⚠️ What is a Fake Loan? How to Identify and Avoid Loan Scams in India [2025 Guide]

📅 Updated: June 2025

✍️ Published by: Vizzve Financial

🛑 Why This Blog Matters

In today’s fast-paced digital world, not all loan offers are real. Fake loan scams are rising across India, targeting unaware borrowers with promises of fast, no-check loans.

This guide helps you:

Understand fake loan tricks

Spot red flags

Protect your money and data

Choose a safe, RBI-registered lender like Vizzve Financial

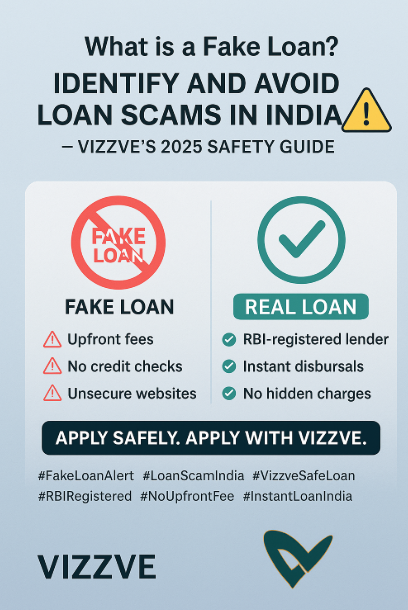

📌 What is a Fake Loan?

A fake loan is a fraudulent loan offer where scammers trick users into paying fees or sharing personal data, but never disburse any money. Victims often lose:

Money via “processing fees” or “GST charges”

Personal data like PAN, Aadhaar, bank account details

🚩 Common Red Flags of Fake Loan Offers

| Red Flag | Why It's Suspicious |

|---|---|

| 💬 Unsolicited DMs or Calls | Real lenders don’t randomly reach out |

| 💸 Upfront Fees | No RBI-registered NBFC asks for money first |

| 🔒 No Credit Check | Legit lenders always evaluate credit |

| ⚠️ Pressure Tactics | “Apply Now or Never” = Scam |

| ❌ Vague Loan Terms | No clarity on interest, EMIs |

| 🏢 No Physical Address | Always verify address on Google |

| 🌐 Unsecure Website | URL should start with https |

| 📱 Poor App Reviews | Fake loan apps have 1-star ratings |

| 🚫 No RBI/NBFC Registration | Always check RBI website for lender list |

😱 How Fake Loan Scams Work

Too-Good-To-Be-True Offers: Low interest, no documents, instant approval

Clickbait Links or Fake Apps

Ask for Fees: "Processing", "GST", "File Charge"

Ghost You: Once paid, they disappear

Identity Theft: Your data is sold or misused

🧠 Tips to Identify Fake Loans

Never pay upfront

Verify app reviews on Google Play

Ask for RBI registration number

Avoid WhatsApp-based loan approvals

Cross-check with RBI NBFC List

✅ Choose a Safe Option: Vizzve Financial

Why Vizzve is Trusted by 5+ Lakh Indians:

| Feature | Details |

|---|---|

| 💼 RBI Registered | 100% safe and verified NBFC |

| ⚡ Instant Loans | ₹3,000 to ₹1,00,000 disbursed in minutes |

| 📱 App-Based | Download here |

| 🔐 No Risk | No hidden charges, no upfront fees |

| 👩💼 Real Support | Human help available via 8449 8449 58 |

🛡️ How to Avoid Fake Loan Scams

✅ Apply only through official websites or Play Store apps

✅ Check for secure URLs (https://)

✅ Never pay before disbursal

✅ Don’t share OTP or bank info via DM

✅ Ask for written loan agreement

📣 How to Report Fake Loan Scams

| Step | Where to Report |

|---|---|

| 🧑💻 Cyber Crime | www.cybercrime.gov.in |

| ☎️ Helpline | Call 1930 (Cyber Fraud Hotline) |

| 🏦 Bank | Notify your bank immediately |

| 🚨 Police | File FIR with proof (screenshot, receipts) |

| 📱 App Store | Report fake loan app directly |

📌 FAQ – Quick Answers

Q1. What is a fake loan?

A scam where fraudsters promise a loan, collect fees, but never give money.

Q2. How to check if a loan app is fake?

Check Play Store reviews, RBI registration, website authenticity, and fees.

Q3. What to do if I was scammed?

Report to cybercrime portal, bank, and lodge a police complaint.

Q4. Is Vizzve a legit lender?

Yes. Vizzve Financial is RBI-registered and trusted by over 5 lakh borrowers.

Q5. What documents does Vizzve require?

Only Aadhaar + PAN for most loans. No salary slips or guarantor needed.

🔒 Be Safe. Be Smart. Choose Vizzve.

A real loan can change lives. A fake one can ruin it.

Always choose RBI-registered platforms like Vizzve Financial for safe, fast, and verified loans.

📲 Apply Now

✅ Download the Vizzve App

📞 Call: 8449 8449 58

🌐 Visit: www.vizzve.com