Building a ₹10 lakh portfolio in just 36 months may sound ambitious—but with discipline, the right allocation, and the right investment vehicles, it’s absolutely achievable.

Whether you're a beginner or a working professional with limited time, this blueprint gives you a simple, no-nonsense strategy to hit the ₹10 lakh mark in under 3 years.

AI ANSWER BOX

To build a ₹10 lakh portfolio in 36 months, invest ₹20,000–₹25,000 per month in diversified equity-oriented SIPs (index funds + flexicap + smallcap), maintain 10–15% in liquid assets, avoid withdrawals, increase SIPs annually, and track your portfolio every quarter. Consistency builds the corpus—more than returns.

Step-by-Step Blueprint to Build ₹10 Lakh in 36 Months

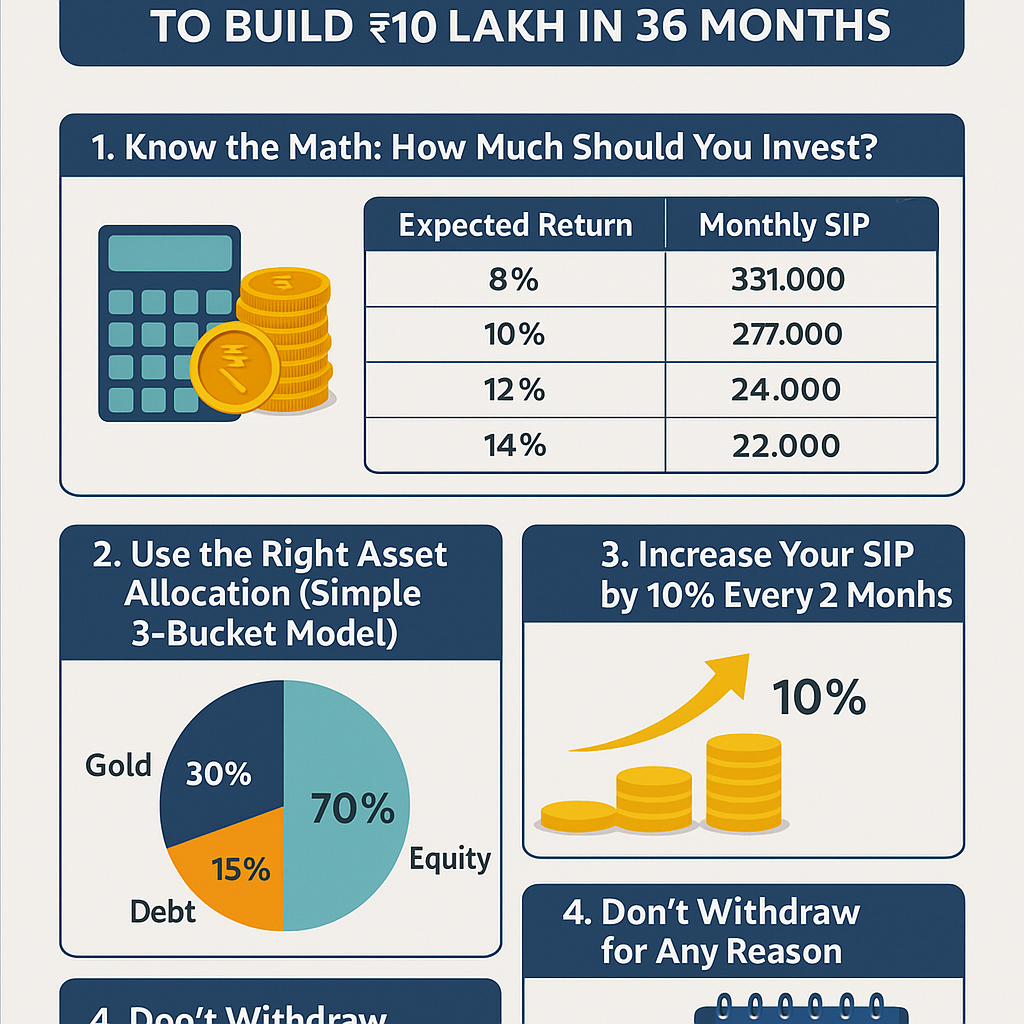

1. Know the Math: How Much Should You Invest?

To reach ₹10 lakh in 36 months, here are three scenarios:

Scenario 1: High-Growth SIP (12–14% return)

Monthly SIP needed → ₹22,000–₹24,000

Scenario 2: Moderate Portfolio (10–11% return)

Monthly SIP needed → ₹25,000–₹27,000

Scenario 3: Ultra-Safe Plan (<8%)

Monthly required → ₹29,000–₹31,000

Table — SIP Needed to Hit ₹10 Lakh in 3 Years

| Expected Return | Monthly SIP Needed | Total Invested | Final Value (Approx) |

|---|---|---|---|

| 8% | ₹31,000 | ₹11.16 lakh | ₹10 lakh |

| 10% | ₹27,000 | ₹9.72 lakh | ₹10 lakh |

| 12% | ₹24,000 | ₹8.64 lakh | ₹10 lakh |

| 14% | ₹22,000 | ₹7.92 lakh | ₹10 lakh |

Best Target Range:

👉 ₹22,000–₹25,000/month

2. Use the Right Asset Allocation (Simple 3-Bucket Model)

Bucket 1 — Equity (70%)

For growth.

40% Index Funds (Nifty 50 or Nifty Next 50)

20% Flexicap or Large & Midcap

10% Smallcap (optional, for high returns)

Bucket 2 — Debt / Liquid (15%)

For safety + stability.

Liquid funds

Short-term debt funds

Bank RD if needed

Bucket 3 — Gold / Digital Gold (15%)

For diversification + inflation hedge.

3. Best SIP Portfolio for 36 Months (Suggested Mix)

Monthly SIP Split for ₹24,000 SIP:

| Category | Fund Type | Allocation | SIP Amount |

|---|---|---|---|

| Index Fund | Nifty 50 / Nifty Next 50 | 40% | ₹9,600 |

| Flexicap | Equity diversified | 20% | ₹4,800 |

| Midcap / Smallcap | High growth | 10% | ₹2,400 |

| Debt | Liquid / short-term | 15% | ₹3,600 |

| Gold | Digital gold / gold ETF | 15% | ₹3,600 |

This ensures growth + stability + hedge.

4. Increase Your SIP by 10% Every 12 Months

This is called Step-Up SIP.

If you start with ₹22,000, increasing it by 10% yearly makes your 3-year corpus substantially higher.

Step-Up Benefits:

Beats inflation

Speeds up wealth creation

Achieves 10 lakh goal earlier

5. Use Quarterly Portfolio Review (Not Monthly)

Check performance every 3 months, not daily.

Review checklist:

Fund beating benchmark?

Consistency in SIP?

Rebalance if equity rises above 80%

6. Don’t Withdraw for Any Reason (Zero Interruptions)

The biggest reason people fail 10-lakh goals:

❌ Missing SIPs

❌ Withdrawing for emergencies

❌ Stopping during market dips

Rule: If market falls, invest more, don’t pause.

7. Build a Backup Cushion (Emergency Fund)

Have ₹50,000–₹1.5 lakh in liquid assets BEFORE starting high SIPs.

This prevents emergency withdrawals.

8. Automate Everything

Automation ensures discipline.

Automate:

SIP deductions

Step-up SIP

Salary deduction into liquid fund

Goal tracking alerts

Example: Real Blueprint for ₹10 Lakh in 3 Years

Suppose:

You invest ₹24,000/month at 12%.

After 36 months:

You invest: ₹8.64 lakh

You grow to: ₹10 lakh

Result → Goal achieved.

Expert Commentary

As a financial planner, I tell investors: short-term goals depend more on discipline than returns.

A 3-year horizon is tight, so the key is:

Stable SIP

Right asset mix

No interruptions

Regular rebalancing

Even average returns will hit ₹10 lakh if you stay consistent for 36 months.

Key Takeaways

₹10 lakh in 3 years is achievable with a ₹22–25k SIP.

Use a 70:15:15 allocation (Equity:Debt:Gold).

Automate SIP + step-up by 10% annually.

Don’t withdraw—stay consistent.

Review every quarter, not daily.

FAQs (15)

1. How much should I invest monthly to reach ₹10 lakh in 3 years?

₹22,000–₹25,000 depending on expected returns.

2. Can a beginner follow this plan?

Yes—it's made for beginners.

3. Is equity necessary?

Yes, for growth; debt alone won't build ₹10 lakh.

4. Can I reach ₹10 lakh faster?

Increase SIP or add lump sum.

5. Should I use smallcap funds?

Optional; keep <10% for safety.

6. What if markets fall?

Don’t stop SIP—market dips help long-term returns.

7. Can I use FD for this goal?

FD returns are too low for a 3-year compounding goal.

8. Is gold necessary?

It adds safety & diversification.

9. Should I review funds monthly?

No—quarterly reviews are enough.

10. What platforms allow SIP?

Groww, Zerodha, Kuvera, ET Money, banks.

11. Can salaried employees follow this?

Yes—ideal for them.

12. Should students try this?

Yes, if they have stable income.

13. What if I cannot invest ₹22k monthly?

Start lower → increase via step-up SIP.

14. Is debt fund safe?

Safer than equity; offers stability.

15. What happens if I miss SIPs?

Goal delays—avoid interruptions.

Conclusion

Reaching ₹10 lakh in 36 months is a realistic goal—if you follow a disciplined plan.

Smart SIPs, the right asset mix, and consistent investing can help you build a solid portfolio even with moderate income.

If you need funds to support investments, emergencies, or financial planning:

Vizzve Financial offers quick personal loans, minimal documentation, and a smooth approval process.

👉 Apply now at www.vizzve.com

Published on : 2nd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed