When checking your CIBIL report or loan repayment status, you may come across the term Special Mention Account (SMA).

This classification is used by banks to flag early warning signs of stress in a borrower’s loan account — even before the account becomes an NPA (Non-Performing Asset).

Understanding SMA is crucial because it reflects your repayment discipline and can significantly influence your future loan eligibility.

Here’s everything you need to know.

What Is a Special Mention Account (SMA)?

A Special Mention Account (SMA) is a category used by banks to identify accounts that show early signs of delay or default in loan repayment.

It helps lenders monitor risk before the loan becomes a major problem.

SMA classification is directly linked to the number of days your EMI is overdue.

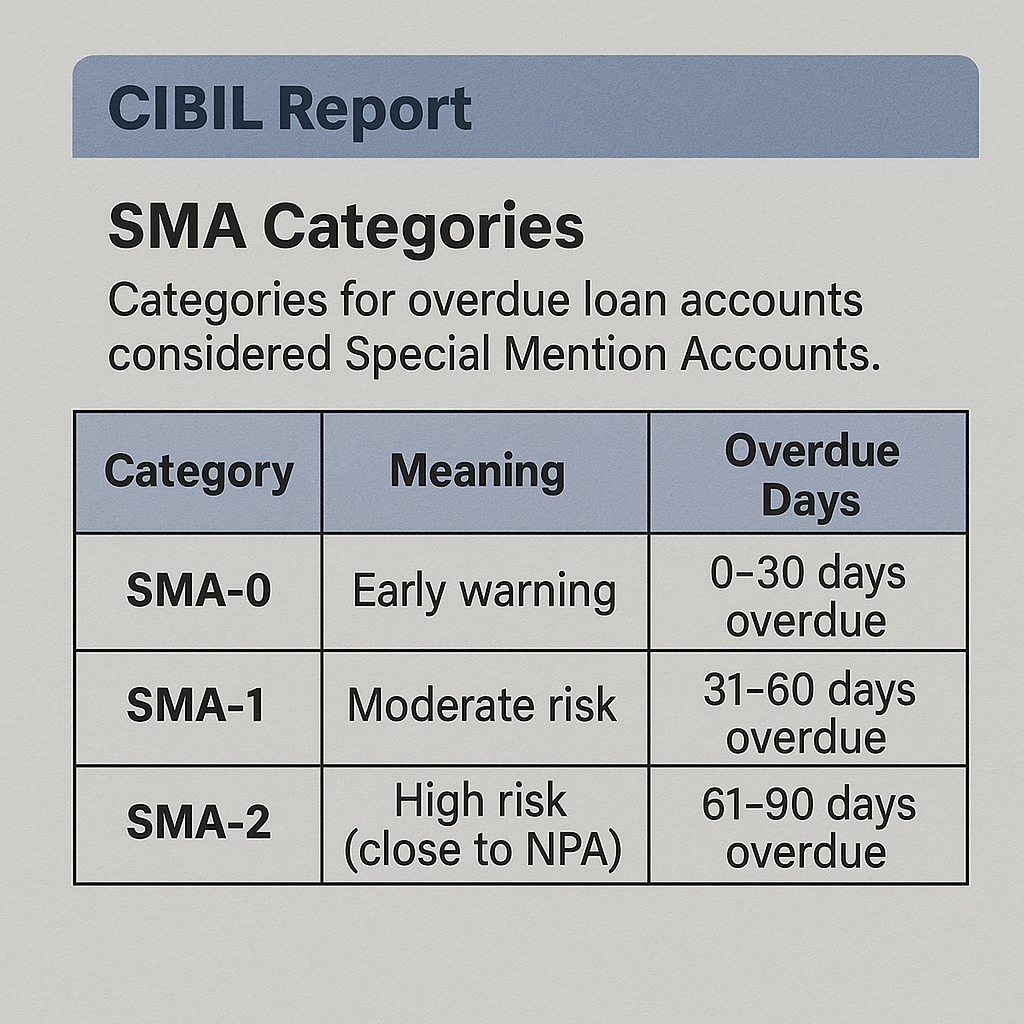

Types of SMA in CIBIL Report

SMA accounts are classified into three categories based on overdue days:

1. SMA-0 — Early Warning (0–30 days overdue)

Your EMI is overdue but less than 30 days.

Indicates:

Slight irregularity

Possible oversight or delay

Not yet serious but gets recorded

Impact:

A warning signal to banks

May affect approval for new loans if frequent

2. SMA-1 — Increasing Risk (31–60 days overdue)

Your EMI is overdue between 31 to 60 days.

Indicates:

Borrower is struggling with payments

Higher risk of future default

Impact:

Lenders may restrict new credit

Interest or penalty charges apply

Big red flag for future borrowing

3. SMA-2 — High Risk (61–90 days overdue)

Your EMI is overdue between 61 to 90 days.

Indicates:

Severe repayment stress

Account may soon slip into NPA

Impact:

Very high impact on credit score

Banks may initiate recovery action

New loan applications likely to get rejected

When does an account become an NPA?

If your EMI remains overdue for 90+ days, the account is officially classified as a Non-Performing Asset (NPA).

This is the most serious category and has major consequences for your credit profile.

How SMA Appears in Your CIBIL Report

CIBIL reflects the SMA category under your loan account history.

Banks update it monthly based on repayment behaviour.

If your account is marked as SMA-0, SMA-1, or SMA-2, lenders reviewing your report will see clear signs of financial stress.

Impact of SMA on Your Credit Score

SMA classification affects:

✔ Your credit score

Delays beyond 30 days cause the score to drop.

✔ Your loan eligibility

Banks avoid lending to SMA-1/SMA-2 borrowers.

✔ Interest rates

You may be charged higher rates in future.

✔ Loan top-ups

Banks restrict additional credit if your account is under SMA.

Even SMA-0 repeated multiple times indicates chronic late payments.

How to Avoid Getting SMA Classification

Pay EMIs before the due date

Enable auto-debit for loans

Maintain enough balance on EMI date

Avoid taking multiple loans when income is unstable

Communicate with your bank if facing temporary financial issues

How to Remove SMA Status from Your Account

Clear all overdue EMIs immediately

Ensure no dues remain pending for 90 days

Request lender to update CIBIL after repayment

Maintain 6–12 months of clean repayment history

Once timely payments resume, the SMA tag reduces its impact over time.

FAQs

1. What does SMA mean in CIBIL?

It means your loan account has overdue EMIs and is showing early signs of financial stress.

2. Is SMA a negative mark?

Yes, it indicates delayed payments, but not as severe as NPA.

3. Does SMA affect loan approval?

Yes. Lenders may reject or delay approval for new loans.

4. How long does SMA stay in the CIBIL report?

Until the overdue EMIs are cleared and lenders update the status.

5. What happens if SMA-2 is not resolved?

Your account will become an NPA after 90+ days overdue

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

Source Credit: By: Jaivinder Bhandari Review By: Ankur Koul