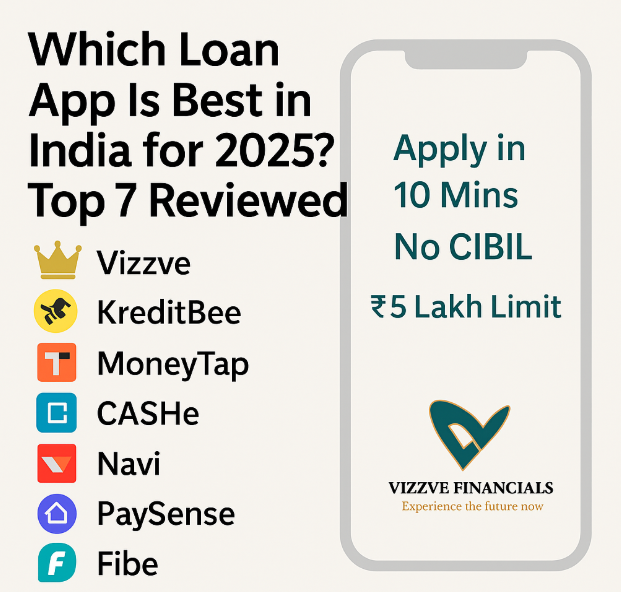

📱 Which Loan App Is Best in India for 2025? Top 7 Reviewed

📅 Updated: May 2025

✍️ Published by: Vizzve Financial

💡 Why This Blog Is Trending

As of 2025, the demand for instant personal loans via apps has skyrocketed. Whether it’s for emergencies, education, business needs, or travel — loan app comparisons help users make smarter choices.

This guide ranks the top 7 loan apps in India based on speed, approval flexibility, CIBIL independence, and user experience — especially for those without income proof or formal credit history.

🏆 Top 7 Best Loan Apps in India for 2025

1. Vizzve Financial – Best Overall for Instant Approval with Low CIBIL

🌐 www.vizzve.com

✅ Loan Amount: ₹10,000 – ₹5,00,000

📱 Documents: Aadhaar + PAN + bank statement

⚡ Speed: 10–30 minutes

🧠 USP: AI-based approval, no CIBIL mandatory

🤝 Ideal For: Gig workers, freelancers, first-time borrowers

“Vizzve is perfect if you're tired of bank rejections.”

2. KreditBee – Best for Small Emergency Loans

🌐 kreditbee.in

✅ Loan Amount: ₹1,000 – ₹2,00,000

🕒 Approval: 30 mins – 1 hr

📲 Ideal For: Salaried and semi-formal jobholders

3. MoneyTap – Best for Flexible Credit Line

🌐 moneytap.com

✅ Loan Amount: ₹3,000 – ₹5,00,000

🔄 USP: Borrow in chunks, pay only for usage

🧾 CIBIL required

4. CASHe – Best for Social Credit Lending

🌐 cashe.co.in

✅ Loan Amount: ₹10,000 – ₹3,00,000

🧠 Uses social score + UPI patterns

📲 Best for: Freelancers & digital footprint users

5. Navi – Best for High Loan Amounts

🌐 navi.com

✅ Loan Amount: ₹10,000 – ₹20,00,000

📄 Requires full KYC

⚡ Fast disbursal but selective approval

6. PaySense – Best for EMI Convenience

🌐 gopaysense.com

✅ Loan Amount: ₹5,000 – ₹5,00,000

🧾 Custom EMI plans

💼 Suitable for salaried employees

7. EarlySalary (Fibe) – Best for Young Professionals

🌐 fibe.in

✅ Loan Amount: ₹8,000 – ₹5,00,000

📱 Great app UX, early jobbers friendly

💳 Also offers salary advances and BNPL

📊 Comparison Table (At a Glance)

| App | Best For | Speed | CIBIL Required | Max Loan |

|---|---|---|---|---|

| Vizzve | Low score users & speed | 10–30 mins | ❌ No | ₹5 Lakh |

| KreditBee | Small emergencies | 30–60 mins | ❌ Partial | ₹2 Lakh |

| MoneyTap | Flexible borrowing | 1–2 hours | ✅ Yes | ₹5 Lakh |

| CASHe | Alt score users | 1–3 hours | ❌ No | ₹3 Lakh |

| Navi | High amount seekers | 1–4 hours | ✅ Yes | ₹20 Lakh |

| PaySense | EMI convenience | 1–2 hours | ✅ Yes | ₹5 Lakh |

| Fibe | Young salaried | 1–2 hours | ✅ Yes | ₹5 Lakh |