What Is the Difference Between SGST and CGST? – A Complete Guide for 2025

Vizzve Admin

🧾 What Is the Difference Between SGST and CGST? – A Complete Guide for 2025

Published by: Vizzve Financial | Updated: May 9, 2025

Category: GST Explained | Tax Filing | Indian Finance

Reading Time: 4–5 Minutes

💡 Introduction

GST (Goods and Services Tax) has transformed India’s indirect tax system. But many taxpayers still get confused about the terms SGST and CGST. Whether you’re a business owner, freelancer, or just filing your taxes, it’s crucial to understand what these terms mean and how they affect your invoices.

📚 What Are SGST and CGST?

✅ CGST (Central Goods and Services Tax)

-

Definition: CGST is the portion of GST collected by the central government on intra-state (within the same state) supply of goods and services.

-

Applicability: When you sell a product or service within your own state, CGST is charged along with SGST.

-

Example: If you sell goods worth ₹1,000 in Karnataka, the CGST (say 9%) = ₹90 is paid to the Central Government.

✅ SGST (State Goods and Services Tax)

-

Definition: SGST is the portion of GST collected by the state government for the same intra-state transaction.

-

Applicability: SGST is charged alongside CGST and is collected by your respective state government.

-

Example: The same ₹1,000 sale in Karnataka will also include SGST (9%) = ₹90 to be paid to the State Government of Karnataka.

🔄 When Are SGST and CGST Applicable?

| Transaction Type | Applicable Taxes | Collected By |

|---|

| Intra-State (same state) | CGST + SGST | Central + State Government |

| Inter-State (different states) | IGST (Integrated GST) | Collected by Central Government |

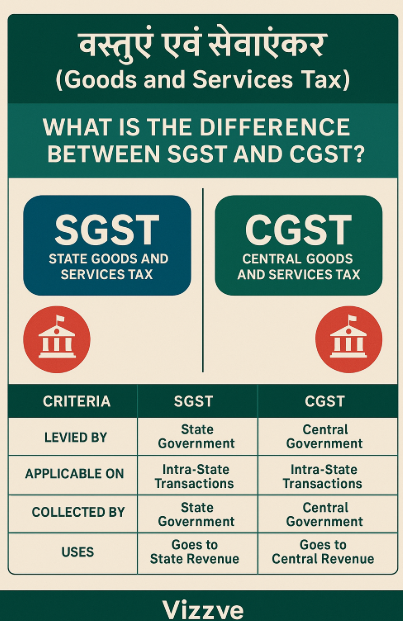

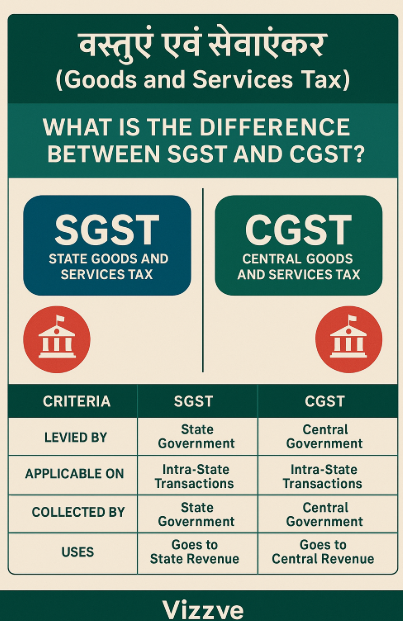

🎯 Key Differences Between SGST and CGST

| Criteria | SGST | CGST |

|---|

| Full Form | State Goods and Services Tax | Central Goods and Services Tax |

| Levied By | State Government | Central Government |

| Applicable On | Intra-state transactions | Intra-state transactions |

| Share of Tax | Goes to State’s Revenue | Goes to Central Revenue |

| Input Tax Credit | Can be used only against SGST | Can be used only against CGST |

🏛️ Why Was GST Split into CGST and SGST?

India is a federal country, meaning both the Center and States have the power to levy taxes. To ensure both get a fair share of revenue, GST was divided into CGST and SGST for intra-state transactions. This promotes:

💡 Real-Life Example

If you are a shopkeeper in Delhi selling a mobile phone for ₹10,000:

🔄 What About Inter-State Transactions?

If you sell the same mobile phone from Delhi to Maharashtra, you will charge IGST (18%) = ₹1,800, and the entire tax goes to the Central Government, which later shares the state’s portion.

📢 Vizzve Financial Tip:

When filing GST returns or generating invoices, make sure you correctly identify whether it’s an intra- or inter-state transaction. Vizzve’s accounting partners can help small businesses manage this through automated GST-ready billing.

⚙️ How to File SGST and CGST?

-

Register on www.gst.gov.in

-

Use GST returns form GSTR-1, GSTR-3B

-

File monthly or quarterly depending on turnover

-

Maintain proper invoice records and HSN codes

✅ Final Summary

| SGST | CGST |

|---|

| Collected by State | Collected by Center |

| For same-state sales | For same-state sales |

| 50% of GST split | 50% of GST split |

Both are equally important and must be calculated and paid correctly to avoid penalties.

📈 Want to Grow Your Business Without Tax Confusion?

Apply for a GST-compliant business loan through Vizzve Financial – trusted by thousands of small business owners for:

✅ Instant Loan Approvals

✅ Low Interest Rates

✅ 100% Paperless Process

✅ Loans from ₹50,000 to ₹10 Lakhs

Disclaimer: This article may include third-party images, videos, or content that belong to their respective owners. Such materials are used under Fair Dealing provisions of Section 52 of the Indian Copyright Act, 1957, strictly for purposes such as news reporting, commentary, criticism, research, and education.

Vizzve and India Dhan do not claim ownership of any third-party content, and no copyright infringement is intended. All proprietary rights remain with the original owners.

Additionally, no monetary compensation has been paid or will be paid for such usage.

If you are a copyright holder and believe your work has been used without appropriate credit or authorization, please contact us at grievance@vizzve.com. We will review your concern and take prompt corrective action in good faith... Read more