⚙️ What Happens After You Apply for a Vizzve Loan? (Behind the Scenes)

📅 Updated: June 2025 | 🔎 Loan Journey Explained | ✅ RBI-Approved | Trusted by 5+ Lakh Indians

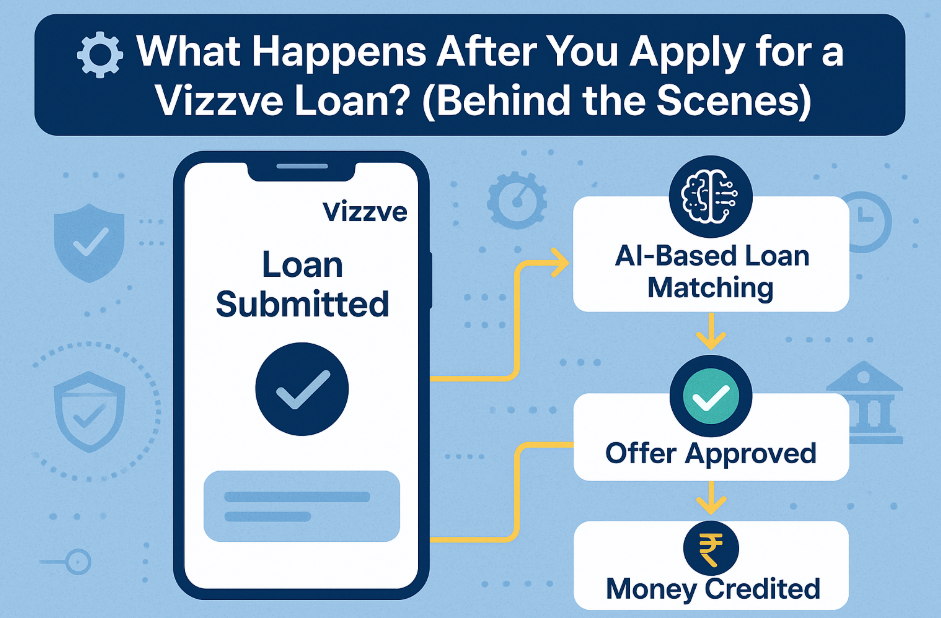

🧠 Ever Wondered What Really Happens After You Click “Apply” on Vizzve?

Applying for a loan online is easy—but what happens in the background once you hit “Submit”?

In this blog, we pull back the curtain on Vizzve’s powerful loan engine and show you the behind-the-scenes process that ensures instant approvals, safe disbursals, and 100% transparency.

🔄 Step-by-Step: What Happens After You Apply

1️⃣ eKYC & Profile Verification (0–30 seconds)

Once you enter your Aadhaar, PAN, and bank details, Vizzve’s system:

Runs an instant eKYC check

Cross-verifies your mobile and identity using OTP & UIDAI APIs

Ensures fraud protection using geo-check & IP match

✅ No documents. No upload. 100% automated.

2️⃣ AI-Based Loan Matchmaking (30–60 seconds)

Vizzve’s AI engine analyzes your:

Income patterns

UPI & bank flow

Past EMI behavior

CIBIL (if available)

It then instantly matches you with the best-fit RBI-registered NBFC partner offering the highest eligibility and lowest interest.

3️⃣ Offer Display & Digital Acceptance (1–2 mins)

You’re shown:

💰 Approved loan amount (₹10,000 to ₹5,00,000)

📉 Applicable interest rate

📆 Flexible EMI options

Just click “Accept” and sign digitally with OTP. No physical paperwork!

4️⃣ Disbursal Begins (2–3 mins)

After acceptance:

Vizzve notifies the NBFC instantly

Loan is disbursed to your linked bank account via IMPS/NEFT

You get a confirmation SMS, email, and in-app receipt

Most users receive their funds within 5–7 minutes after applying.

5️⃣ Repayment & Support (Ongoing)

EMI reminders via WhatsApp/SMS

UPI AutoPay or NACH setup

24/7 in-app or WhatsApp support

Pre-closure option anytime

🧠 FAQs

Q. How long does approval take?

Most applications are approved within 1–2 minutes after KYC.

Q. Who decides the loan amount?

Vizzve’s AI and partner NBFCs jointly determine your eligibility.

Q. Is this RBI-compliant?

Yes, Vizzve only partners with RBI-registered NBFCs.

Q. Can I apply without CIBIL?

Yes. Vizzve supports low and no-CIBIL borrowers using alternate scoring.

Q. Is my data secure?

Absolutely. All data is encrypted and used only for loan processing.