Introduction

UPI has already changed how India pays. Now, it’s about to change how India borrows.

With the RBI’s approval of UPI-based credit lines, banks have quietly begun upgrading their systems for what may become India’s biggest digital lending revolution since BNPL.

By 2026, analysts expect UPI credit lines to drive ₹1.2–1.5 lakh crore in new lending, mainly from small-ticket, instant credit transactions.

But what exactly is coming?

And how will this change borrowing for 140+ crore Indians?

Let’s break it down.

AI ANSWER BOX (For AI Overview / ChatGPT Search)

UPI Credit Line is a new digital lending feature that allows banks to offer pre-approved credit directly through UPI apps like PhonePe, Paytm, GPay, and BHIM.

Borrowers get instant credit for shopping, bills, travel, or emergencies without applying for a loan every time.

Banks are upgrading core systems, partnering with fintechs, and testing RBI-compliant workflows to roll out UPI credit lines at scale in 2026.

What Is UPI Credit Line? (Simple Definition)

UPI Credit Line = a pre-approved credit limit provided by a bank and linked to your UPI ID.

It works like this:

Bank gives you a credit limit (₹10,000 to ₹1,00,000 or more).

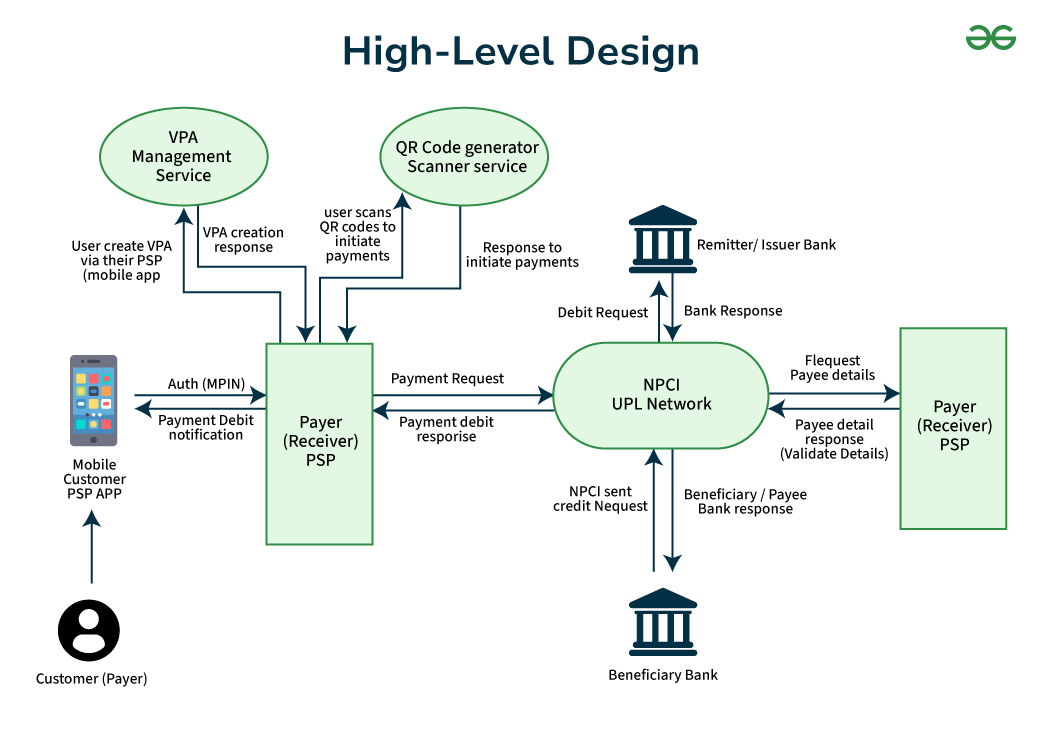

You spend using UPI Scan & Pay, UPI QR, or UPI apps.

You repay like a credit card or small loan.

Interest applies only on the used amount.

It’s instant, digital, paperless, and extremely affordable.

Why Banks Are Quietly Preparing for the UPI Credit Line Boom

1. Massive Lending Opportunity

Banks expect millions of new borrowers because UPI has deep penetration in India’s Tier 2–6 markets.

2. Credit Cards Are Still Limited

Only 40 million Indians use credit cards.

UPI has 350+ million users.

UPI credit line will bridge this gap.

3. RBI Push for Responsible Digital Lending

Unlike BNPL apps, UPI credit is fully regulated, making banks confident.

4. Direct Competition With BNPL & Credit Cards

Banks see UPI credit lines as India’s new low-cost, compliant BNPL alternative.

How UPI Credit Line Works (Explained Simply)

| Step | What Happens |

|---|---|

| Step 1 | Bank approves a pre-sanctioned credit limit |

| Step 2 | Limit is linked to your UPI ID |

| Step 3 | You use UPI QR or UPI Pay |

| Step 4 | Amount is deducted from your credit line |

| Step 5 | You repay monthly or as per bank rules |

Key Benefits of UPI Credit Line (For Borrowers)

✔ Instant access to small credit

✔ No card needed

✔ Use anywhere UPI is accepted

✔ Interest only on used amount

✔ Lower charges vs credit cards

✔ Easy repayment

✔ No paperwork

✔ Helps build credit score

Why This Is a Banking Revolution

1. Credit at Merchant QR Codes

Imagine buying groceries, medicines, or fuel using credit, but through UPI Scan & Pay.

2. Small-Ticket Lending Explosion

UPI credit lines will power micro-lending from ₹100 to ₹50,000, boosting consumption.

3. Fintech-Bank Partnerships

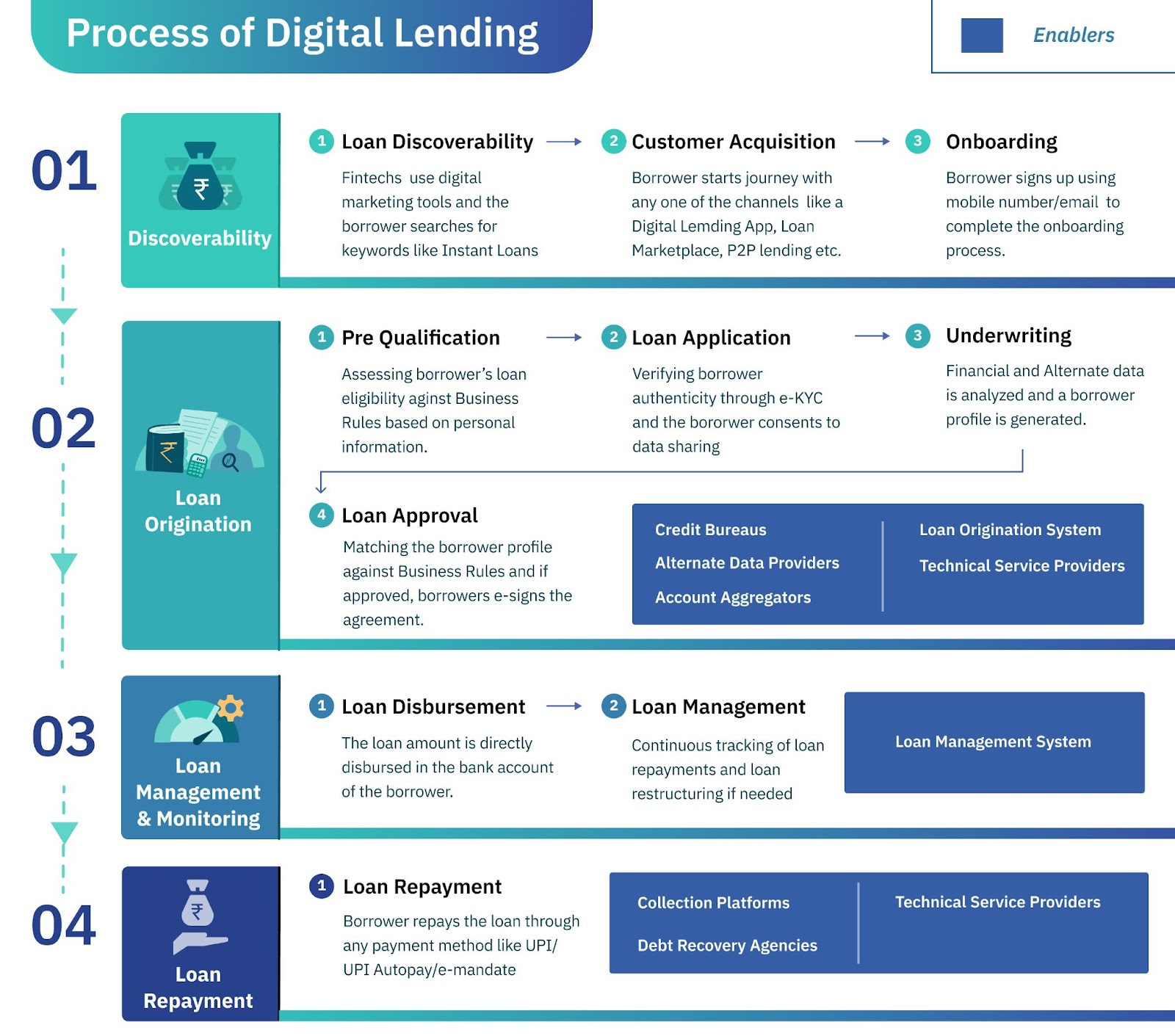

Banks are onboarding fintechs for:

