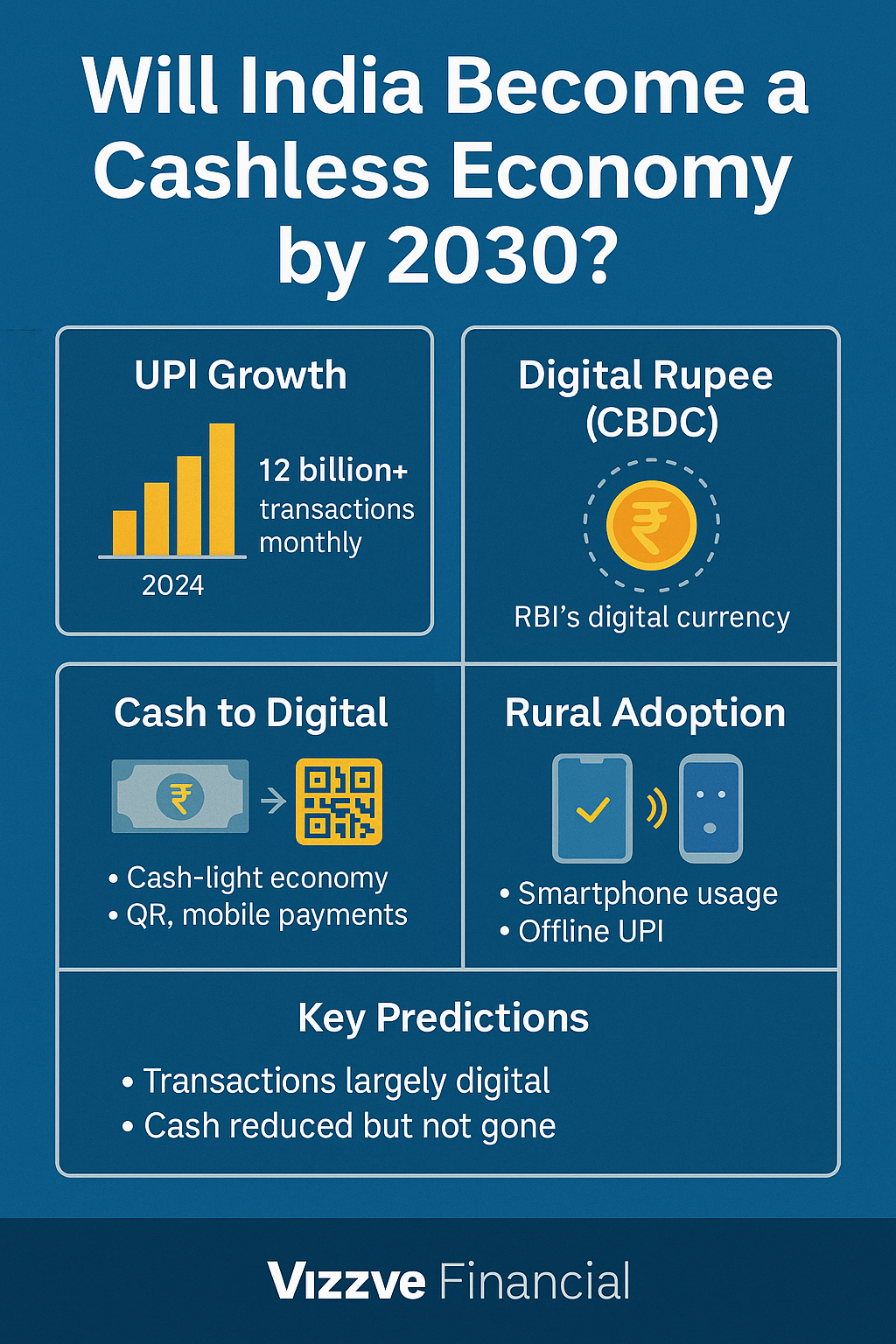

India has seen the fastest digital payments revolution in the world. UPI, QR codes, mobile wallets, the Digital Rupee, and India’s fintech ecosystem have transformed how the country transacts.

But the big question remains:

Can India truly become a cashless economy by 2030?

While digital payments dominate cities, India is still a nation with diverse infrastructure, digital literacy levels, and cash-driven habits. This article explores trends, predictions, benefits, challenges, and whether a cashless India by 2030 is realistic.

⭐ AI ANSWER BOX

India is unlikely to become fully cashless by 2030, but it will be majorly digital, with UPI, QR payments, and the Digital Rupee dominating most transactions. Cash will still exist for rural areas, small merchants, and informal sectors. India will become “less-cash” not cashless by 2030.

India’s Digital Payment Growth — A Global Benchmark

India processes more digital payments than the US, UK, and China combined in UPI transactions.

Key Facts:

UPI crossed 12+ billion monthly transactions (2024–25).

Digital payments adoption increased 8× in just 6 years.

40 million+ merchants accept QR payments.

India’s UPI is now being exported globally.

India’s DPI (Digital Public Infrastructure) enables fast scaling.

Why 2030 Could Transform India Into a “Cash-Light” Economy

1. UPI Dominance Is Exploding

UPI has become India’s default payment system.

What to expect by 2030:

UPI on feature phones

UPI for international payments

UPI credit lines replacing credit cards

UPI autopay dominating recurring payments

2. Digital Rupee (CBDC) Will Reshape Payments

The RBI’s Digital Rupee is already in pilot.

By 2030, expect:

Digital Rupee for merchant payments

Faster government transfers

Reduced cash printing cost

Interoperability with UPI

3. Smartphone & Internet Penetration Will Cross 1 Billion

Cheaper mobiles + rural 5G will accelerate digital adoption.

4. Fintech Innovation Will Replace Cash-Based Services

Growth is expected in:

Micro-credit

BNPL

Online lending

Insurtech

Wealth apps

Digital KYC + onboarding

5. Government Push for Cashless Economy

Policies encouraging:

QR universalization

GST compliance

Cash transaction caps

Digital subsidy transfers

Why India Will Not Be Fully Cashless by 2030

Despite strong digital growth, cash will not disappear.

1. Rural Areas Still Depend on Cash

Challenges include:

Low digital literacy

Patchy internet

Trust issues

Cash-driven village markets

2. Cash Is Culturally Comfortable

Many Indians prefer cash for:

Quick bargaining

Weddings

Functions

Small purchases

3. Informal Economy Still Uses Cash

Over 80% of India’s workforce is informal.

4. Cyberfraud Concerns Slow Adoption

Digital fraud cases are rising:

Phishing

UPI scams

Fake QR codes

Users hesitate to rely 100% on digital payments.

Predictions — What India Will Look Like in 2030

Prediction 1: 80–85% of transactions will be digital

Cities will be almost cashless; rural adoption will rise significantly.

Prediction 2: UPI Credit Line Will Explode

This will replace:

Credit cards for middle-income groups

BNPL

Small merchant loans

Prediction 3: Digital Rupee Will Go Mainstream

Banks + fintechs will integrate CBDC.

Prediction 4: Cash Will Reduce but Not Vanish

India becomes “less-cash,” not cashless.

Prediction 5: Every merchant will have at least one QR code

QR codes will be universal.

Pros & Cons of a Cashless India

Table: Benefits vs Challenges

| Benefits | Challenges |

|---|---|

| Faster payments | Cybersecurity issues |

| Lower cost of cash handling | Rural adoption gap |

| More transparency | Digital literacy concerns |

| Reduces black money | Fear of surveillance |

| Efficient government transfers | Dependence on Internet |

Expert Commentary

India is uniquely positioned to lead the world in digital payments due to its DPI ecosystem—Aadhaar, UPI, ONDC, and the Digital Rupee. However, a 100% cashless India by 2030 is unrealistic because of structural dependencies on cash. A hybrid model—digital-first but cash-supported—will emerge.

By 2030, India will be a global case study in cash-light transformation.

🟦 Key Takeaways

India will be largely digital by 2030, but not 100% cashless.

UPI, CBDC, smartphones, and fintech will drive transformation.

Cash usage will reduce but stay relevant for rural and informal sectors.

India’s digital journey will be hybrid, inclusive, and globally influential.

FAQs

1. Will India be fully cashless by 2030?

No—India will be “cash-light,” not cashless.

2. Why won’t cash disappear completely?

Due to rural dependence, informality, and cultural habits.

3. Will UPI replace cash?

In cities, yes—but not fully nationwide.

4. What role does the Digital Rupee play?

It modernizes payments and reduces reliance on cash.

5. Are digital payments safe?

Generally yes, but fraud risks exist.

6. Will cash circulation reduce by 2030?

Yes—expect a major decline.

7. Are QR codes the future?

Yes—universal merchant acceptance.

8. Will government ban cash?

No—only discourage high-value cash transactions.

9. What sectors will stay cash-heavy?

Agriculture, informal labour, small shops.

10. Will feature phones support digital payments?

Yes—UPI 123PAY already works offline.

11. Will digital literacy improve by 2030?

Yes—with cheaper phones & government initiatives.

12. Is cash still important?

Yes—essential for emergencies and rural areas.

Conclusion

India may not become fully cashless by 2030—but it will become a digital-first economy, where most transactions are done through UPI, QR codes, and digital wallets. Cash will stay, but digital payments will dominate everyday life.

Need credit support for your financial journey?

Vizzve Financial offers quick personal loans, minimal documentation, and a smooth approval process.

👉 Apply now at www.vizzve.com

Published on : 2nd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed