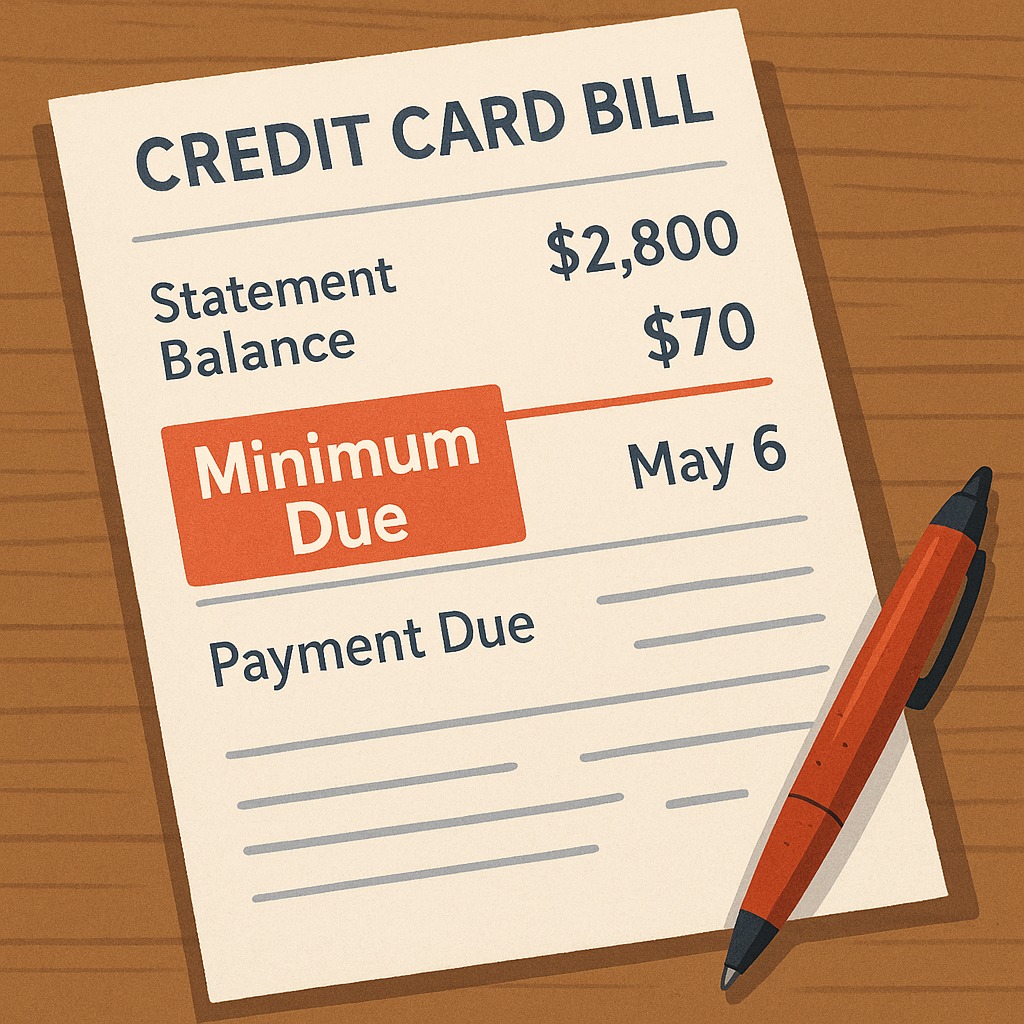

Every month, millions of credit card users notice a line on their bill that says:

“Minimum Amount Due.”

It’s usually a small, manageable number — far lower than the actual total outstanding balance.

And psychologically, that small number feels like relief.

But this “relief” is designed to influence behaviour.

Credit card companies want you to pay the minimum due, because it keeps you in revolving credit, where interest rates are extremely high.

Let’s understand why people fall for this trap and the psychology behind it.

1. The Illusion of Affordability

The minimum due is often:

3% to 5% of the total outstanding

Sometimes as low as ₹500

This makes users think:

“I can manage this. The bill is not that big.”

But the remaining 95% stays as revolving balance, attracting 30–42% annual interest.

2. Stress Reduction Bias

Credit card bills trigger financial anxiety.

When the brain is stressed, it chooses the easiest available option — known as the cognitive ease principle.

Paying the minimum due reduces the emotional burden, even if it increases the financial burden.

3. The ‘Safe Zone’ Misconception

Many people wrongly assume:

“If I pay the minimum, my credit score is safe.”

“This must be what the bank expects me to pay.”

Banks highlight the minimum due in bold fonts to reinforce this idea.

In reality:

You avoid default, but

You don’t avoid interest, and

Your utilisation remains high (which hurts CIBIL score)

4. Present Bias: Short-Term Comfort vs Long-Term Cost

Humans naturally prioritise:

Immediate comfort

Short-term relief

over

Long-term financial health

Paying the minimum due feels like solving the problem today, even though the debt will grow tomorrow.

This is why credit card companies rely on present bias.

5. The Snowball Effect: How Debt Quietly Grows

If you keep paying only the minimum due:

The principal does not decrease

Interest keeps accumulating

Monthly minimum due stays almost the same

Your total debt grows silently

A ₹50,000 balance can take years to repay if you only pay the minimum due.

6. Anchoring Bias: The Minimum Due Becomes Your Mental Benchmark

Anchoring happens when people rely too much on the first number they see.

When the minimum due is displayed upfront, your brain “anchors” to that number.

Even if you can afford to pay more, you subconsciously think:

“Maybe I should just pay the minimum.”

7. The Credit Card Design Strategy

Credit card statements are intentionally designed to:

Highlight minimum due

Hide total cost of revolving credit

Make the bill feel smaller

Reduce “payment pain”

It’s not accidental — it’s behavioural economics at work.

Why Paying Minimum Due Is Dangerous

❗ Interest of 30–42% per year

❗ Debt can take years to repay

❗ CIBIL score drops due to high utilisation

❗ Risk of falling into a debt trap

❗ Harder to qualify for future loans

Credit card debt is one of the costliest forms of borrowing.

How to Avoid the Minimum-Due Trap

✔ Always aim to pay the full amount due

✔ If not possible, pay at least 40–50% of the balance

✔ Reduce credit utilisation below 30%

✔ Don’t spend more than you can repay in 30 days

✔ Use a budgeting system (50/30/20 rule works well)

✔ Make part-payments mid-cycle if needed

❓ FAQs

1. Is paying minimum due bad for credit score?

It prevents default but keeps utilisation high, which lowers CIBIL score.

2. Do banks encourage minimum-due payments?

Yes — it’s profitable because interest on revolving credit is extremely high.

3. What happens if I pay only minimum due every month?

You enter a “debt treadmill” where your balance hardly reduces.

4. How much should I pay ideally?

Always the total amount due. At minimum, try to pay 50% of your outstanding.

5. Can minimum due save me from penalties?

Yes, you avoid late fees. But you do not avoid high interest charges.

Published on : 20th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed