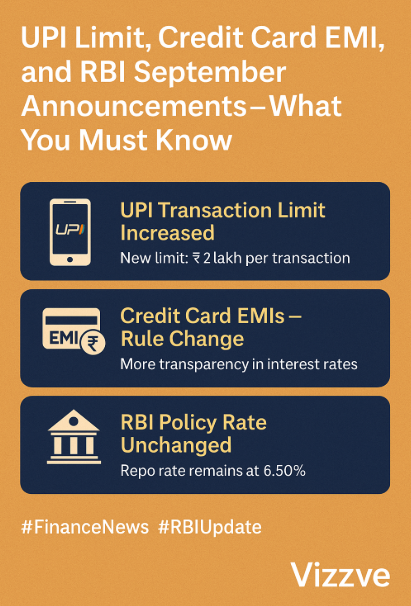

🏦 UPI Limit, Credit Card EMI, and RBI September Announcements – What You Must Know

📅 Updated: May 2025

🖋️ Published by: Vizzve Financial

📢 Introduction: Major Financial Policy Updates Announced

September 2025 brought big news from the Reserve Bank of India (RBI) — with changes that directly impact your daily transactions, EMIs, and how you use UPI. Whether you're a salaried individual, small business owner, or digital-first consumer, these updates change how you bank, borrow, and spend.

Here’s everything you need to know – simplified.

🔑 1. UPI Transaction Limit Increased

📲 New Limit for UPI (September 2025)

-

Previous Limit: ₹1 lakh per transaction

-

✅ New Limit: ₹2 lakh per transaction (for select categories)

Where It Applies:

-

Hospital payments

-

Educational institutions

-

High-value merchant payments

🟢 Impact: This move boosts UPI for big-ticket transactions, reducing the need for net banking or cards.

💳 2. Credit Card EMIs – Rule Change

Starting October 1, 2025, banks and NBFCs must:

-

🔄 Disclose total interest payable at the time of EMI conversion

-

📄 Provide monthly statements with interest breakdown

-

⚠️ Allow foreclosure without hidden penalties after 3 months

💡 What It Means for You:

Transparency improves. You’ll know exactly what you're paying when opting for EMI on credit cards.

🏦 3. RBI Policy Rate Remains Unchanged

-

Repo Rate: Maintained at 6.50%

-

📈 RBI focuses on controlling inflation, while allowing consumer borrowing to grow

💼 Impact on You:

-

Personal loan interest rates remain steady

-

Affordable EMIs for both salaried and self-employed borrowers

💬 Tip: Apply for a festive loan NOW while rates are stable – Vizzve offers loans from ₹10,000 to ₹5,00,000 with flexible EMIs.

🧾 4. New RBI Guidelines on Digital Lending Apps

To fight fraud and ensure safety, RBI now mandates:

-

✅ RBI-registered NBFC partnership for all lending apps

-

🔍 Mandatory display of lender name and registration number

-

🔐 Stricter data privacy & grievance redressal norms

🎯 Why Vizzve Complies:

Vizzve works with RBI-approved NBFCs, uses encrypted systems, and follows all new compliance standards.

🎯 Key Takeaways for Consumers

| Update | Action to Take |

|---|---|

| UPI ₹2L Limit | Use UPI for medical, education, retail |

| Credit Card EMI Rule | Check EMI cost breakdown carefully |

| Stable Repo Rate | Consider fixed-rate festive loans |

| Lending App Compliance | Choose RBI-tied platforms like Vizzve |