Many people fear increasing their credit card limit because they think it will tempt them to overspend.

But here’s the truth: increasing your credit limit is one of the fastest and safest ways to improve your credit score — as long as you use it responsibly.

A higher limit lowers your credit utilisation ratio, improves your credit profile, and boosts your eligibility for home loans, personal loans and credit cards.

Here’s why it works.

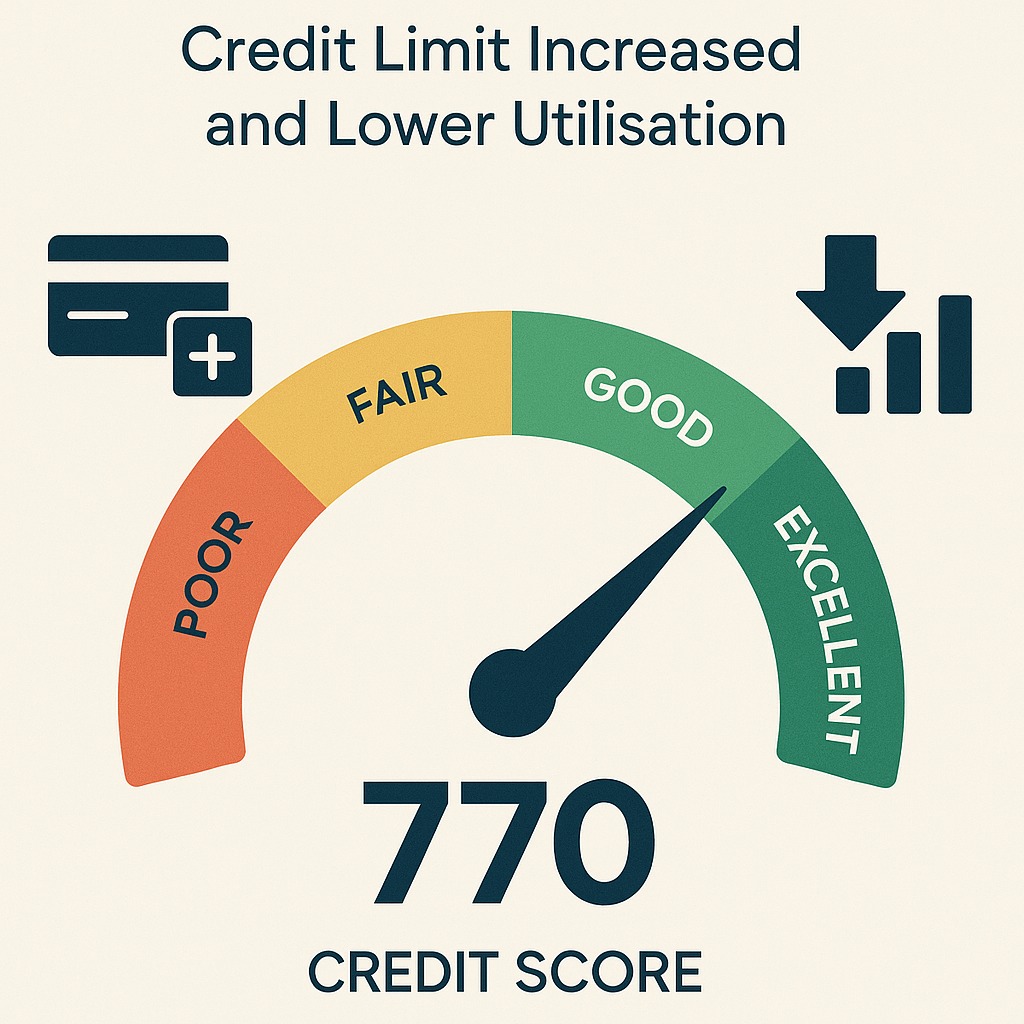

1. It Automatically Lowers Your Credit Utilisation Ratio (The No. 1 Score Factor)

Credit utilisation =

Amount you spend ÷ Total credit limit × 100

If your limit is ₹1,00,000 and you spend ₹50,000, your utilisation is 50% — which is bad for your score.

If your limit increases to ₹2,00,000 and you still spend ₹50,000:

Utilisation = 25% → excellent.

Credit utilisation accounts for nearly 30% of your credit score, and low utilisation = higher score.

2. Helps You Maintain a Healthy Score Even During High-Spend Months

Festivals, emergencies, travel or medical expenses can temporarily increase spending.

A higher limit gives you breathing room so utilisation doesn’t spike above 30%.

This prevents sudden score drops.

3. Shows Lenders You Are Trustworthy and Creditworthy

Banks don’t increase credit limits randomly.

When they approve a higher limit, it signals:

Strong repayment behaviour

Good income profile

Responsible usage

Low credit risk

This boosts your overall credit profile and loan eligibility.

4. Helps You Qualify for Bigger Loans at Better Interest Rates

Higher limits with good repayment patterns show that you can handle large credit responsibly.

This helps with:

Home loans

Car loans

Personal loans

Business loans

Lenders trust borrowers with high limits + low usage, often giving:

Lower interest rates

Higher pre-approved loan amounts

Faster approvals

5. Improves Your Credit Score Without Spending Any Money

Unlike paying off loans or reducing EMIs, increasing your credit limit:

Costs nothing

Takes just minutes

Gives instant score benefits

Most banks allow digital limit enhancement requests.

6. Provides a Safety Cushion for Emergencies

Higher limits are not just good for your credit score — they’re practical.

If you face:

Medical expenses

Travel emergencies

Unexpected repairs

…the higher limit ensures you don’t max out your card or damage your credit profile.

7. Helps Build a Strong Long-Term Credit History

Higher limits maintained responsibly show:

Stability

Maturity

Consistent financial discipline

This builds a long-term positive history, which is essential for a high credit score.

When Should You Request a Credit Limit Increase?

✔ When your income increases

✔ When you have a 12-month track record of timely payments

✔ When your utilisation consistently crosses 30%

✔ Before applying for a major loan

✔ After clearing all outstanding dues

A responsible borrower always keeps a high limit, low usage profile.

When You Should NOT Increase Your Limit

✘ If you struggle with overspending

✘ If you are revolving interest-bearing balances

✘ If you have multiple unpaid loans

✘ If you’re near credit burnout

Limit increase only works when you use credit wisely.

FAQs

Q1. Does increasing the limit reduce my credit score?

No. It actually improves your score if utilisation stays low.

Q2. How often can I increase my limit?

Banks typically allow once every 6–12 months.

Q3. What is the ideal credit utilisation?

Below 30% of your total credit limit.

Q4. Will the bank do a hard inquiry?

Some banks do; others increase limits without any inquiry.

Q5. Should I increase limits on all cards?

Yes — as long as you maintain discipline.

Published on : 15th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed