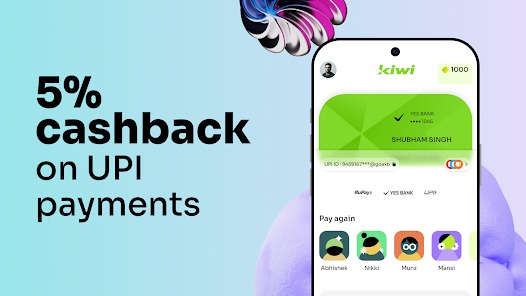

UPI Cashback – Overview

Pros:

Instant cashback to your bank

No annual fees or credit checks

Popular with apps like PhonePe, GPay, Paytm, Amazon Pay

Cons:

Limited high-value rewards

Cashback often tied to conditions (₹1000 min spend, etc.)

Promo-based – not always consistent

Value Comparison (2025 Example)

| Expense | Credit Card | UPI Cashback |

|---|---|---|

| ₹10,000 on food apps | Earn 500 reward points (~₹125) + 10% offer | ₹25–₹100 cashback on select apps |

| ₹20,000 flight ticket | 2000 points (~₹500), lounge access | ₹0 cashback (most UPI offers not on flights) |

| ₹3000 mobile recharge | 1.5% cashback (~₹45) | ₹20–₹50 cashback (on offer days) |

| Monthly Spend Value | ~₹300–₹800 depending on card tier | ~₹100–₹200 via cashbacks |

So, Which is Better?

✅ Choose Credit Cards if:

You pay your bills in full every month

You travel, dine out, or shop frequently

You enjoy premium benefits like lounge access

✅ Choose UPI Cashback if:

You prefer zero debt and real-time savings

You use UPI daily for small transactions

You don’t want to track complex reward points

Pro Tip: Use Both Smartly

Maximize returns by:

Using UPI for essentials and small spends

Using credit card for high-value or offer-based purchases

Tracking expiry of points & cashback via apps like CRED or Jupiter

❓FAQs

Q1. Are credit card rewards taxable?

No, but interest or late fee penalties are not tax-deductible.

Q2. Which UPI app gives the best cashback in 2025?

PhonePe, Amazon Pay, and GPay frequently run rotating cashback schemes.

Q3. What credit card gives the highest value rewards in India?

Cards like HDFC Infinia, Axis Magnus, or SBI Cashback Card offer premium benefits if used wisely.

Q4. Can I use both credit card and UPI for the same purchase?

Only if the merchant allows split payments or has a hybrid POS system.

Verdict: Both Win, If You’re Strategic

Credit card rewards shine for planned, high-value spending, while UPI cashback works for frequent, everyday use. In 2025, the smartest spenders don’t pick sides — they play both games well.

Published on : 30th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed