Many salaried people today feel trapped in a cycle where their entire salary vanishes the moment it arrives. Between rent, EMIs, groceries, bills, lifestyle expenses, subscriptions and unplanned costs, it feels like there’s nothing left to save — not even ₹500.

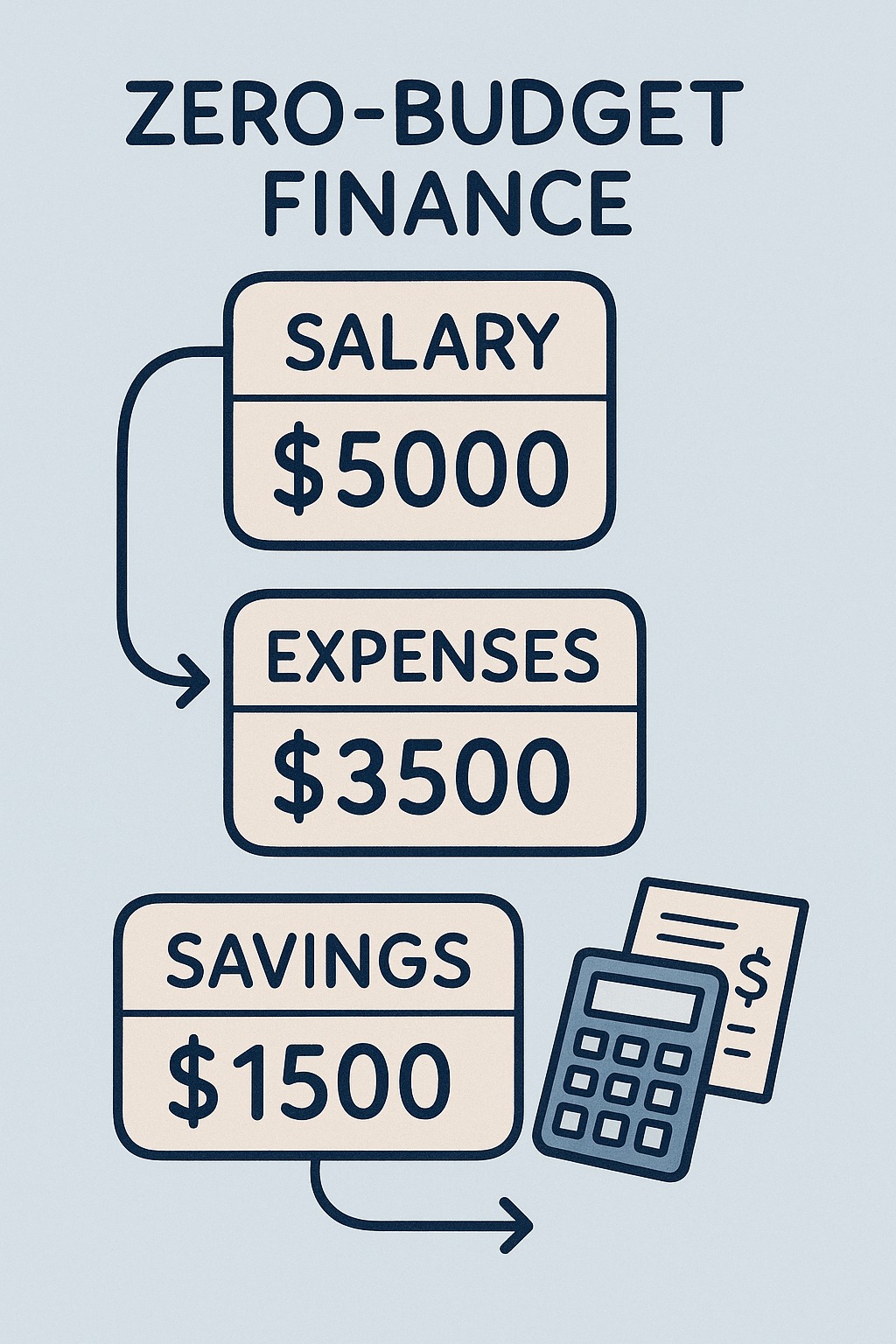

This is where Zero-Budget Finance comes in.

It’s a practical method designed for people whose salary is already over-committed, helping them take control of money without increasing income or cutting life’s basic comforts.

1. Understand the Zero-Budget Finance Approach

Zero-budget finance is not “spending zero.”

It simply means every rupee has a job — you decide where your money goes before it arrives.

Instead of random spending, you categorize your money into:

Essentials

EMIs & dues

Survival expenses

Future commitments

Mini-savings

You take full control without needing a big income.

2. Your First Step: List Your Real Monthly Obligations

Write down everything you pay every month:

Rent

EMIs

Credit card bills

Electricity & WiFi

Groceries

Insurance

Transportation

Subscriptions

Most people realise they are paying for many non-essential things without noticing.

This visibility alone saves money.

3. Apply the “Rearrange, Reduce, Remove” Rule

✔ Rearrange

Move payments to salary date + 3 days so you pay bills when your salary comes in.

This avoids late fees and interest.

✔ Reduce

Ask vendors for:

EMI restructuring

Credit card conversions

Lower data plans

Cheaper insurance premiums

Removing duplicate subscriptions

A reduction of even ₹500–₹1500 per item changes your monthly flow.

✔ Remove

Anything you don’t use for 45 days → eliminate.

This includes:

OTT subscriptions

Food delivery memberships

Gym but you don’t go

App subscriptions

Unused credit cards

4. Create a Zero-Balance Budget: Salary = 100% Allocated

Here’s how:

If salary = ₹40,000, assign all of it to categories like:

₹15,000 → Rent

₹6,000 → EMIs

₹5,000 → Groceries

₹2,000 → Transport

₹1,500 → Subscriptions & utilities

₹1,000 → Emergency fund

₹500 → Personal spending

₹500 → Sinking fund (future expenses)

₹8,500 → Debt repayment + savings strategy

End result:

You spend everything on paper first → no surprises later.

5. Build a “Mini Emergency Fund” Even If You’re Broke

Start with ₹10–20 per day.

Yes, even that counts.

A ₹600–₹900 monthly cushion becomes a lifesaver for:

Medical expenses

Transportation issues

Social commitments

Unexpected bills

This prevents you from taking loans again.

6. Switch to Cash Envelopes for 3 Categories

Use cash for:

Groceries

Personal spending

Eating out

Psychology says:

People spend 30–40% less when using cash instead of UPI/card.

This automatically reduces wasteful spending.

7. Fix Your Debt: The Biggest Salary Killer

If EMIs eat half your salary, follow:

✔ “Snowball Method”

Pay off the smallest EMI first → get mental motivation.

✔ “Avalanche Method”

Clear the highest-interest one first.

✔ Renegotiate EMIs

Banks easily restructure for salaried customers.

8. Increase Income Without Side Hustles

Small internal adjustments can bring extra money:

Claim tax deductions

Use credit card reward points

Redeem bank cashback

Use salary account benefits

Sell unused items

Use employer reimbursements properly

Even an extra ₹1000–₹3000 helps.

9. Review Every 30 Days

Budgeting is not one-time.

Income changes. Expenses change. You evolve.

A monthly 15-minute review keeps you financially stable.

Conclusion

You don’t need a bigger salary to control your money.

You need a better system.

Zero-budget finance helps you:

Break the cycle of paycheck-to-paycheck

Avoid debt traps

Save small but consistently

Stabilize your monthly budget

Reduce financial stress

When every rupee has a purpose, your money finally starts working for you.

FAQs

Q1. Is zero-budget finance only for low-income earners?

No. It’s helpful for anyone whose expenses exceed or match their salary.

Q2. Can I save if my salary is completely committed?

Yes — even ₹10–₹50/day savings build stability.

Q3. Does zero-budgeting help reduce debt?

Yes, because it prioritizes essential EMIs and puts control back in your hands.

Q4. How long before I see results?

Most people see relief in 30–60 days.

Q5. Do I need apps for this method?

A notebook or phone note is enough.

Published on : 14th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed