🔍 Introduction:

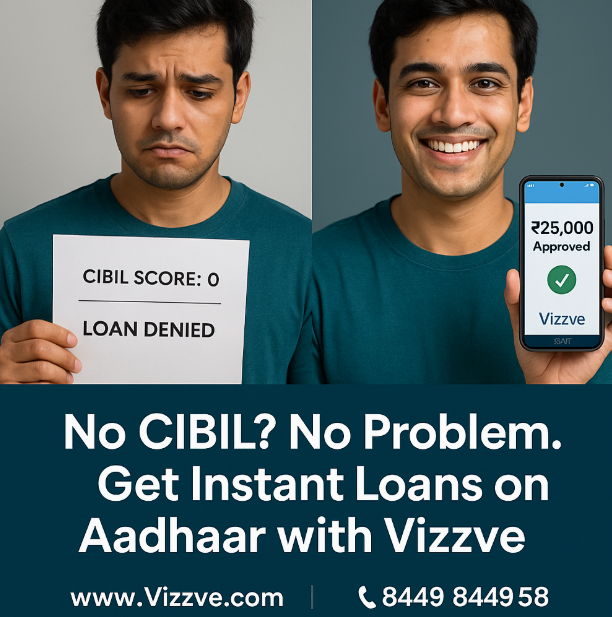

Struggling with a low or zero CIBIL score? You're not alone. In 2025, over 10 lakh Indians successfully received loans without any credit score. Thanks to digital lenders like Vizzve Financial and supportive NBFCs, it’s now easier than ever to get a personal loan using just your Aadhaar card.

💡 How You Can Get a Loan Without CIBIL in 2025:

✅ Apply via Aadhaar-Only KYC

No income proof or salary slips needed for small-ticket loans. Vizzve verifies identity with just Aadhaar and PAN.

✅ Zero Collateral Required

Vizzve and partner NBFCs offer unsecured loans starting from ₹5,000 up to ₹2 lakhs.

✅ Faster Approvals

Loan approval in minutes and disbursal in 24–48 hours, directly to your bank account.

✅ Customized for Everyone

Whether you’re a homemaker, freelancer, or small business owner, Vizzve has loan options tailored to your needs.

🏦 Why Vizzve Financial?

🔹 Trusted by 10,00,000+ Users

🔹 No Credit Score Required

🔹 Paperless Process

🔹 Section 8 MicroSeva Support for ₹5,000–₹25,000 loans

🔹 Direct customer care: 📞 8449 8449 58 | 🌐 www.vizzve.com

🎯 Final Word:

CIBIL score isn’t everything in 2025. With Aadhaar-based verification and ethical lending from Vizzve, financial freedom is possible even with bad credit. Apply today and get your loan approved—no questions asked about your credit history!

📚 Frequently Asked Questions (FAQs)

❓1. Can I get a personal loan without a CIBIL score in 2025?

Yes. With fintech platforms like Vizzve Financial, you can easily get a personal loan without a CIBIL score. Aadhaar-based KYC and PAN are enough for approval—especially for amounts up to ₹2 lakhs.

❓2. How much loan can I get without a credit history?

You can get a loan from ₹5,000 to ₹2,00,000 without a credit history. Vizzve MicroSeva also offers micro-loans between ₹5,000 to ₹25,000 for women, students, and daily wage workers.

❓3. Is Aadhaar enough to get a loan in India?

Yes. Aadhaar and PAN are sufficient for KYC with lenders like Vizzve Financial, especially if you're applying for small-ticket loans or have no formal income documentation.

❓4. Who is eligible for loans without CIBIL via Vizzve?

Vizzve supports:

-

👩👧 Homemakers

-

🧑🎓 Students

-

💼 Freelancers & gig workers

-

🧺 SHG members & small vendors

-

👷 Daily wage earners

❓5. How fast is the loan disbursal process?

Loan approval is instant in most cases, and funds are credited within 24–48 hours after KYC verification. No long bank queues or paperwork needed.

❓6. Will not having a CIBIL score affect my loan interest rate?

Some lenders may charge slightly higher rates for no-CIBIL cases. However, Vizzve offers competitive and ethical interest rates—especially under MicroSeva NGO-supported loans.

❓7. Is it safe to apply for a loan through Vizzve?

Absolutely. Vizzve Financial is a trusted platform partnered with RBI-registered NBFCs and backed by Vizzve MicroSeva Foundation, a Section 8 registered social enterprise.

❓8. Where can I apply instantly?

👉 Apply now via www.Vizzve.com or call 📞 8449 8449 58 for quick assistance.