Every bank customer in India is assigned a unique CIF number.

If you have ever set up internet banking, transferred your account to another branch, or contacted customer support, you have probably heard the term CIF number.

But what does it actually mean?

Here is a simple and complete explanation.

CIF Number Full Form

CIF = Customer Information File

A CIF number is an 8 to 11-digit unique identification number assigned to every customer by the bank.

It acts like your digital profile ID, storing all your personal, financial, and KYC information in one place.

What Is a CIF Number? (Meaning)

A CIF number links all your banking relationships with the bank under one unified customer profile.

This means:

Even if you have multiple accounts (savings, FD, RD, loans)

All of them are mapped to one CIF number

It helps the bank view your complete history instantly.

👉 CIF Number = Your master file in the bank’s database

What Information Does a CIF File Contain?

Your Customer Information File stores:

Full name, address, date of birth

KYC documents (Aadhaar, PAN, etc.)

Account details (savings, current, FDs, RDs)

Loan details

Demat information

Transaction summary

Nominee information

Account status and risk profile

This helps banks offer personalised services and comply with KYC/AML rules.

Where Can You Find Your CIF Number?

You can easily locate your CIF number through:

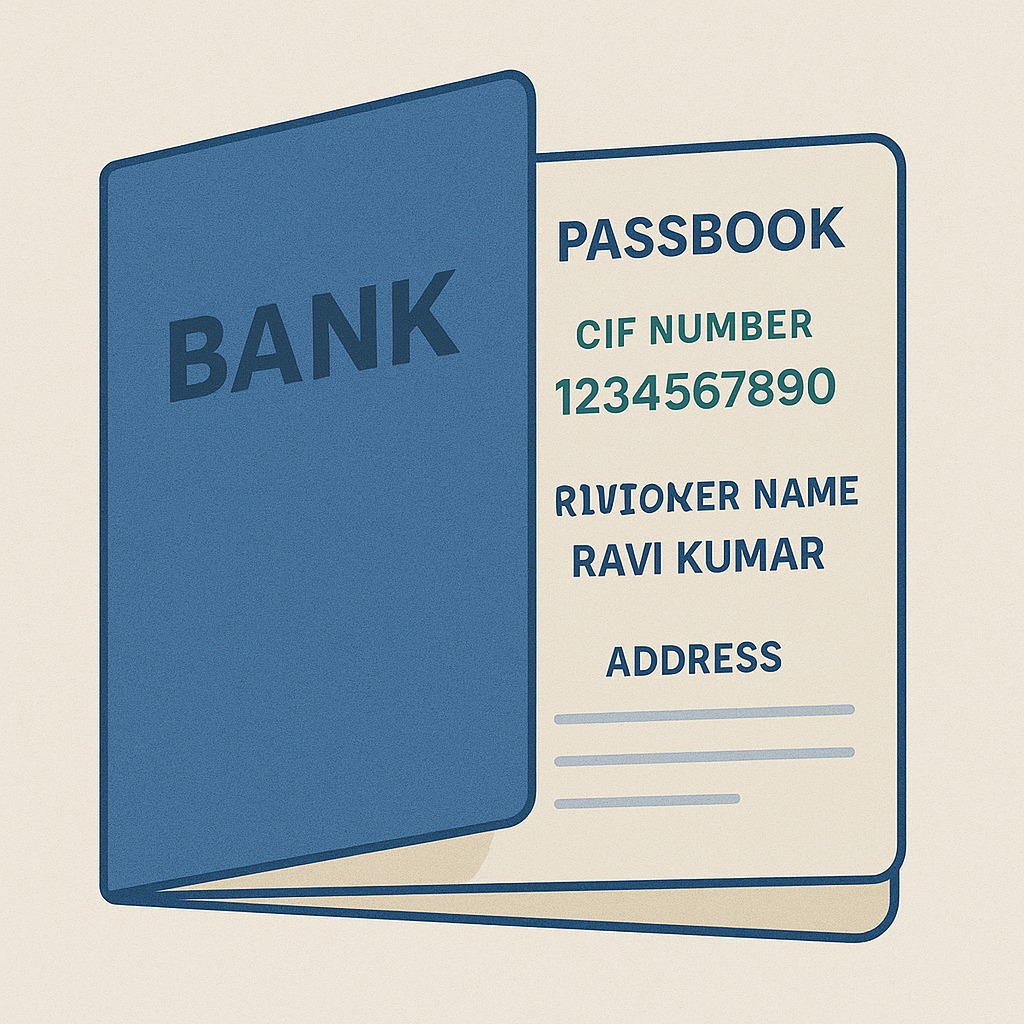

✔ Bank Passbook

Printed on the front page.

✔ Account Statement

Usually displayed at the top.

✔ Internet Banking

Check “Account Details” section.

✔ Mobile Banking App

Available under profile or account information.

✔ Welcome Kit / Chequebook

Some banks print CIF in the welcome booklet.

✔ Customer Care

You can request your CIF number after verification.

✔ Visiting Your Branch

Bank staff can provide it on request.

Is CIF Number the Same as an Account Number?

No. They are different.

| CIF Number | Account Number |

|---|---|

| Customer ID | Specific bank account |

| One per customer | One per account |

| Links all accounts | Used for transactions only |

You can have multiple accounts, but only one CIF number per bank.

Why Is CIF Number Important?

✔ Helps banks retrieve your entire profile quickly

✔ Needed for internet/mobile banking setup

✔ Mandatory for account transfers between branches

✔ Helps track KYC records

✔ Links all accounts under a single customer identity

✔ Ensures seamless banking services

It strengthens both security and customer convenience.

Is CIF Number Confidential?

Yes.

Since it contains sensitive personal and financial information, you should never share it publicly or with unknown parties.

FAQs

1. What is the full form of CIF number?

Customer Information File.

2. Is CIF number printed on passbook?

Yes, most banks print it on the first page.

3. Can two people have the same CIF number?

No. Every customer has a unique CIF number.

4. What happens if I lose my CIF number?

You can retrieve it through mobile banking, internet banking, or by contacting your branch.

5. Is CIF required for net banking?

Yes, some banks ask for CIF during registration.

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed