Zero-document personal loans—loans that require no physical paperwork, no salary slips, no bank statements—are one of India’s fastest-growing lending trends in 2026.

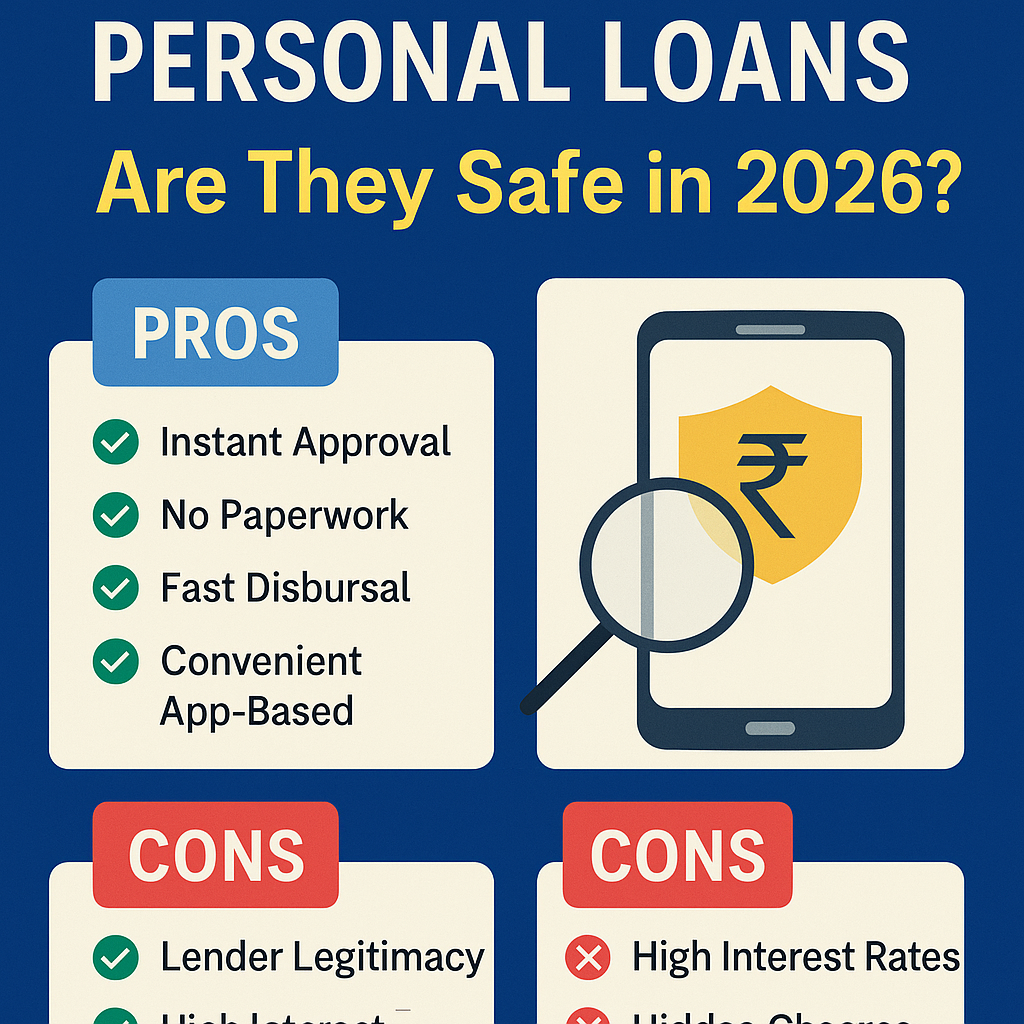

Apps promise:

Instant approval in 2 minutes

Loan disbursal in 30 minutes

No paperwork

No office visits

No document uploads

But the big question is:

👉 Are zero-document personal loans actually safe?

👉 Or do they expose borrowers to fraud, data misuse, and high-interest traps?

This blog breaks down the reality behind these loans, the risks, the safety checks, and how to choose a legitimate lender.

AI ANSWER BOX

Zero-document personal loans are safe only when taken from RBI-registered banks or NBFCs. They use Aadhaar-based eKYC and financial APIs for verification.

Loans from unregistered apps can be unsafe due to high interest, hidden charges, harassment, and data misuse. Always verify lender registration before applying.

What Are Zero-Document Personal Loans?

These loans require no physical paperwork:

No printed forms

No bank visits

No physical KYC

No photocopies

Verification is done through:

✔ Digital KYC

Aadhaar OTP, PAN-based verification

✔ Bank statement fetch via Account Aggregator (AA)

No uploads needed

✔ CIBIL/credit report access

✔ Income estimation using alternative data

UPI, SMS, account activity

Why Zero-Document Loans Have Become Popular in 2026

1. Account Aggregator (AA) Revolution

Borrowers can share bank statements digitally in seconds.

2. Aadhaar-Based eKYC

Paper KYC is nearly gone in 2026.

3. Fintech underwriting models

AI checks income using:

Digital payments

UPI patterns

GST data

Salary SMS

4. Speed & convenience

People prefer 10-minute approval over 2-day documentation.