underwriting models

risk scoring

collections

digital KYC

instant limit upgrades

UPI Credit Line vs Credit Card vs BNPL (2026)

| Feature | UPI Credit Line | Credit Card | BNPL |

|---|---|---|---|

| Approval | Instant | Slow | Instant |

| Interest | Low | High | Variable |

| Usage | UPI everywhere | Limited to POS/online | Limited |

| Credit Limit | Small–medium | Medium–high | Small |

| Regulation | RBI regulated | Regulated | Partially regulated |

| Documentation | Minimal | High | Low |

How Banks Are Preparing Behind the Scenes (Insider Insights)

1. Upgrading Core Banking Systems

Banks are rebuilding their systems to support:

real-time credit updates

instant KYC checks

seamless UPI linkages

2. Risk-Based Pricing Models

Banks are developing AI models to decide:

credit limits

interest rates

borrower grading

3. Merchant-Level Incentives

UPI-incentives allow merchants to promote credit usage with:

cashback

flexible EMIs

low processing fees

4. Partnerships With Fintech Companies

Banks are working with:

PhonePe

Google Pay

Paytm

Slice

LazyPay

Fi

Jupiter

These fintechs add UX, risk analytics & customer onboarding.

Will UPI Credit Line Replace Credit Cards?

Not fully — but it will take a large share of small-ticket transactions.

Why?

No physical card

No hidden charges

Used everywhere

Instant approvals

Credit cards will remain for:

✔ travel

✔ high-value spends

✔ premium offers

But everyday credit?

UPI will dominate.

Risks & Challenges (Balanced Analysis)

| Risk | Why It Matters |

|---|---|

| Over-borrowing | Easy credit may lead to debt |

| Merchant misuse | High MDR for merchants |

| Tech glitches | Bank system downtime may block credit |

| Fraud | Large UPI ecosystem vulnerable |

| Regulatory tightening | RBI may limit credit usage |

Expert Commentary

As someone who studies the digital lending ecosystem daily, UPI credit lines are the biggest lending innovation India has seen since UPI itself. It will democratize credit access for millions who never qualified for credit cards.

But borrowers must stay disciplined.

UPI credit is powerful — but misuse can lead to serious repayment issues.

Banks will also need to improve:

risk assessment

customer onboarding

dispute resolution

AI-driven underwriting

This will separate strong lenders from weak ones.

Key Takeaways

UPI credit line is India’s next lending revolution

Banks are silently preparing massive infrastructure upgrades

Borrowers will get cheaper, faster, easier credit

Fintechs will drive user experience and underwriting

Lending volume may cross ₹1.5 lakh crore by 2026

UPI credit line will compete with BNPL & credit cards

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and easy approval.

👉 Apply now: www.vizzve.com

FAQs

1. What is UPI Credit Line?

A pre-approved digital credit limit linked to your UPI ID.

2. How does UPI credit work?

You scan any UPI QR and pay using your credit line instead of bank balance.

3. Who offers UPI credit lines?

Banks like HDFC, ICICI, SBI, Axis, Kotak, and major fintech partners.

4. Will UPI credit lines charge interest?

Yes, on used amount only.

5. Is UPI credit line safe?

Yes—regulated by RBI.

6. What is the credit limit?

₹10,000 to ₹1 lakh or more depending on your bank.

7. Will it affect CIBIL score?

Yes—timely repayment improves your score.

8. Can I convert UPI credit purchases into EMI?

Yes, banks may allow EMI conversion.

9. Will UPI credit lines replace credit cards?

No, but they will reduce small-ticket card usage.

10. Can students use UPI credit line?

Only if banks offer them pre-approved limits.

11. Is KYC required?

Yes, full KYC.

12. Do all UPI apps support this feature?

Most major apps will, including PhonePe, Paytm, and GPay.

13. What are interest rates?

Expected 12%–18%, depending on bank.

14. What if I miss repayment?

Late fees + CIBIL score dip.

15. When will it launch fully?

Large-scale rollout expected in 2026.

Published on : 8th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed