What Is Compound Interest?

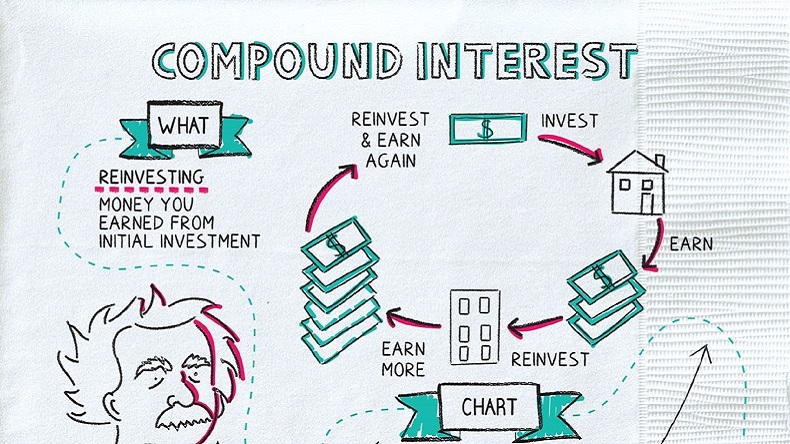

Compound interest is interest earned on your original amount plus the interest it already earned. This creates a snowball effect where your money keeps growing faster over time—even while you sleep.

🧠 “Compound interest is the 8th wonder of the world.” – Albert Einstein

Unlike simple interest (earned only on the principal), compound interest works in layers, accelerating your wealth-building over time.

The Formula (Simplified)

Compound Interest = P × (1 + r/n)^(nt) – P

Where:

P = Principal (your starting money)

r = Annual interest rate

n = Number of compounding periods per year

t = Number of years

Real-Life Example

Let’s say you invest ₹1,00,000 at 10% interest, compounded annually for 20 years.

After 1 year: ₹1,10,000

After 5 years: ₹1,61,000

After 10 years: ₹2,59,000

After 20 years: ₹6,72,000

Without doing anything, your ₹1L turns into nearly ₹7L thanks to the magic of compounding.

Where You Can Earn Compound Interest in India

Mutual Funds (SIPs)

Reinvested returns grow exponentially over time.

Public Provident Fund (PPF)

Government-backed, tax-free, and compounded annually.

Fixed Deposits (FDs)

Interest can be compounded quarterly or annually.

Recurring Deposits (RDs)

Monthly investments with compounding benefit.

National Pension Scheme (NPS)

Long-term compounding for retirement.

Why Compound Interest Is So Powerful

✅ 1. Passive Wealth Growth

Your money works even while you sleep or do nothing.

✅ 2. Rewards Patience

The longer you stay invested, the greater the returns.

✅ 3. Creates Financial Freedom

Small, regular investments can lead to crore-level wealth over time.

The Rule of 72: Quick Estimation

To know how fast your money doubles:

72 ÷ Interest Rate = Years to Double

Example:

At 12% return → 72 ÷ 12 = 6 years to double your money.

How to Maximize Compound Interest in 2025

Start Early – Even ₹500/month in your 20s matters

Invest Regularly – SIPs are perfect for this

Reinvest Returns – Don’t withdraw gains early

Stay Long-Term – More years = more power

Avoid Frequent Withdrawals – Let compounding stay uninterrupted

FAQs

1. Can compound interest make you rich?

Yes, over time, even small amounts grow into significant wealth if left untouched.

2. Is compounding better than fixed deposits?

FDs offer compounding but usually at low rates. SIPs and long-term mutual funds offer higher compounding potential.

3. How often should compounding happen?

More frequent compounding (monthly > yearly) gives better returns.

4. Is compound interest taxed in India?

Yes, unless it’s a tax-free scheme like PPF. Otherwise, gains are subject to income or capital gains tax.

Final Word: Compounding Is Time’s Best Gift to Your Money

Your income might have limits, but your money doesn’t have to.

⏱️ “The earlier you start, the more you earn—without extra effort.”

Let compound interest do the heavy lifting for your future.

Vizzve Helps You Start Today

✅ Compound Interest Calculator

✅ SIP Goal Planners

✅ Tax-Efficient Investment Options

✅ Beginner-Friendly Wealth Plans

Start building wealth while you sleep—with Vizzve Finance.

Published on : 26th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed