✨ Introduction

Many borrowers get shocked when the first EMI amount is higher or lower than what the bank or NBFC originally showed during the loan application.

You may wonder:

Why did my EMI increase?

Why is the first EMI different?

Why are the next EMIs slightly lower/higher?

The truth is — these EMI changes happen due to technical but important financial factors most borrowers overlook.

This guide explains all of them in simple, practical language.

AI ANSWER BOX (AI-Optimized Summary)

Your EMI amount changes after disbursement because of interest added for extra days before EMI start date, processing fee deductions, GST, rounding-off differences, rescheduled EMI dates, partial disbursement, and lender-specific calculation methods. These adjustments affect the final EMI shown in your loan schedule.

Why Your EMI Changes After Disbursement — Core Reasons

Here are the most common reasons lenders adjust EMIs after loan disbursement:

1. Interest for “Extra Days” Before Your First EMI

This is the #1 reason EMI changes.

Example:

Loan disbursed: 10th May

EMI date: 5th June

That’s 26 extra days of interest added to your first EMI.

Impact:

✔ First EMI becomes slightly higher

✔ Remaining EMIs might reduce or stay same

2. Processing Fee Deducted From Loan Amount

If the processing fee is deducted upfront, your loan amount is reduced, but EMI is still calculated on the full loan principal.

Borrower receives: ₹98,500

Bank calculates EMI on: ₹1,00,000

This mismatch causes confusion → EMI feels higher.

3. GST on Processing Fee & Other Charges

GST applies on:

✔ Processing Fee

✔ Loan Insurance

✔ Convenience Fee

This slightly increases the first EMI or adjusts the schedule.

4. EMI Date Change After Disbursement

Many lenders allow you to shift your EMI date.

When this happens:

Tenure shifts

Interest days change

EMI recalculates

Even a 5–10 day difference adds or reduces interest.

5. Rounding-Off Adjustments

Banks round EMI values to the nearest rupee or decimal, which causes:

First EMI slightly higher

Last EMI slightly lower

OR vice-versa

This is normal.

6. Partial Disbursement or Split Disbursement

image_group{"query":["loan disbursement cheque india","bank loan transfer india"],"aspect_ratio":"16:9"}

If the bank disburses the loan in parts, interest is calculated on the amount disbursed.

This can affect EMI slightly until full amount is disbursed.

7. Insurance Premium Added to the Loan

Some lenders add loan protection insurance to the principal.

This increases the EMI because the loan amount becomes higher.

8. System Recalculation After KYC or Agreement Finalization

Once digital signing is done, the lender recalculates interest based on actual timestamps — not estimated ones.

So differences of even hours matter in some NBFCs.

9. Pre-EMI Interest Adjustments

In some loans, especially top-ups, lenders charge Pre-EMI until full disbursement.

Then convert it to Full EMI, causing visible change.

EMI Change Example (Simple Table)

| Item | Old EMI | New EMI |

|---|---|---|

| Original EMI (shown during application) | ₹10,250 | — |

| Added interest for 22 days | — | +₹270 |

| GST adjustments | — | +₹35 |

| Rounding difference | — | +₹5 |

| Final EMI | — | ₹10,560 |

This is normal and expected.

When EMI Change Is NORMAL

✔ First EMI different

✔ EMI adjusted after date change

✔ Small ₹10–₹500 difference

✔ Tenure extended by a few days

✔ EMI recalculated after partial disbursal

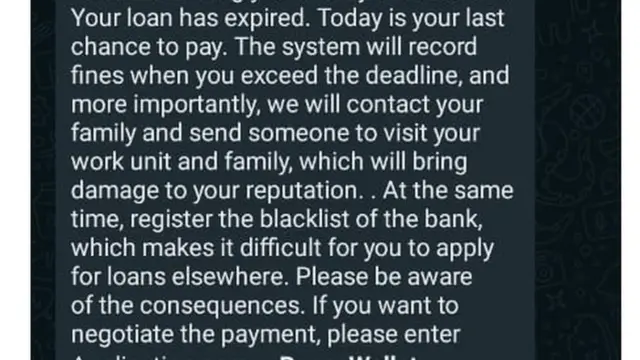

When EMI Change Is a RED FLAG

⚠️ Contact your lender immediately if:

❌ EMI is more than ₹500–₹1,000 higher

❌ Tenure is changed without consent

❌ Loan amount credited is lower than agreed

❌ Extra fees charged without notification

How to Double-Check EMI Accuracy

✔ Step 1: Read your loan agreement

✔ Step 2: Check “Repayment Schedule” inside email/app

✔ Step 3: Look at your “Amortization Table”

✔ Step 4: Calculate days between disbursement & EMI date

✔ Step 5: Verify processing fee + GST

✔ Step 6: Confirm if insurance was added

Expert Commentary

Financial experts confirm that EMI changes happen due to technical interest calculations, not hidden charges.

However, experts warn borrowers to:

Always check GRIR (gross loan amount)

Verify processing fee + GST

Compare offer letter vs signed agreement

90% of EMI differences are normal, but 10% require clarification.

⭐ Key Takeaways

EMI changes due to extra interest days, processing fee, GST, rounding

First EMI is often different from the rest

Always check your loan amortization schedule

EMI changes beyond ₹500 must be verified

Most EMI changes are normal — not a scam

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process.**

👉 Apply now at www.vizzve.com

❓ FAQs

1. Why did my EMI increase after disbursement?

Extra interest days + GST + processing fee.

2. Why is my first EMI different?

Because interest is calculated from disbursement date to EMI date.

3. Can EMI change without my approval?

Small adjustments are normal. Big changes need inquiry.

4. Why are later EMIs lower?

Rounding adjustments.

5. Does GST affect EMI?

Yes, slightly.

6. Does processing fee affect EMI?

Indirectly, yes.

7. Why is EMI lower than shown?

If tenure increased slightly.

8. What if EMI increased a lot?

Contact lender.

9. Does EMI change if EMI date is changed?

Yes.

10. What if disbursement was delayed?

Interest adjusts.

11. Do NBFCs charge higher adjustments?

Sometimes.

12. Is EMI change fraud?

Usually no.

13. Is interest charged by days?

Yes, for the first cycle.

14. Can EMI reduce later?

Yes, due to rounding.

15. Can I fix EMI manually?

No — system-calculated.

Published on : 10th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed