India’s digital payments revolution continues at record speed.

According to November 2025 data, UPI has hit a new all-time high, marking its strongest month yet in both value and volume.

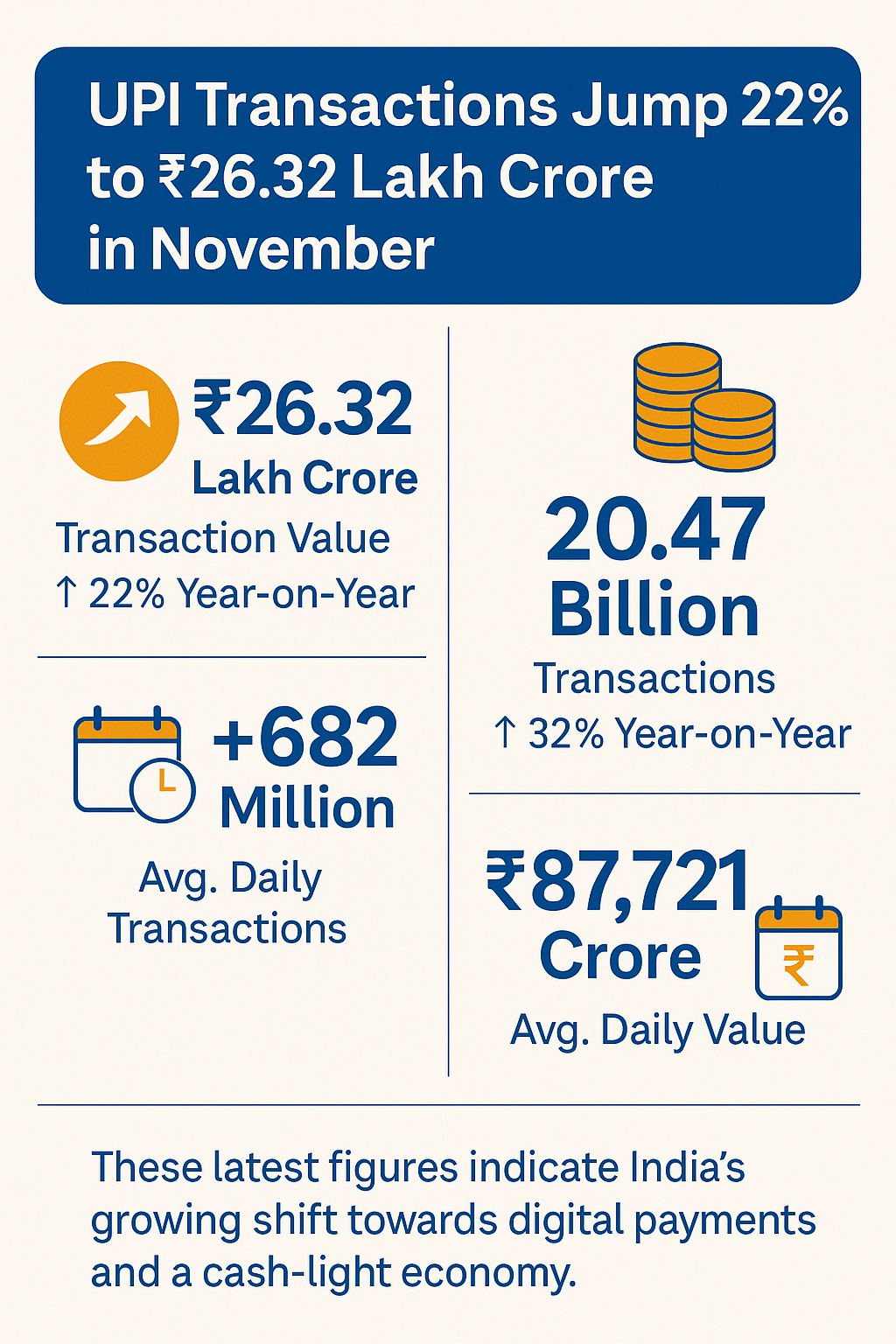

📌 Transaction value: ₹26.32 lakh crore (↑ 22% YoY)

📌 Transaction count: 20.47 billion (↑ 32% YoY)

📌 Average daily transactions: 682+ million

📌 Daily value exchanged: ₹87,721 crore

These numbers highlight UPI’s unstoppable momentum and its critical role in India’s move toward a cash-light digital economy.

AI ANSWER BOX

UPI transactions in November recorded a 22% year-on-year jump, reaching ₹26.32 lakh crore in value, while transaction volume rose 32% to 20.47 billion. This reflects India’s growing digital payment adoption, driven by UPI’s ease of use, merchant acceptance, smartphone penetration, and government-backed digital infrastructure.

UPI November 2025 – Key Highlights

| Metric | November Data | YoY Growth |

|---|---|---|

| Transaction Value | ₹26.32 lakh crore | 22% ↑ |

| Number of Transactions | 20.47 billion | 32% ↑ |

| Avg. Daily Transactions | 682 million+ | — |

| Avg. Daily Value | ₹87,721 crore | — |

Sources: NPCI & Livemint

Why UPI Is Growing So Rapidly

1. Massive Merchant Adoption

Over 40 million+ merchants now accept UPI.

Street vendors, kirana stores, malls, autos—everyone uses QR codes.

2. UPI Is Now Used for High-Value Payments

Not just chai and snacks:

Rent

Salary transfers

Online shopping

Insurance premiums

Bill payments

Hospital fees

UPI has matured from micro-payments to mainstream.

3. Deep Rural Penetration

UPI adoption has surged in Tier-2, Tier-3, and rural areas due to:

Cheaper smartphones

Simple onboarding

Wide QR code distribution

Feature-phone UPI (UPI 123PAY)

4. India's Digital Public Infrastructure (DPI)

UPI + Aadhaar + DigiLocker + eKYC + FASTag

→ seamless digital ecosystem.

5. Government Push

Zero MDR charges

UPI incentives

Merchant onboarding drives

How UPI Is Transforming India’s Economy

1. Cash Is Losing Ground

UPI has become the default payment system for daily transactions.

2. Faster Financial Inclusion

Digital payments are helping crores enter the formal financial system.

3. Small Businesses Are Going Digital

QR codes level the playing field for small merchants.

4. Boost to Transparent Transactions

UPI reduces:

Cash leakages

Black money scope

Unrecorded transactions

5. India Becomes a Global Model

Many countries are adopting or integrating UPI-based systems.

Challenges That Remain

Despite the growth, India is not yet fully digital.

1. High Cash Dependence in Rural Areas

Cash still dominates:

Agriculture

Small vendors

Labour markets

2. Cyber Frauds & Scams

As users rise, so do:

Phishing attacks

Fake QR codes

Vishing scams

3. Infrastructure Issues

Occasional:

Server outages

Network delays

Failed transactions

4. Low Digital Literacy

Many first-time users need guidance.

What the November Spike Means for 2026 and Beyond

Prediction 1: Monthly UPI value could cross ₹30 lakh crore by mid-2026.

Prediction 2: UPI Lite, UPI AutoPay & Credit Line on UPI will boost adoption further.

Prediction 3: Digital Rupee (CBDC) and UPI may integrate for faster merchant payments.

Prediction 4: India may achieve 85–90% digital payment penetration in cities.

Expert Commentary

As a fintech analyst, I believe the November UPI figures highlight more than just transaction growth—they show the trust and reliability Indians place in digital payments.

UPI has evolved into a national payment backbone, enabling frictionless payments across every segment—from micro-merchants to corporate transfers.

This momentum is expected to accelerate as UPI expands into credit, cross-border payments, and offline rural ecosystems.

Key Takeaways

UPI clocked ₹26.32 lakh crore in value in November.

Transactions hit 20.47 billion, highest ever.

Growth driven by merchants, rural adoption & digital public infra.

India is shifting toward a cash-light economy.

UPI may cross ₹30 lakh crore/month by 2026.

FAQs

1. What was UPI’s total value in November 2025?

₹26.32 lakh crore.

2. How many transactions were recorded?

Over 20.47 billion.

3. Why is UPI growing so fast?

Ease of use, QR adoption, smartphone penetration & digital infrastructure.

4. Is India becoming cashless?

Not fully, but India is becoming strongly cash-light.

5. Which sectors use UPI the most?

Retail, transport, food delivery, utilities & online businesses.

6. Does UPI support high-value payments?

Yes—rent, tuition fees, insurance, etc.

Conclusion

The November UPI surge is a strong indication that India is rapidly embracing digital payments at every level.

With rising adoption, enhanced security, and deeper rural penetration, UPI is likely to remain the backbone of India’s digital economy.

If you're planning your financial goals or need a quick loan,

Vizzve Financial offers:

✔ Fast approvals

✔ Low documentation

✔ 100% digital process

✔ Secure, trusted platform

👉 Apply now at www.vizzve.com

Published on : 3rd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

Source Credit : MINT