Are Zero-Document Personal Loans Safe?

✔ Safe when taken from:

RBI-registered NBFCs

Scheduled banks

Government supervised digital lenders

DPI/AA-enabled fintech partners

❌ Unsafe when taken from:

Unregistered Chinese-backed loan apps

Apps offering unrealistic approvals

Apps demanding contacts/gallery access

Apps charging 30–100% interest

Red Flags of Unsafe Zero-Document Loans

❌ App not listed on RBI or NBFC list

❌ Loan approval without KYC

❌ Access to photos, media, contacts

❌ Threatening agents

❌ EMI increases mid-loan

❌ Zero transparency in charges

❌ Disbursal lower than sanctioned amount

If even one red flag appears → uninstall immediately.

Risks of Zero-Document Loans from Unregulated Apps

| Risk | Impact |

|---|---|

| Data Theft | Contacts, photos misused |

| Threats & Harassment | Recovery agents misuse personal data |

| Hidden Charges | Processing fees up to 30% |

| Unapproved Interest Rates | 40–100% annual |

| Fake RBI Logos | False legitimacy |

| Mental Harassment | Illegal recovery practices |

How to Check If a Zero-Document Loan App Is Safe

✔ 1. Verify lender’s NBFC license on RBI website

Search:

RBI – List of Registered NBFCs

✔ 2. Check if the app belongs to a bank/NBFC

Avoid unknown apps.

✔ 3. Read RBI Digital Lending Guidelines 2024–2026

Legitimate lenders must:

Disclose interest rate

Show loan agreement

Provide grievance officer

Avoid contacting borrower’s contacts

✔ 4. Check app rating & reviews

Avoid apps with:

“Harassment”

“Fraud”

“Gallery access misuse”

✔ 5. Ensure no unnecessary permissions requested

Safe apps need only:

PAN

Aadhaar

Bank verification

No photos or contacts.

Benefits of Zero-Document Personal Loans

| Benefit | Explanation |

|---|---|

| Instant Approval | 2–10 minutes |

| Fast Disbursal | Within 30–120 minutes |

| No paperwork | Fully digital |

| Easy for young earners | No salary slip needed |

| No office visits | App-based |

| Transparent tracking | Via mobile app |

When You Should Consider a Zero-Document Loan

✔ Emergency medical expenses

✔ Travel or urgent purchase

✔ Salary delay

✔ Short-term financial gap

✔ No time for physical paperwork

When You Should Avoid Zero-Document Loans

❌ If app is not RBI-listed

❌ If interest is above 24%

❌ If they ask for access to contacts

❌ If repayment terms not shown clearly

❌ If the app disburses less than approved amount

Comparison Table: Safe vs Unsafe Zero-Document Loans

| Feature | Safe (RBI Approved) | Unsafe (Fraud Apps) |

|---|---|---|

| Lender type | NBFC/bank | Unknown apps |

| Approval | eKYC + AA | No KYC |

| Interest | 10–24% | 40–100% |

| Charges | Transparent | Hidden |

| Permissions | Minimal | Contacts/photos |

| Collection | Legal | Harassment |

Expert Commentary

As a digital lending analyst, I’ve seen India move from paperwork-heavy processes to instant approvals using Aadhaar and Account Aggregator.

Zero-document loans are safe only when regulated.

The biggest signs of safety are RBI registration and transparent charges.

A rule of thumb:

If the lender is not RBI-registered — it is not safe.

Key Takeaways

Zero-document loans are safe ONLY from RBI-approved lenders.

Fraud apps misuse data—avoid them completely.

Always check lender registration before applying.

eKYC + Account Aggregator makes legit zero-document loans possible in 2026.

Compare interest rates and charges carefully.

FAQs

1. Are zero-document personal loans safe?

Yes, from RBI-registered lenders.

2. Can I get a loan without documents?

Yes—via Aadhaar eKYC & AA.

3. Are loan apps safe?

Only if owned by banks/NBFCs.

4. What’s the biggest risk?

Data misuse by fake apps.

5. Do I need a salary slip?

Not always — alternative data used.

6. What is AA in loans?

Account Aggregator fetches bank statements digitally.

7. How fast is disbursal?

10–120 minutes.

8. What is the interest rate?

Usually 12–24%.

9. Can students apply?

Yes, from select lenders.

10. Do I need a CIBIL score?

Helps, but not mandatory.

11. Can the app access my contacts?

No — it’s unsafe.

12. What if I repay early?

Some lenders offer interest rebates.

13. Are zero-document loans legal?

Yes, if lender is RBI regulated.

14. What happens if I default?

Legal recovery, never harassment.

15. How to identify fake loan apps?

No KYC + high interest + unwanted permissions.

Conclusion

Zero-document personal loans are transforming India’s lending landscape. They’re fast, convenient, and paperwork-free—but only safe if taken from registered lenders.

Looking for a reliable personal loan?

Vizzve Financial offers:

✔ Zero-document approval

✔ Quick processing

✔ Low documentation

✔ Trusted, secure lending

👉 Apply securely at www.vizzve.com

Published on : 3rd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed