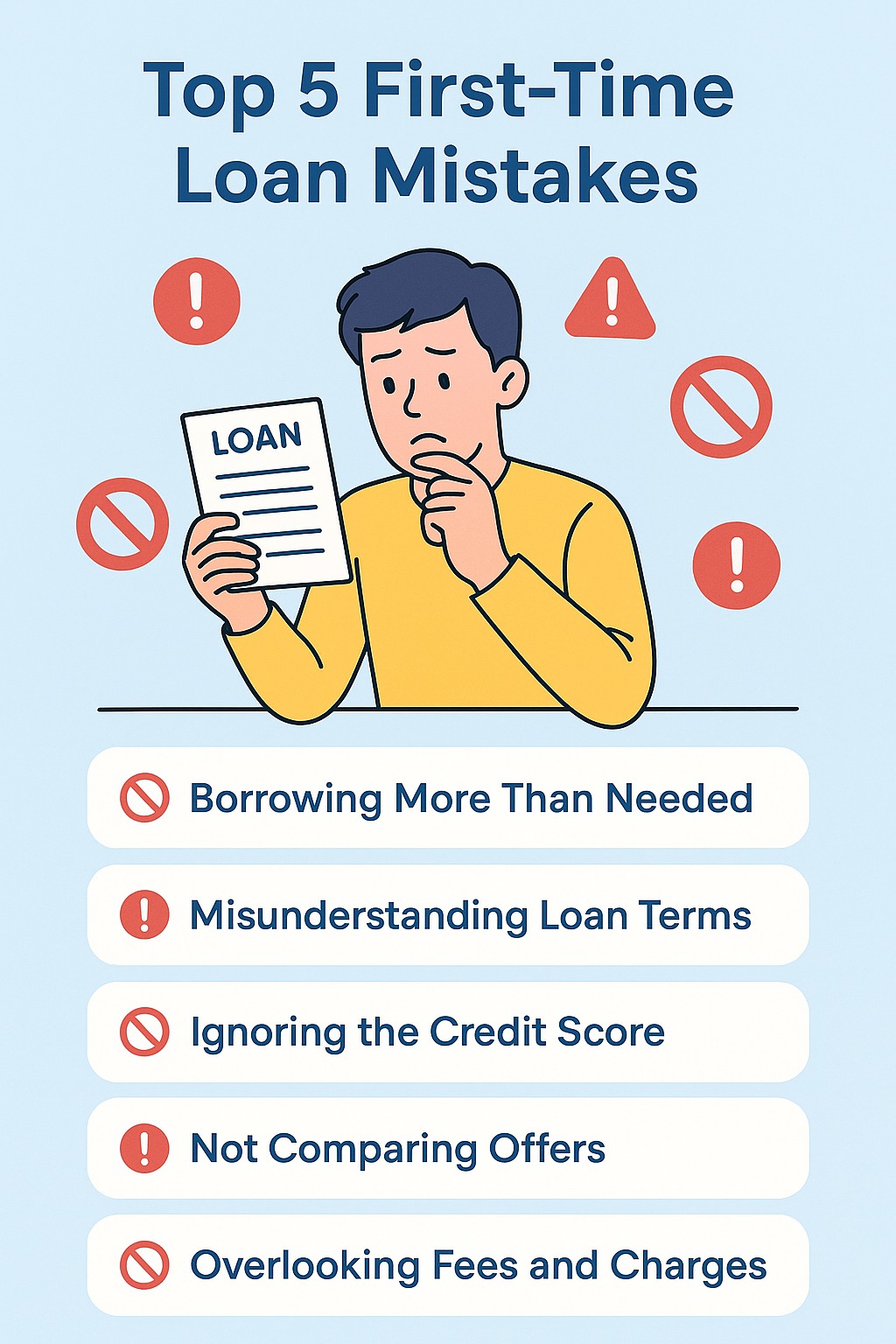

Taking your first loan can feel like stepping into uncharted territory.

From confusing terms to unexpected costs, your first borrowing experience can either build your financial future — or start a debt spiral.

Here’s everything I wish someone had told me before signing that dotted line.

Vizzve Finance breaks it down so you don’t make the same mistakes.

📌 1. Your Loan Amount Isn’t Your Real Cost

You may borrow ₹1 lakh, but you’ll repay way more once interest, GST, processing fees, and insurance are added.

👉 Lesson: Always check the total repayment amount, not just the loan amount.

📌 2. Interest Rate ≠ Annual Cost

That attractive “10%” rate? It might be a flat rate, not a reducing one. And your APR (Annual Percentage Rate) might be 16% or more.

👉 Lesson: Compare APR, not just the interest rate.

📌 3. Prepayment Isn’t Always Free

You’d think paying your loan early is a good thing — but many lenders penalize prepayment!

👉 Lesson: Ask about prepayment charges before signing up.

📌 4. Your Credit Score Affects Everything

Had I known how much a CIBIL score impacts loan approval and rates, I would’ve paid more attention to it earlier.

👉 Lesson: Check and build your credit score before applying.

📌 5. Processing Fees Add Up

Most lenders charge 1%–3% of the loan as a processing fee — deducted upfront.

👉 Lesson: A ₹1 lakh loan could give you only ₹97,000 in hand. Read the fine print.

📌 6. Loan Apps Can Be Predatory

Some apps look flashy but operate in the grey market — with shady terms and harassment on defaults.

👉 Lesson: Always borrow from RBI-approved lenders like those partnered with Vizzve.

📌 7. Missing Even One EMI Hurts Your Score

A single missed payment can drop your credit score by 50–100 points.

👉 Lesson: Set auto-debit reminders and maintain an emergency buffer.

📌 8. You Can Negotiate!

Don’t blindly accept the first offer. You can negotiate better rates or terms, especially with a good credit profile.

👉 Lesson: Always compare on platforms like Vizzve Finance.

📌 9. Your Job & Income Matter

Self-employed? You may face higher rates or stricter eligibility than salaried individuals.

👉 Lesson: Be ready with ITR proofs or bank statements for better terms.

📌 10. Loans Aren’t Bad – Bad Planning Is

Loans can be powerful tools — if you know how to manage them.

👉 Lesson: Use loans for needs, not wants. Borrow within your limits.

✅ How Vizzve Finance Helps First-Time Borrowers

At Vizzve, we simplify the process so you can borrow with confidence:

📲 Compare personal loan offers from trusted partners

🔍 Transparent fee and rate structure

💬 Free financial consultation before applying

🧾 Real-time EMI calculators & loan eligibility check

🔐 Zero hidden charges, ever

🎯 Whether it's your first or fifth loan, borrow smart. Start with clarity, not confusion.

💬 FAQs

1. What documents do I need for my first loan?

Typically, PAN card, Aadhaar, income proof, and bank statements for the past 3–6 months.

2. Can I take a personal loan without a credit history?

Yes — some lenders offer loans to first-timers, but rates may be higher. Vizzve helps match you with the right ones.

3. Should I go with NBFCs or banks?

Both are valid, but NBFCs may offer faster disbursals with easier eligibility. Compare offers via Vizzve before choosing.

Published on : 17th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed.