India’s Market Surge: Hype or Inevitable?

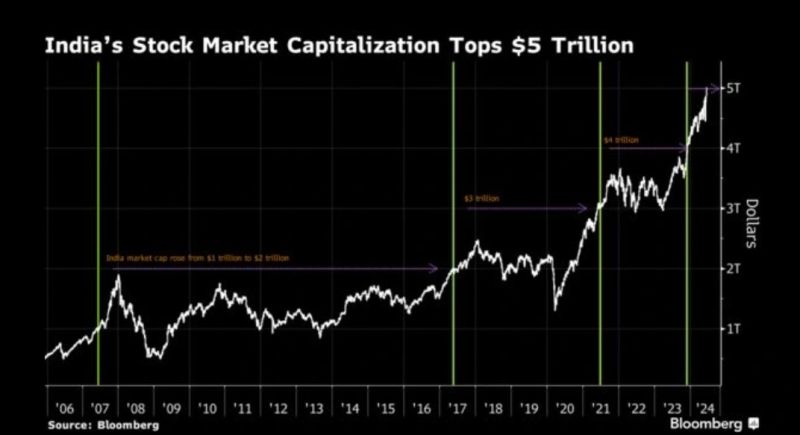

In 2024, India overtook Hong Kong to become the fourth-largest stock market in the world, crossing $4 trillion in market capitalization. The next big question?

Can India hit $5 trillion soon?

Let’s explore what experts predict, what’s driving the momentum, and what it means for you as an investor.

Key Drivers Behind India’s Stock Market Boom

1. Domestic Retail Participation

Thanks to UPI, Demat accounts, and platforms like Zerodha, retail investors are flooding into the markets like never before.

2. Strong Corporate Earnings

India’s top companies have shown solid revenue and profit growth in IT, finance, pharma, and manufacturing.

3. Government Reforms & Infra Push

Schemes like PM Gati Shakti, PLI, and Startup India are creating long-term value.

4. Foreign Institutional Investment (FII)

Global investors see India as a stable and fast-growing economy, especially with China facing slowdown and regulation issues.

5. Green & Tech Economy

New sectors like EVs, solar, semiconductors, and AI startups are creating fresh investor interest.

Risks to Watch Out For

Geopolitical tensions (Middle East, China-Taiwan)

Oil price volatility affecting India’s import bill

US Fed interest rate decisions

Valuation overheating in mid and small caps

What Experts Say

🔹 Morgan Stanley (2024):

“India is set to be the third-largest economy by 2027, and its stock market may reflect this earlier.”

🔹 Motilal Oswal Securities:

“$5 trillion market cap is possible by 2026–27 if GDP and earnings continue at current trajectory.”

🔹 Nirmal Jain (IIFL):

“India’s retail investors are the game changers. Every correction is being bought into.”

India Market Cap Milestones

| Year | Market Cap (USD) |

|---|---|

| 2020 | $2.1 Trillion |

| 2022 | $3.1 Trillion |

| 2024 | $4.0 Trillion |

| 🎯 Target | $5 Trillion by 2026? |

What Should Investors Do?

✔️ Stay Invested in Long-Term Themes – Infra, banks, energy, digital

✔️ SIP into Index Funds – Nifty 50, Sensex

✔️ Balance Growth with Safety – Diversify into debt, gold, REITs

✔️ Avoid FOMO & Penny Stocks – Stay rational, not emotional

FAQs

Q1. Is India’s stock market overvalued right now?

Certain midcaps and smallcaps are overvalued, but long-term potential remains strong.

Q2. What sectors will lead the $5 trillion march?

Banking, infrastructure, manufacturing, tech, and green energy are expected leaders.

Q3. Should I invest lump sum or via SIP?

SIP is safer for most retail investors. Lump sum only if you're sure of market timing.

Published on : 25th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed