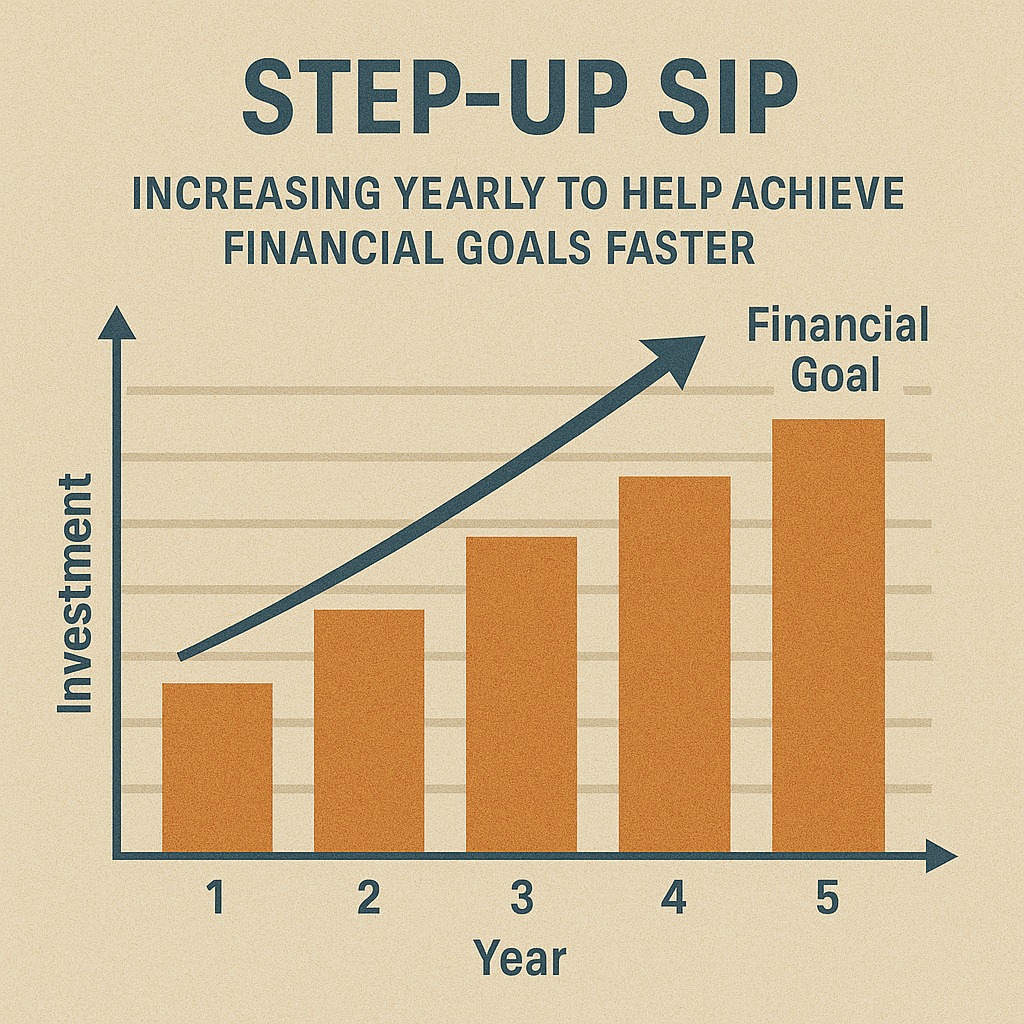

Systematic Investment Plans (SIPs) are one of the simplest and most effective ways to build long-term wealth. But to truly unlock their full potential, financial planners recommend using a Step-Up SIP — a feature where you automatically increase your SIP amount at regular intervals.

This small tweak can dramatically improve your wealth creation over time, helping you reach financial goals faster and more comfortably.

Here’s why stepping up your SIP is a powerful investment habit.

What Is a Step-Up SIP?

A Step-Up SIP (also called a top-up SIP) allows you to increase your monthly SIP by a fixed percentage or fixed amount every year.

For example:

Starting SIP: ₹5,000 per month

Step-Up: ₹500 every year

Year 2 SIP: ₹5,500

Year 3 SIP: ₹6,000

…and so on.

It mirrors your rising income, making investing easier without straining your budget.

Why You Should Step Up Your SIP

1. Helps You Beat Inflation Naturally

Inflation increases costs every year.

So your goals — child’s education, retirement, home purchase — become more expensive with time.

A flat SIP does not keep pace with inflation.

A step-up SIP ensures:

Your investments grow

Your contribution matches rising costs

You stay on track to meet long-term targets

2. Helps You Compounding Much Faster

The earlier you increase your SIP, the more aggressively compounding works for you.

Even a small 10% annual increase can lead to significantly higher wealth over a 10–20 year period.

Example:

₹5,000 monthly SIP for 15 years without step-up → ~₹20 lakhs

₹5,000 SIP with 10% annual step-up for 15 years → ~₹32 lakhs

You gain more without a large effort.

3. Aligns With Your Rising Income

Most people see their income grow every year through:

Salary increments

Promotions

Business expansion

Bonus payouts

If your income rises but your SIP doesn’t, you lose the chance to fast-forward wealth creation.

Step-up SIPs ensure your savings rate grows with your earning potential.

4. Helps You Reach Big Life Goals on Time

Financial goals such as:

Children’s education

Retirement planning

Buying a house

Wealth creation for future

…need large, long-term disciplined investments.

Step-up SIPs help close the gap between:

What you’re investing today

What you should invest to meet the goal

It keeps your plan aligned.

5. Reduces Stress on Your Budget

Instead of forcing yourself to start with a high SIP from day one, you can:

Start small

Increase gradually

Stay consistent

This makes investing psychologically easier and budget-friendly.

6. Improves Chances of Meeting Goals Without a Shortfall

Flat SIPs often create a corpus deficit.

Investors later realize:

They started too late

They invested too little

Their SIP wasn’t inflation-adjusted

Step-up SIPs eliminate that risk by keeping the investment amount relevant and future-ready.

How Much Should You Step Up?

Most experts recommend:

10% step-up per year for salaried individuals

Fixed ₹500–₹2,000 increase annually for beginners

Higher step-ups (15–20%) during years of large salary hikes

The key is consistency.

FAQs

1. What is a step-up SIP?

A feature that allows you to automatically increase your SIP amount every year.

2. How does it help?

It accelerates compounding, beats inflation, and helps achieve financial goals sooner.

3. Is it better than a regular SIP?

For long-term goals — yes. Step-up SIPs build far bigger wealth.

4. Can I modify my step-up amount?

Yes. Most mutual fund platforms allow you to change or stop the step-up anytime.

5. Should beginners use step-up SIPs?

Absolutely. It lets them start small and gradually grow their investment journey.

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed