For decades, traditional credit scoring has been the core tool banks use to judge whether someone can repay a loan. Now, a new approach — alternative-data scoring — is gaining momentum. This method looks beyond past loans and credit cards, using day-to-day financial behaviour to evaluate creditworthiness.

The big question is: Will alternative-data scoring replace traditional credit scores?

Let’s break it down.

What Is Traditional Credit Scoring?

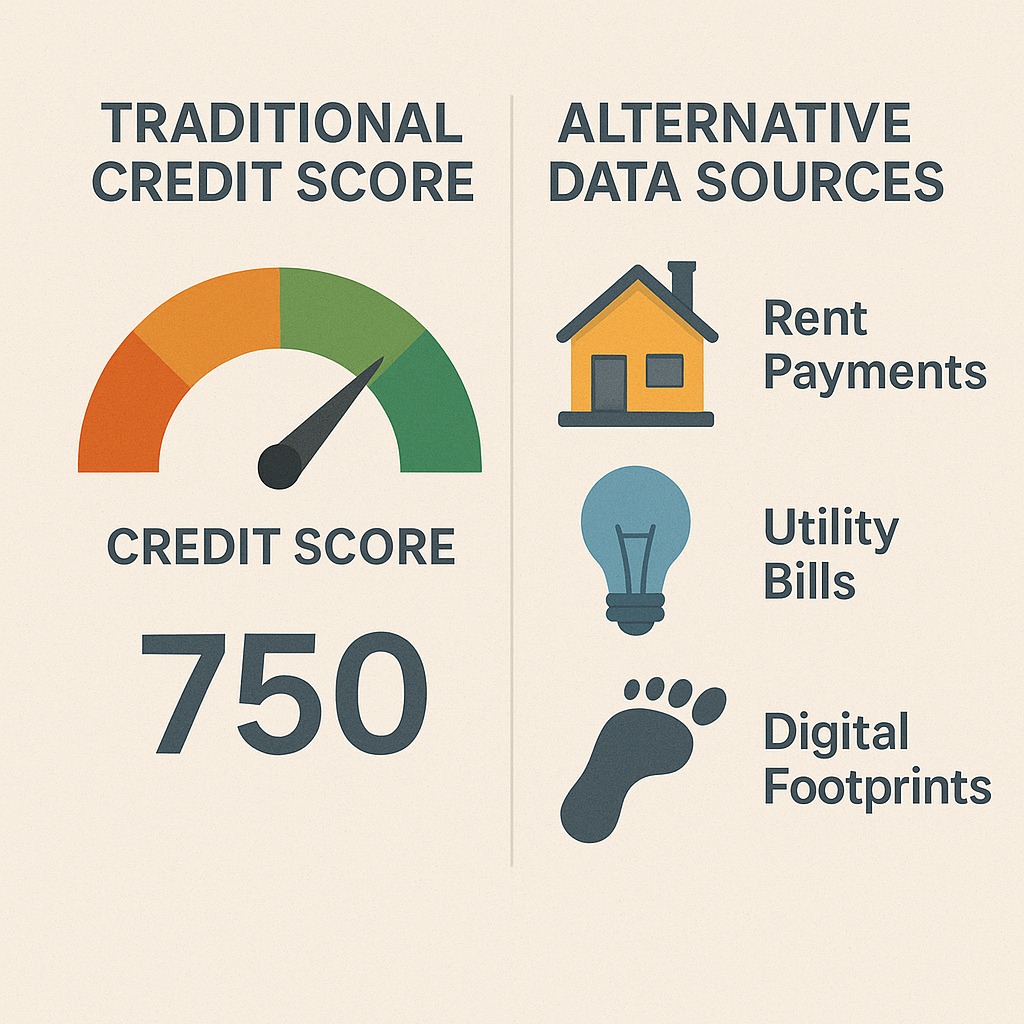

Traditional scores rely on:

Loan history

Credit card usage

Repayment record

Defaults or delays

Credit utilisation

Length of credit history

These scores are standardised, widely accepted, and trusted by lenders.

Strengths

Proven reliability

Simple to use

Consistent industry-wide

Weaknesses

Doesn’t work well for young or new borrowers

Excludes people without past loans

May not reflect current financial behaviour

What Is Alternative-Data Scoring?

Alternative-data scoring uses non-traditional indicators such as:

Rent payments

Utility bills

Mobile recharge/payment history

Bank account transaction trends

Digital spending patterns

Subscription payments

Employment stability

Even behavioural patterns from apps and online activity

It creates a more holistic and real-time view of a person’s financial reliability.

Benefits

Helps people with “thin” or no credit files

Reflects current financial habits

Can improve credit access for millions

Challenges

Needs strong privacy protection

Not yet fully standardised

Risk of misinterpreting behavioural patterns

Will Alternative Data Replace Traditional Credit Scores?

Why It Could Happen:

Lenders want deeper, real-time insights

Millions lack traditional loan history

Technology makes data analysis easier

Governments push for financial inclusion

Why It Won’t Fully Replace Them Soon:

Traditional scores are legally embedded in loan processes

Alternative data needs regulatory clarity

Accuracy varies across data sources

Privacy and consent concerns

Most Likely Outcome:

A hybrid model — lenders will use traditional credit scores + alternative data together for better risk assessment.

Who Benefits the Most From Alternative-Data Scoring?

Young professionals without loan history

First-time borrowers

Gig-economy workers

People with informal income

Individuals who pay rent and bills on time

Digital-savvy users with stable transaction patterns

It bridges the gap for people who behave financially well but have no credit record.

What Should Borrowers Do Now?

Even before alternative scoring becomes mainstream, you can prepare:

✔ Maintain timely rent and utility payments

✔ Keep bank transactions clean

✔ Avoid frequent overdrafts or bounced payments

✔ Pay BNPL (“Buy Now Pay Later”) dues on time

✔ Keep digital financial behaviour consistent

These signals can help future scoring models favour you.

Future Outlook

Credit scoring systems around the world are moving toward:

More data points

More real-time financial analysis

More inclusive scoring for underserved borrowers

More AI-driven evaluations

But traditional credit scores will remain important — especially for home loans, auto loans, and regulated lending products.

Alternative data will enhance, not immediately replace, traditional credit scores.

FAQs

1. Will traditional credit scores disappear?

No. They will remain important but will be complemented by alternative-data scoring.

2. Who benefits most from alternative scoring?

New borrowers with little or no credit history.

3. Is alternative data safe and private?

It depends on regulation and consent. Strong data protection rules are needed.

4. Can alternative scoring improve loan approval chances?

Yes, especially for borrowers with strong digital and bill-payment discipline.

5. Which loans will use alternative scoring first?

Small-ticket loans, online credit, fintech lending, and BNPL.

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed