Personal loan EMIs can feel heavy—especially when interest rates are high.

One of the most common solutions recommended is a Personal Loan Balance Transfer (BT).

But the question is:

👉 Is balance transfer really the best way to reduce your EMI?

👉 Or are there better (or safer) options?

Let’s break it down clearly.

AI ANSWER BOX

A balance transfer reduces EMI only if your remaining loan tenure is long and the new lender offers a significantly lower interest rate (1.5%–4% less).

If your loan is old, nearing completion, or if charges are high, balance transfer may NOT help.

It works best in the early 6–18 months of the loan.

What Is a Personal Loan Balance Transfer?

A balance transfer is when you move your existing loan from your current bank/NBFC to another lender offering:

✔ Lower interest rate

✔ Lower EMI

✔ Better tenure options

✔ Better service

You close the old loan → new lender pays it off → you pay EMIs to the new lender.

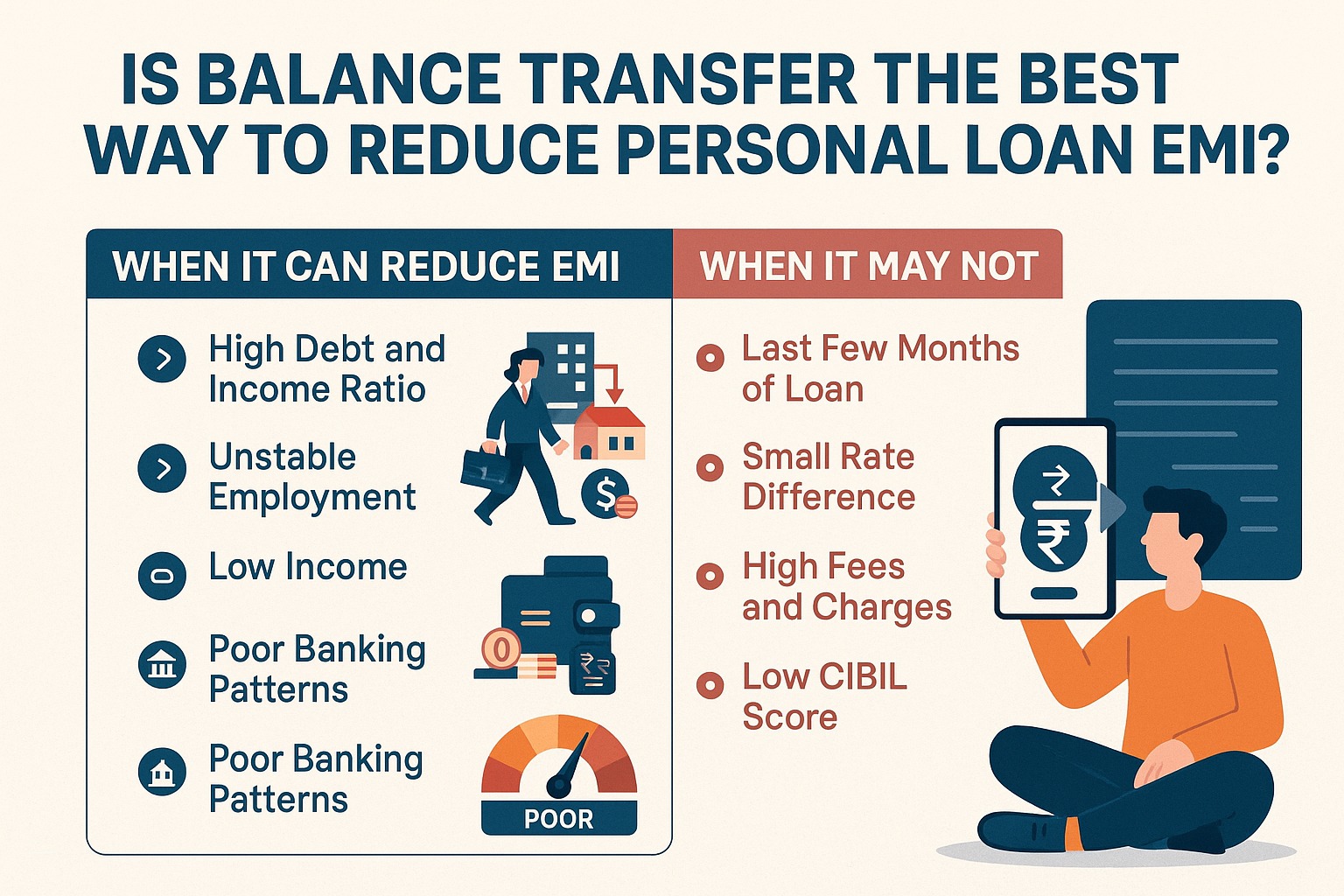

When Balance Transfer Helps Reduce EMI (Best Scenarios)

✔ 1. Your current loan interest rate is high

Example:

Old rate: 16%

New lender: 11% → EMI drops 10–25%.

✔ 2. You still have long tenure left (24+ months)

More tenure = more interest savings.

✔ 3. Your CIBIL score improved

New lender may offer premium customer rates (9.5%–12%).

✔ 4. Your income is higher now

Better profile → better interest rate.

When Balance Transfer DOES NOT Help

❌ You’re in the last 6–12 months of the loan

Most interest is already paid.

❌ Difference in interest rates is very small (<1%)

❌ Processing fee + foreclosure charges are high

❌ Your CIBIL score is low (<680)

New lender may reject or offer high rates.

❌ You want EMI reduction but not tenure extension

Lower EMI = longer tenure (higher interest paid).

Balance Transfer vs Tenure Extension (Which is better?)

| Option | EMI | Interest Paid | Best For |

|---|---|---|---|

| Balance Transfer | ↓ Low | ↓ Lower (if done early) | High interest existing loan |

| Increase Tenure | ↓ Low | ↑ Higher | Immediate cash-flow relief |

BT saves money, while tenure increase increases total cost.

Charges Involved in Balance Transfer

Before doing BT, check:

Foreclosure charges (0–5% depending on lender)

Processing fee (1–3%)

Stamp duty

Insurance (optional)

Other administrative charges

If charges > savings → BT is NOT worth it.

Example – Does BT Really Save Money?

Scenario:

Loan amount: ₹5,00,000

Existing rate: 16%

Remaining tenure: 36 months

New lender offers:

Interest rate: 11%

Processing fee: 1.5%

Savings with BT: ₹30,000–₹55,000 (approx)

👉 Worth it.

Scenario 2:

Remaining tenure: 8 months

Rate difference: Only 1%

👉 NOT worth it

Pros & Cons of Balance Transfer

Pros

Lower EMI

Lower interest payable

Longer tenure flexibility

Better service options

Can consolidate finances

Cons

Additional charges

Multiple documentation steps

Possible credit enquiry

Takes 7–14 days

May extend total repayment cost

Alternatives to Balance Transfer

✔ 1. Increase loan tenure with same lender

Immediate EMI drop.

✔ 2. Ask for interest rate reduction

Sometimes banks reduce rates based on CIBIL improvement.

✔ 3. Part-payment / lump-sum repayment

Reduces EMI or tenure significantly.

✔ 4. Consolidate using top-up loan

Lower blended EMI.

🟦 Expert Commentary

As a loan expert, I recommend balance transfer only when the net savings exceed the total charges and the borrower still has at least 50–70% of tenure remaining.

Most people transfer too late or without comparing charges, which reduces benefits.

Balance transfer is powerful — but only when timing and math are right.

Key Takeaways

BT is beneficial only when rate difference is big and tenure is long.

Always calculate total savings before switching.

Late-stage BT rarely helps.

Compare all charges carefully.

BT is one of the best EMI reduction options when done early.

FAQs

1. Does balance transfer reduce EMI?

Yes, if new lender offers lower rates.

2. When is BT the best option?

Early in the loan with 24+ months left.

3. Is BT free of cost?

No — processing fees + foreclosure charges apply.

4. Can CIBIL affect balance transfer?

Yes — higher score gets lowest rates.

5. How long does BT take?

7–14 days.

6. Can BT increase total cost?

Yes, if done late or with high fees.

7. Is part-payment better than BT?

Sometimes yes — depends on savings.

Conclusion

Balance transfer can be the best way to reduce your personal loan EMI — but only if done smartly.

If your current loan rate is high and you still have long tenure left, BT can save you thousands.

Looking for a simple, fast, safe loan experience?

Vizzve Financial offers:

✔ Quick personal loans

✔ Low documentation

✔ Competitive interest rates

✔ Smooth approval process

👉 Apply now at www.vizzve.com

Published on : 3rd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed