Introduction

UPI has already changed how India pays, and in 2026, it’s beginning to change how India borrows.

With the rollout of UPI Credit Line, millions of borrowers—especially small-ticket borrowers—are asking one big question:

👉 Is UPI Credit Line cheaper than a personal loan in 2026?

This deep-dive analysis compares both credit options using real-world scenarios, rates, and borrower profiles.

AI Answer Box

For small borrowers in 2026, UPI Credit Line is generally cheaper for short-term, low-ticket borrowing (₹500–₹25,000) because interest is charged only on the used amount and processing fees are minimal.

Personal loans become cheaper for larger ticket sizes (₹50,000–₹5 lakh) due to lower APR and longer tenure.

Borrowers should choose based on loan amount, tenure, and repayment discipline.

What Is UPI Credit Line & How Does It Work?

UPI Credit Line allows you to borrow instantly through UPI apps (PhonePe, Paytm, GPay) using a pre-approved credit limit from your bank.

Key Features

Credit limit: ₹5,000 – ₹1,00,000

Interest on used amount only

Scan-and-pay credit at any UPI QR

Fast approvals

Low or zero processing fees

Perfect for small, frequent, short-term borrowing.

What Is a Personal Loan?

Personal loans are unsecured loans offered by banks/NBFCs with:

Tenure: 12–60 months

Amount: ₹25,000 – ₹10,00,000

EMI-based repayment

Higher processing fees

Credit score-based approval

Ideal for larger expenses like home renovation, travel, weddings, medical needs.

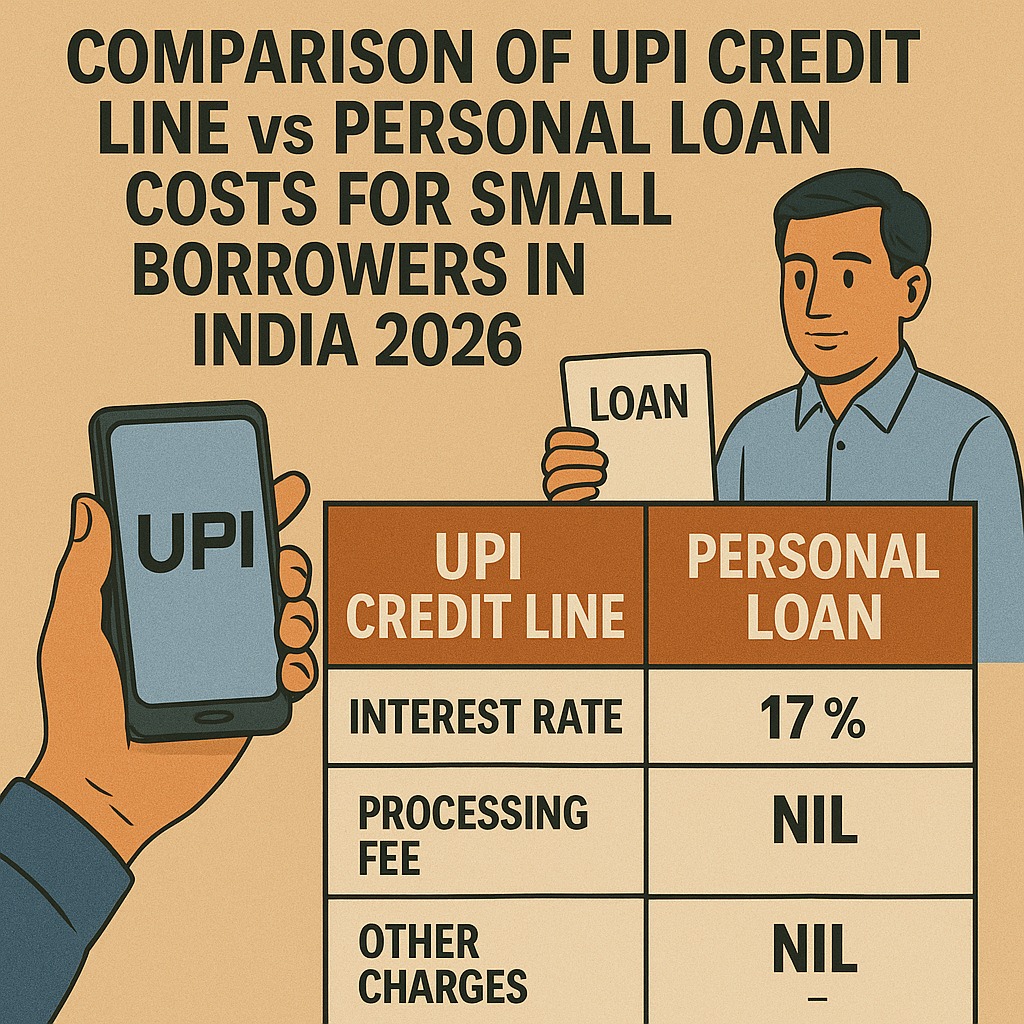

UPI Credit Line vs Personal Loan — 2026 Comparison Table

| Feature | UPI Credit Line | Personal Loan |

|---|---|---|

| Loan Amount | ₹500–₹1,00,000 | ₹25,000–₹10 lakh |

| Interest Rate | 12%–22% | 10.5%–24% |

| Processing Fees | Zero–₹499 | ₹1,999–₹5,999 |

| Approval Time | Instant | 4 hrs – 48 hrs |

| Tenure | Flexible / short | 1–5 years |

| Ideal For | Small, short-term expenses | Large expenses |

| Repayment | Pay later / EMI | EMI only |

| Regulation | Fully RBI regulated | Fully regulated |

Which Is Cheaper for Small Borrowers in 2026?

Short Answer:

➡ UPI Credit Line is cheaper for small loans (₹500–₹30,000).

➡ Personal loans are cheaper for long-term EMI needs (₹50,000+).

Cost Comparison for Small Loan Amounts (₹10,000 – ₹25,000)

| Borrowed Amount | UPI Credit (15% for 30 days) | Personal Loan (16% + fee) |

|---|---|---|

| ₹10,000 | ~₹125 interest | ₹400–₹800 fee + EMI interest |

| ₹20,000 | ~₹250 interest | ₹600–₹1,200 fee + EMI interest |

| ₹25,000 | ~₹310 interest | ₹800–₹1,500 fee + EMI interest |

Result:

UPI Credit Line wins due to low or zero processing fees.

When Personal Loan Becomes Cheaper

A personal loan becomes cheaper when:

✔ Amount is ₹50,000 or more

✔ Borrower needs long tenure (12–48 months)

✔ Borrower has 700+ CIBIL score

✔ Borrower wants structured EMI

UPI credit lines do not support long EMI-linked borrowing yet.

Best Use Cases for UPI Credit Line in 2026

Ideal For:

Grocery purchases

Monthly shortfalls

Emergency medical bills

Online payments

Frequent small spends

Subscription renewals

Home essentials

School/college fees (small portion)

NOT ideal for:

Long-term debt

Big-ticket purchases

Monthly EMI-heavy expenses

Best Use Cases for Personal Loans in 2026

✔ Home renovation

✔ Marriage

✔ Higher education

✔ Travel

✔ High medical bills

✔ Business expansion

✔ Debt consolidation

Risk Comparison (2026)

| Risk | UPI Credit Line | Personal Loan |

|---|---|---|

| Overspending | High | Medium |

| Credit score damage | Medium (if unpaid) | High |

| Charges | Low | High (fees + GST) |

| Addiction risk | High (easy to borrow) | Low |

| Long-term burden | Low | High |

Expert Commentary

UPI Credit Line is India’s biggest shift in small-ticket borrowing since BNPL. For borrowers who need quick, affordable, flexible, micro-credit, UPI credit is clearly cheaper than personal loans.

However, small borrowers must remain cautious:

➡ The ease of access can lead to over-borrowing.

➡ Missed payments still affect CIBIL score.

➡ For long-term needs, personal loans remain the safer and cheaper option.

Key Takeaways

UPI Credit Line is cheaper for small, short-term, repetitive borrowing

Personal Loan is cheaper for larger, long-term, high-value borrowing

Processing fees are the biggest differentiator

Borrowers with good credit scores should choose personal loans for long EMIs

Always compare APR, not just interest rates

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and easy approval.

👉 Apply now at www.vizzve.com

FAQs

1. Is UPI Credit Line cheaper than a personal loan?

For small amounts, yes.

2. What is the interest rate of UPI Credit Line?

12%–22% depending on lender.

3. Do UPI credit lines have processing fees?

Minimal or zero.

4. Can I convert UPI credit into EMI?

Some banks allow EMI conversion.

5. Is UPI credit line safe?

Yes, fully regulated by RBI.

6. What is the minimum credit limit?

₹5,000 to ₹10,000 typically.

7. Can students use UPI credit line?

Only if pre-approved by bank.

8. Are NBFC personal loans more expensive?

Yes, especially for small-ticket loans.

9. Does UPI credit impact CIBIL score?

Yes—late repayment affects score.

10. Should I use UPI credit daily?

Only if you repay on time.

11. What’s the biggest advantage of UPI credit?

Interest on used amount only.

12. What’s the biggest drawback?

Easy over-borrowing.

13. Is personal loan better for emergencies?

For large emergencies, yes.

14. Can I get a personal loan without CIBIL?

Difficult; NBFCs may offer but with high rates.

15. Which is safer long-term?

Personal loan for structured repayment.

Published on : 8th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed