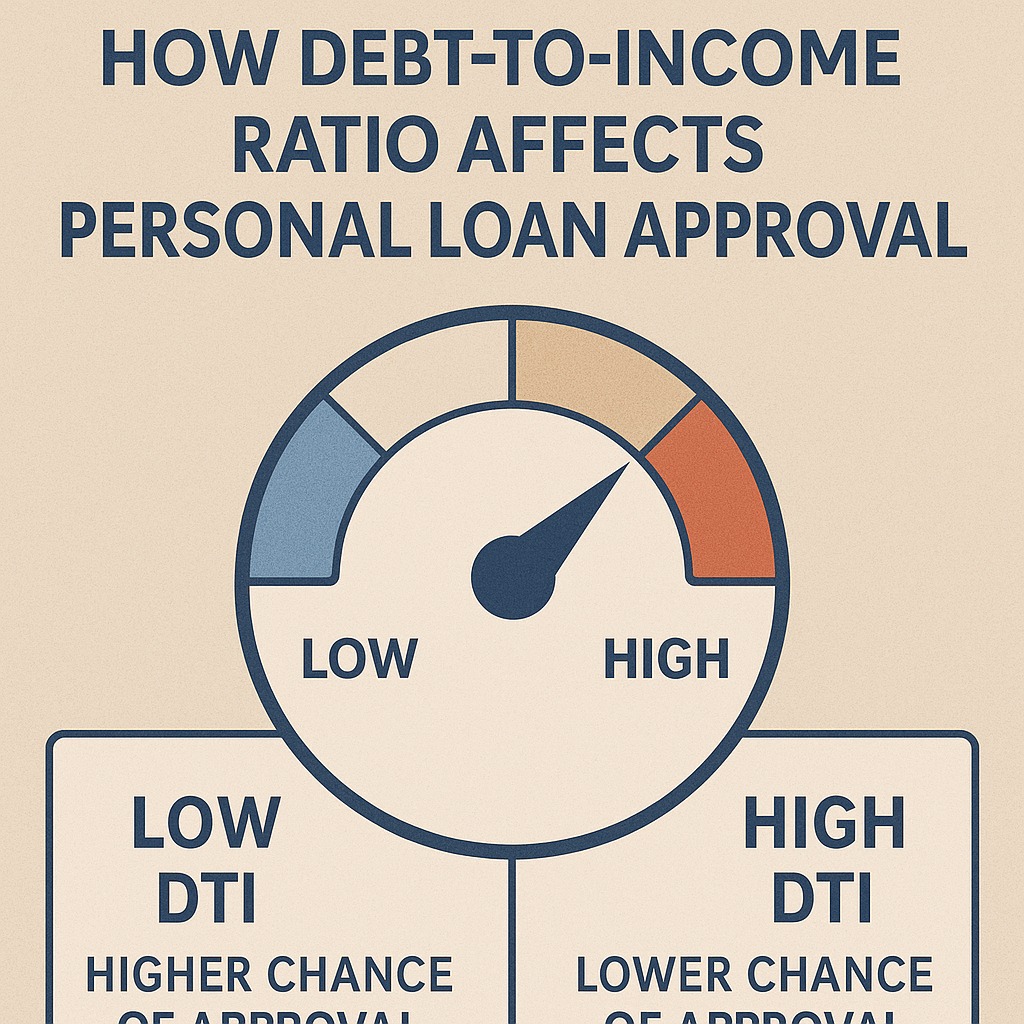

When you apply for a personal loan, lenders don’t just look at your credit score—they also check your Debt-to-Income (DTI) Ratio. This simple percentage tells lenders how much of your monthly income is already going toward existing debt.

A strong DTI ratio increases your chances of loan approval at a lower interest rate, while a weak one may lead to rejection or higher EMI burden.

Let’s understand why your DTI ratio matters and how it impacts your personal loan approval.

What Is Debt-to-Income (DTI) Ratio?

Your DTI ratio compares:

Your monthly debt payments

÷

Your monthly income

It shows how much of your income is tied up in existing financial obligations like:

Personal loan EMIs

Credit card bills

Home loan EMIs

Car loan EMIs

Buy-now-pay-later dues

A lower DTI ratio means more disposable income and less financial stress.

Why Lenders Care About DTI Ratio

1. It Shows Your Repayment Capacity

Lenders want to ensure you can take on a new loan without struggling.

A lower DTI = higher repayment capacity.

2. It Reflects Financial Stability

A person with a low DTI has healthier finances and lower chances of missing EMIs or defaulting.

3. It Affects Loan Approval Speed

Applicants with good DTI ratios get faster approvals since the risk is lower.

4. It Influences Interest Rates

A better DTI = lower risk = lower interest rate offers.

A high DTI may lead to:

Higher rates

Lower loan amount

Rejection in extreme cases

5. It Helps Predict EMI Stress

Banks analyse whether a new EMI will push you into financial pressure.

For example: If your DTI goes above 50%, lenders see you as a high-risk borrower.

What Is a Good DTI Ratio?

| DTI Ratio | Meaning | Impact on Loan |

|---|---|---|

| Below 30% | Excellent | High approval chances |

| 30–40% | Good | Likely approval |

| 40–50% | Risky | Approval with conditions |

| Above 50% | High risk | Possible rejection |

Most lenders prefer DTI below 40% for personal loans.

How to Improve Your DTI Ratio

Pay off small loans or credit card dues

Increase your income (side job, commission, incentives)

Avoid taking multiple loans at the same time

Choose a longer loan tenure to reduce EMI

Consolidate high-interest loans

These small steps can significantly boost your loan eligibility.

FAQs

1. What is the ideal DTI ratio for personal loan approval?

Most lenders prefer a DTI ratio below 40%.

2. Does DTI affect my interest rate?

Yes. A lower DTI usually brings better interest rates.

3. Can I get a loan with a high DTI?

Possibly, but with:

Higher rates

Lower loan amount

More documentation

4. Does credit score matter more than DTI?

Both are equally important—DTI shows repayment capacity, while credit score shows repayment history.

5. How do I calculate my DTI ratio?

(Your total monthly EMIs ÷ Your monthly income) × 100

Published on : 25th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

Source Credit : MINT